USD/CAD Weekly Forecast: US Inflation Remains Stubbornly High

The pair had a bullish week as American economic data sparked bets on how aggressively the Federal Reserve will increase interest rates.

A US report released on Friday showed an annual increase in export prices of 0.8% as opposed to expectations for a 0.2% decline. According to figures released on Thursday, weekly unemployment benefit claims were lower than expected, while producer prices rose monthly in January. Retail sales figures released on Wednesday showed a considerable increase, while CPI data from Tuesday indicated persistently rising inflation.

There were also hawkish comments from two Fed officials on Thursday and forecasts for three additional Fed rate increases this year from Goldman Sachs and Bank of America.

On Thursday, BoC’s Tiff Macklem warned that the jobs market remains too tight and the economy is still too hot as he left the door open to further rate hikes.

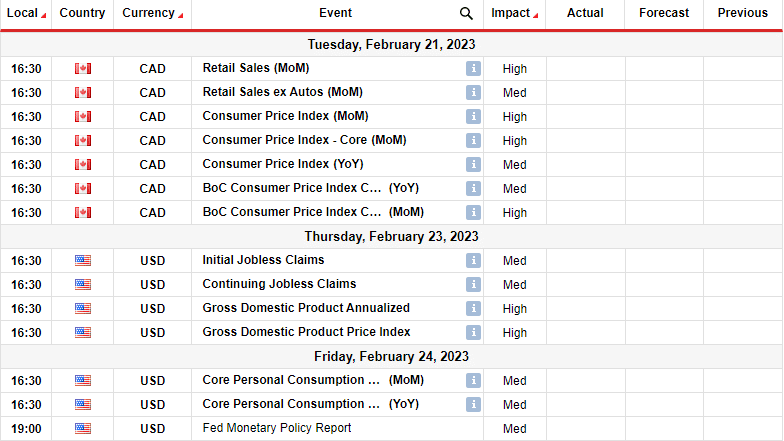

Next Week’s Key Events For USD/CAD

Investors will pay attention to inflation data from Canada next week that will show whether the economy is still hot. Focus will also be on GDP data from the US that might continue the trend of positive data from the country.

USD/CAD Weekly Technical Forecast: Buyers Face A Key Resistance Zone

The daily chart shows USD/CAD in a bullish move as the price trades above the 22-SMA and the RSI above 50. This follows a bounce from 1.3300, a strong support level. The previous move was bearish as the price respected the 22-SMA as resistance, and the RSI stayed below 50.

However, recent USD/CAD price movements have been quite choppy. The price has stayed close to the SMA and the RSI close to the 50-mark. Neither bears nor bulls have committed to pushing the price to extreme levels of overbought or oversold. This is a sign that the price is consolidating on a larger timeframe.

Currently, bulls are in control but face the 1.3450-1.3500 resistance zone. A break above this level will likely increase the price to 1.3701. Otherwise, it will retest the 1.3300 support.

More By This Author:

EUR/USD Price Analysis: Euro Climbs As Focus Shifts To US CPI

USD/JPY Weekly Forecast: Cautious Ahead Of US Inflation

Gold Price Under Strong Downside Pressure After Hot NFP