USD/CAD Weekly Forecast: Markets Brace For Another BoC Pause

The USD/CAD weekly forecast suggests an increasing likelihood of another Bank of Canada pause in June.

Ups and downs of USD/CAD

The USD/CAD pair had a bearish week as the Canadian dollar strengthened and the US dollar fell. The loonie had a strong week after Canada reported hotter-than-expected inflation numbers. The figures led to a sharp drop in Bank of Canada rate cut expectations. Currently, traders are pricing a 27% chance of a rate cut at the June meeting.

Meanwhile, the dollar fell as market participants worried about the debt situation in the US. Moody’s downgraded the country’s credit rating due to its huge debt. Meanwhile, Trump’s policies might add to the already large debt.

Next week’s key events for USD/CAD

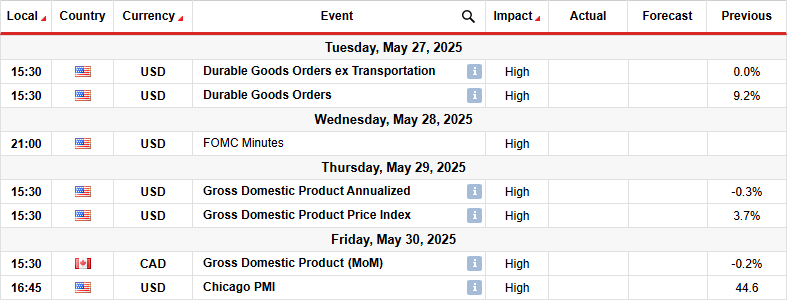

Next week, the US will release key reports showing the state of the economy. These include durable goods orders and the gross domestic product. Moreover, market participants will go through the FOMC meeting minutes for clues on future moves.

The previous GDP reading revealed a 0.3% contraction in the economy. A weaker-than-expected reading next week would point to weakness that could pressure the Fed to lower borrowing costs.

Moreover, traders will watch Canada’s GDP report, which will also shape the outlook for BoC rate cuts. After this week’s upbeat inflation figures, rate cut expectations have significantly dropped, with a higher likelihood of another pause in June.

USD/CAD weekly technical forecast: Bears eye the 1.3400 support

(Click on image to enlarge)

USD/CAD daily chart

On the technical side, the USD/CAD price has broken and closed below the 1.3800 support level, confirming a continuation of the downtrend. At the same time, the price now trades below the 22-SMA with the RSI nearing the oversold region, suggesting a strong bearish bias.

Previously, the price was trading in a new downtrend before it paused at the 1.3800 key support level. Here, bearish momentum weekend and price action confirmed that. As a result, bulls emerged to push the price above the 22-SMA.

However, the rebound was brief as the price paused at the 1.4000 key psychological level. This allowed bears to return and make a lower low. Given the solid bearish bias, the price might drop to the 1.3400 support level next week.

More By This Author:

USD/CAD Forecast: Trump Tax Bill Sparks US Debt Worries

GBP/USD Outlook: Pound Rises On UK Data, Weaker Dollar

EUR/USD Outlook: Euro Eases After Soft Eurozone PMI Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more