USD/CAD Weekly Forecast: Dollar Thrives On Surprising NFP

There is bullish optimism in the USD/CAD weekly forecast amid a stronger dollar. The bigger-than-expected US employment growth points to a still-tight labor market, supporting the dollar.

Ups and downs of USD/CAD

USD/CAD closed the week higher amid key events in Canada and the US. The Canadian dollar weakened after the Bank of Canada held rates steady at 5%. Still, the bank stated the possibility of another rate hike as inflation remains a concern. Furthermore, weakness came amid a drop in oil prices. Oil fell for a seventh week due to concerns about oversupply.

Meanwhile, the dollar ended the week on the front foot after employment data came in stronger than expected. The US economy reported 199,000 jobs last month, while the unemployment rate fell to 3.7%.

Next week’s key events for USD/CAD

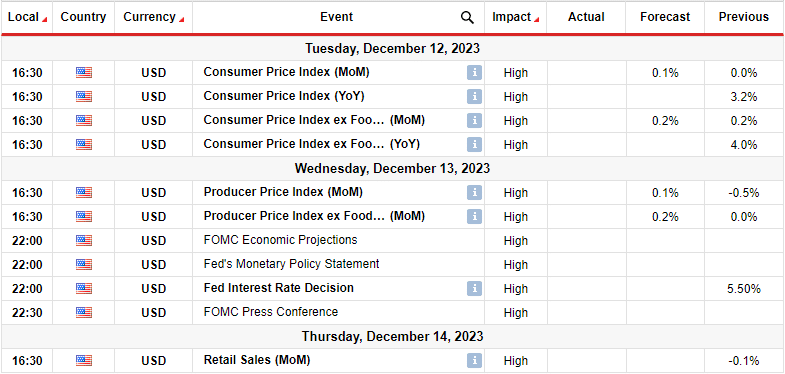

(Click on image to enlarge)

Next week is packed with high-impact events from the US, including the Fed meeting and inflation and retail sales data.

Consumer and producer inflation data will come out before the Fed meeting. Therefore, these reports will determine whether the Fed is hawkish or dovish at the meeting. A drop in inflation will suggest a dovish Fed and increase bets for rate cuts.

Meanwhile, the Fed will likely maintain steady rates on Wednesday. Additionally, the Fed will unveil its economic projections summary, revealing officials’ rate expectations for the next year.

USD/CAD weekly technical forecast: 1.3502 level temporarily halts decline

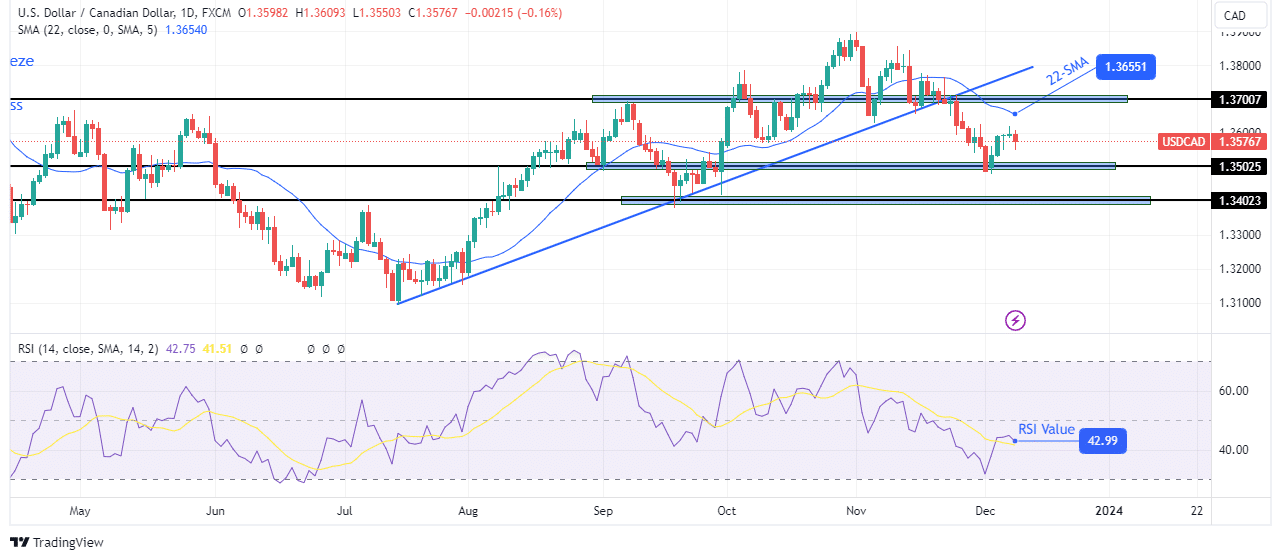

(Click on image to enlarge)

USD/CAD daily chart

After trading in a bullish trend for some time, the price has broken below its support trendline, signaling a reversal. At the same time, the RSI fell well below the pivotal 50 level, suggesting a shift in sentiment.

The decline paused at the 1.3502 support level for a short rebound. However, the bearish bias is strong, meaning the recovery is only temporary. Bears are likely waiting at the nearest resistance level to resume the downtrend. If the price continues climbing next week, it will likely pause at the 22-SMA resistance.

However, there is also a chance the price will climb higher to retest the recently broken trendline. Still, when bears return, the price will fall to retest the 1.3502 and the 1.3402 support levels.

More By This Author:

EUR/USD Price in Demand Zone, All Eyes On US NFPUSD/.JPY Outlook: Yen Heads For A Stellar Week Against The Dollar

GBP/USD Price Analysis: Dollar Gains Before Critical US NFP Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more