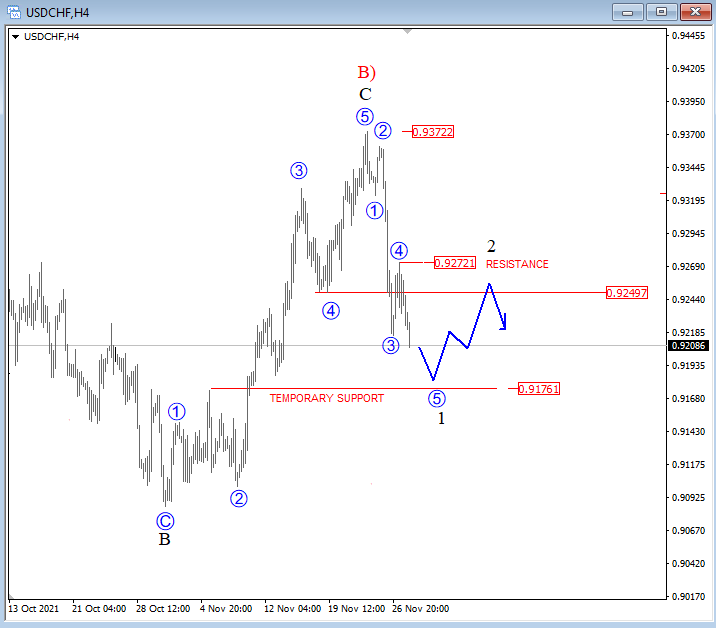

USDCHF And USDJPY Elliott Wave Analysis: Be Aware Of More Weakness After Recovery

USDCHF is coming sharply and impulsively down in the 4-hour chart as CHF is seen as a safe haven in uncertain times. If we consider a completed wave B) correction on a daily chart, then we can expect lower levels within wave C), but ideally after a corrective pullback in subwave 2 as five-wave cycle in subwave 1 can be coming to an end.

USDCHF 4h Elliott Wave Analysis

(Click on image to enlarge)

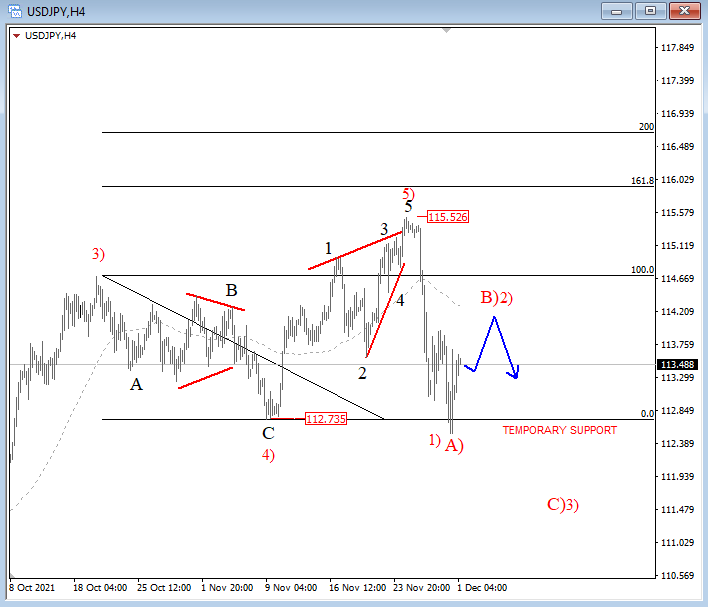

With the current sharp decline from the highs on the 4-hour chart, we think that the USDJPY pair might have completed the 5th wave as an ending diagonal (wedge) pattern and that weakness may resume to a much lower price as a drop from 115.52 is only in one leg. That said, be aware of more weakness after wave B)/2) rally.

USDJPY 4h Elliott Wave Analysis

(Click on image to enlarge)

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.