USD/CAD Weekly Forecast: Cooling Inflation Prompting Cut In Sep

The USD/CAD weekly forecast is bearish as easing US inflation has raised the likelihood of a September Fed cut.

Ups and downs of USD/CAD

The USD/CAD pair had a slightly bearish week but closed well above its lows. During the week, investors focused on Powell’s testimony and US inflation data. Although Powell was cautious, he noted that inflation was on a downtrend.

After his speech, consumer inflation data showed a bigger-than-expected easing in price pressures. This led to a surge in Fed rate cut expectations which weighed heavily on the dollar. However as the week ended, US wholesale inflation figures came in higher-than-expected, allowing the dollar to recover slightly.

Next week’s key events for USD/CAD

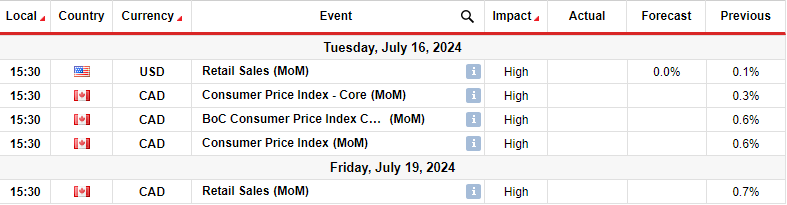

(Click on image to enlarge)

Next week, the US will only release a retail sales report. Meanwhile, Canada will release inflation and retail sales figures. The US retail sales report will add to the recent reports that have shaped the Fed’s rate cut outlook. This week, the likelihood of a September cut rose to 93% after the consumer inflation report. Consequently, if retail sales ease, there will be more certainty about a rate cut in September.

Meanwhile, Canada’s inflation report will impact BoC rate cut bets. Last month, inflation in Canada unexpectedly accelerated, leading to a drop in bets for a cut in July. If inflation spikes again, Canada’s central bank might not cut in July. However, if it eases, chances of a cut will go up.

USD/CAD weekly technical forecast: Bears face the 1.3601 support

(Click on image to enlarge)

USD/CAD daily chart

On the technical side, the USD/CAD price is challenging the 1.3601 key support level. The bias is bearish because the price trades below the 22-SMA with the RSI below 50 in bearish territory. However, after the previous bullish move, the price has been caught in a sideways move between the 1.3601 support and the 1.3800 resistance.

This consolidation could be a pause in the previous bullish trend or the start of a reversal. The price must break below the 0.382 Fib retracement level and the 1.3601 support to confirm a reversal. On the other hand, if this is just a pause, the 1.3601 support might hold firm, allowing bulls to retest and possibly break above 1.3800.

More By This Author:

USD/JPY Outlook: Yen Retreats Following Solid RallyEUR/USD Price Analysis: Fed Rate Cut Expectations Surge

GBP/USD Outlook: Pound Soars On Upbeat UK GDP

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more