USD/CAD Weekly Forecast: Weak Economy Weighs On CAD

The USD/CAD weekly forecast leans bullish amid economic divergence between Canada and the US. Correcting oil prices could also weigh on the loonie.

Ups and downs of USD/CAD

The USD/CAD pair fell this week but closed well above its lows. The decline came as the Canadian dollar strengthened due to a rally in oil prices. Oil soared amid increased tensions in the Middle East.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

However, economic data from the US and Canada supported an uptrend. Notably, US consumer confidence soared, and the economy expanded at a faster-than-expected rate. At the same time, the core PCE price index held steady at 0.2%. These reports supported a strong dollar.

On the other hand, Canada’s economy showed no expansion, missing expectations for a 0.1% growth. Consequently, the Canadian dollar eased.

Next week’s key events for USD/CAD

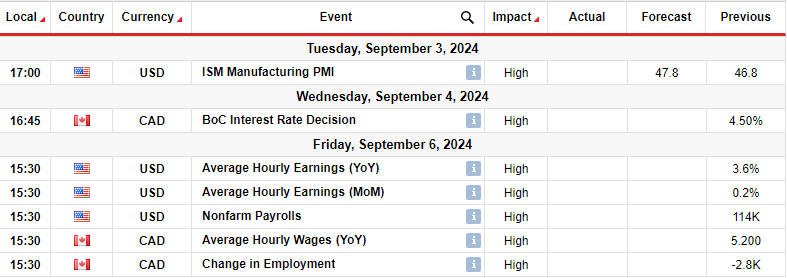

(Click on image to enlarge)

Next week, the US will release manufacturing PMI and employment data. Similarly, Canada will release its employment report. Additionally, investors will watch the Bank of Canada policy meeting on Wednesday.

The employment figures in both countries will shape the outlook for future policy decisions by the Fed and the BoC. Central banks are starting to focus more on growth as inflation nears targets. Therefore, policymakers are keen to see whether demand in the labor sector is falling. Notably, the labor market drives a big part of most economies. Consequently, signs of weakness will pressure central banks to lower borrowing costs.

Meanwhile, investors are expecting another rate cut when the BoC meets.

USD/CAD weekly technical forecast: Sharp decline pauses with 1.3400 in sight

(Click on image to enlarge)

USD/CAD 4-hour chart

On the technical side, the USD/CAD price has continued its decline below the 1.3600 critical level, indicating a solid bearish bias. The price trades far below the 22-SMA, and the RSI is near the oversold region, showing that bears are in the lead.

However, the decline paused before reaching the next support level at 1.3400. This is a sign that bears are exhausted after such a steep decline. Therefore, they need a short break before continuing lower. A pullback could revisit the 1.3600 level or the 22-SMA. Nevertheless, since the bearish bias is strong, the price might eventually fall to the 1.3400 support level.

More By This Author:

AUD/USD Outlook: Dollar Softens Ahead Of Key US Inflation DataUSD/JPY Price Analysis: Safe-Haven Demand Lifts Dollar

USD/CAD Outlook: CAD Strengthens Amid Rising Oil Prices

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more