USD/CHF Weekly Forecast: Fed Ready To Do More To Curb Inflation

The USD/CHF weekly forecast is bullish as the US dollar bulls return after an upbeat jobs report. The Fed is likely to continue rate hikes.

Ups And Downs Of USD/CHF

USD/CHF closed higher on all days of the week apart from Tuesday. This was when the JOLT’s job openings report from the US came out. August saw the biggest drop in US job vacancies in almost two and a half years. This gave investors the impression that the labor market was starting to cool as the economy grappled with higher interest rates to dampen demand and tame inflation.

Soon after, the nonfarm payroll report from the US showed the labor market was still tight. Nonfarm payrolls climbed by 263,000 jobs in September after increasing by an unrevised 315,000 in August. Even though it was the lowest since April 2021, job growth outpaced the decade’s average of 167,000 new jobs per month.

The unemployment rate decreased to 3.5%, indicating a tight labor market. The Federal Reserve will likely continue its aggressive campaign of tightening monetary policy for some time.

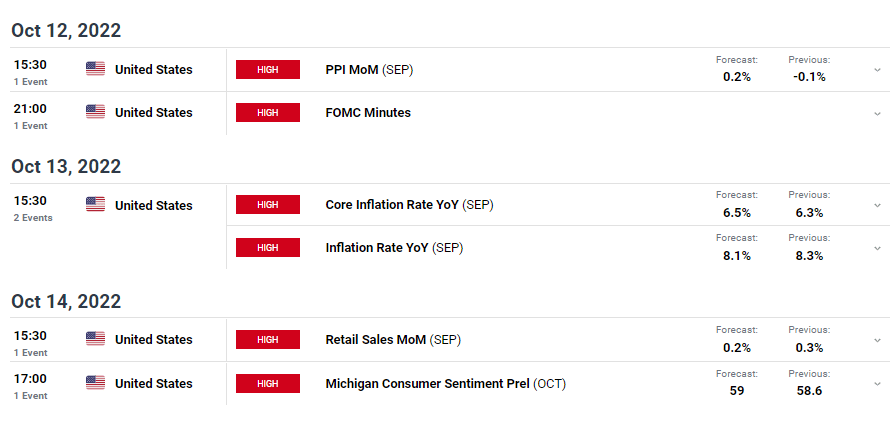

Next Week’s Key Events For USD/CHF

(Click on image to enlarge)

Investors will pay much attention to the US inflation data next week to determine the Fed’s next move. John Williams, president of the New York Federal Reserve, stated on Friday that the US central bank needs to do more to reduce inflation and rebalance economic activity sustainably.

Therefore, if inflation goes up, the Fed will be sure to react aggressively. Markets are expecting another 75bps rate hike at the next Fed meeting.

USD/CHF Weekly Technical Forecast: Price Approaching A Solid Resistance Zone

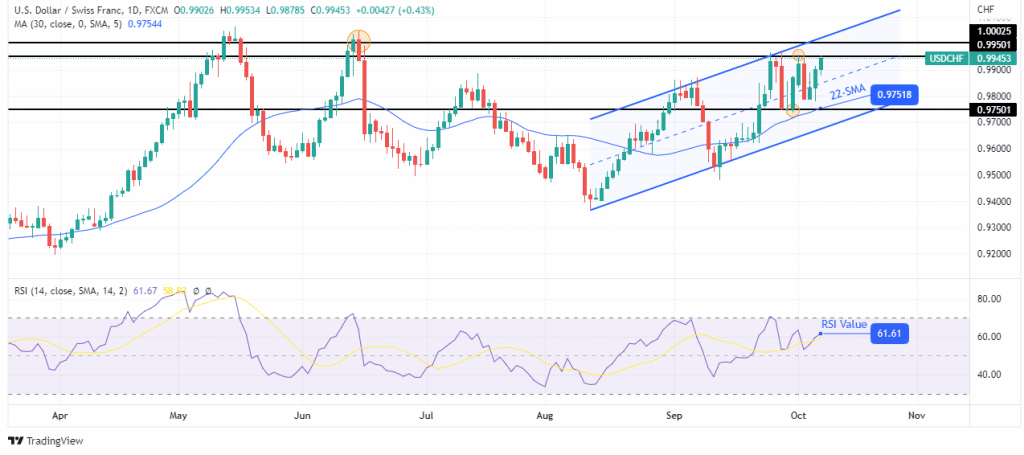

(Click on image to enlarge)

The daily chart shows the price trading above the 22-SMA and the RSI above 50. These indicators favor bullish momentum, which might go on next week. The price trades within an up trending channel with clear support and resistance.

However, the price is coming up to a strong resistance zone comprising the channel resistance and the 1.0002 key psychological level. If bulls cannot gather enough momentum to push beyond this zone, we might see the price retesting at 0.9750.

More By This Author:

USD/CAD Price Prone To Further Gains Amid Recession, Eying US NFPEUR/USD Outlook: ECB’s Growing Concerns Over Broadening Inflation

USD/CAD Forecast: Loonie Plunging amid Weak USD, Higher Oil Prices

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more