USD/CAD Weekly Forecast: BOC To Maintain Current Rates

The USD/CAD weekly forecast is bullish as markets are not expecting a rate increase from the BOC next week.

Ups And Downs Of USD/CAD

According to data on Tuesday, the Canadian economy surprisingly stagnated in the final three months of 2022, giving the BOC enough reason to pause.

According to a forecast made on Thursday by Canada’s independent budget watchdog, the Bank of Canada will keep its main policy rate at its current level of 4.5% till the end of this year before beginning to lower it.

Despite people’s increased optimism over the labor market, consumer confidence in the US unexpectedly fell in February.

Last week, fewer Americans applied for unemployment benefits than expected, a sign of the labor market’s ongoing resilience.

Economic figures released on Friday showed consistent demand for US services. S&P Global and the Institute for Supply Management purchasing managers’ indices demonstrate that the sector’s activity is still increasing despite decreased input prices. Activity in the manufacturing sector increased as well.

These releases contributed to last week’s volatile moves, leaving the pair nearly flat.

Next Week’s Events For USD/CAD

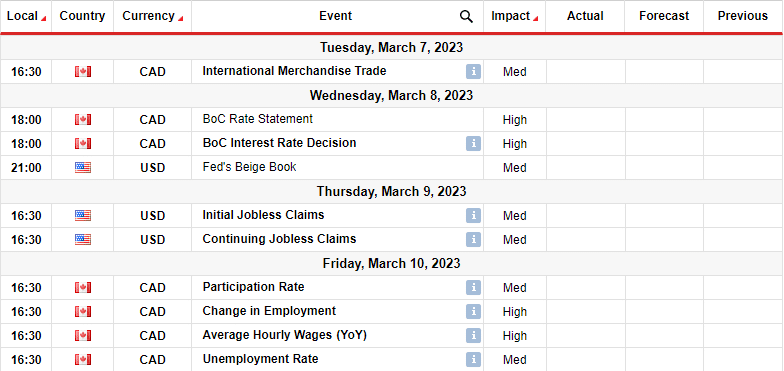

(Click on image to enlarge)

Investors will pay attention to Canada and the US employment data next week. They will also be keen on the BOC’s rate decision. Money markets expect the Bank of Canada to keep its benchmark rate at current levels at next week’s policy announcement.

USD/CAD Weekly Technical Forecast: Bulls Shy Of Breaking 1.3650 Level

(Click on image to enlarge)

The daily chart shows USD/CAD in a bullish move, with the price above the 22-SMA and the RSI above the 50-level. The price is moving sideways with no clear direction on a larger scale. Therefore, bullish and bearish moves do not last very long.

At the moment, the bullish move is facing a strong resistance level at 1.3650. This level might hold firm, seeing the return of bears and a retest of the 1.3452 support.

However, if bulls are strong enough to break above this level, we might see the price rise to the next resistance at 1.3801. It could also lead to a longer-lasting bullish trend.

More By This Author:

AUD/USD Weekly Forecast: Investors Expect 25bps Hike By RBAGBP/USD Weekly Forecast: Dollar To Gain Amid Upbeat Data

EUR/USD Weekly Forecast: US Inflation Rises By Most In 6 Months