USD/CHF Forecast: US Dollar Testing Major Technical Indicator Against Franc

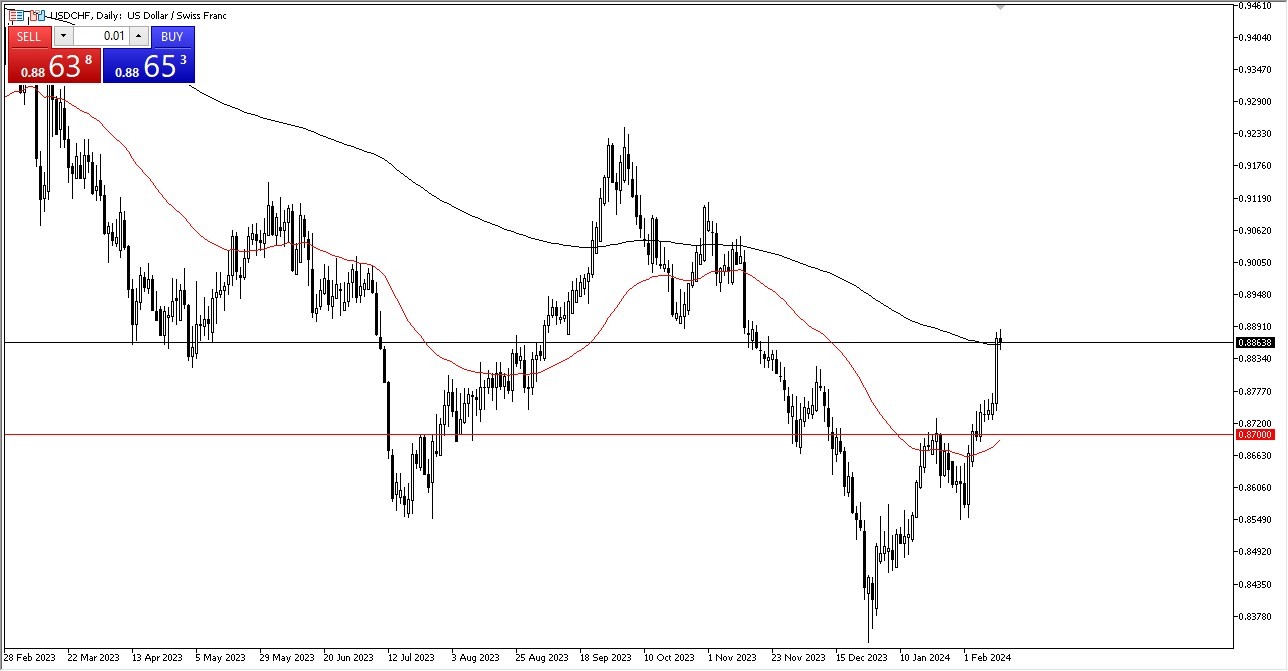

US dollar stability near 200-Day EMA against Franc. Key levels at 0.8850 and 0.8750 in focus amidst CPI-triggered volatility. Watch for potential break above 0.89 for upward momentum, considering geopolitical influences and EU economic impacts.

- The US dollar has been fairly stable during the early hours on Wednesday as we continue to see a lot of noisy behavior.

- As we dance around the 200-Day EMA, investors and traders alike will be paying close attention as this is a longer-term signal.

- The 0.8850 level currently resides right around the same region, and it had been support previously, so all things tied together for a fulcrum of price action.

The explosive move on Wednesday was due to the Consumer Price Index figures coming out hotter than anticipated in the United States, and we did see the US dollar strengthened quite drastically against almost everything. That being said, the Swiss franc itself was rather weak against most currencies, so it became a little bit of a “perfect storm” at this point. Furthermore, it’s probably worth noting that the Swiss National Bank will be perfectly fine with the Swiss franc losing strength.

200-Day EMA, Federal Reserve, Swiss National Bank, and Other Factors

This is a market that has a lot of things going on at the same time, therefore it’s likely that we will continue to see a lot of volatility. If we do pull back from here, I think there is plenty of support near the 0.8750 level, which is where the market took off from during the Tuesday session. If we can break above the 0.89 level, then it’s likely that we will go looking to the 0.90 level above, possibly even the 0.9050 level after that. All things being equal, if we can break above there, then it is likely that we could go much higher.

(Click on image to enlarge)

Keep in mind that both of these currencies are considered to be “safety currencies”, and therefore they have a lot of the same geopolitical issues. If the world continues to burn the way it has been, both of these currencies might be interesting, but you should also keep in mind that the Swiss franc has the handicap of dealing with the European Union surrounding that country, and therefore the European Union slowing down will have a massive influence on the Swiss economy as over 80% of Swiss exports end up in places like Germany, France, Holland, etc. With this, I think we are possibly seeing a longer-term trend change.

More By This Author:

GBP/CHF Forecast: British Pound Breaks Out Against Swiss FrancSP 500 Forecast: Plunges After Consumer Price Index Surprise

Silver Forecast: Plunges After Surprise CPI Reading In America

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more