USD/CAD Tumbles To Four-Month Lows Under 1.3300 After US CPI

Photo by Michelle Spollen on Unsplash

The USD/CAD turned south on Tuesday, falling below 1.3300 as the US Dollar weakened following the release of local inflation data. With data coming below expectations, markets are now fully pricing in a no-hike by the Federal Reserve (Fed) on Wednesday. On the Canadian side, no relevant economic data will be released on Tuesday. The Loonie is also benefiting from higher Oil prices and positive risk sentiment.

Markets diggest US CPI data ahead of Fed’s decision

The US Bureau of Labor Statistics’ Consumer Price Index (CPI) came below expectations in May. The headline inflation rate slightly decreased to 4% YoY versus the 4.1% expected and down from its previous figure of 4.9%. On the other hand, the Core inflation measure matched expectations easing to 5.3% YoY from the previous 5.5%. On a monthly basis, the CPI and the Core CPI rose 0.1% and 0.4%, respectively.

Following the data, the CME FedWatch Tool suggests that investors have practically fully priced in a no-hike for Wednesday’s Fed decision. Attention now shifts to the following meetings, so that investors will eye any clues regarding forward guidance in Chair Powell’s press conference, the updated macroeconomic forecasts and the dot plots from the Federal Open Market Committee (FOMC). As for now, the stronger case for July’s meeting is a 25 bps hike, whose odds slightly increased to 63%.

The US Dollar, measured by the DXY index, is trading 0.35% lower on the day following inflation numbers, retreating to the 103.30 area.

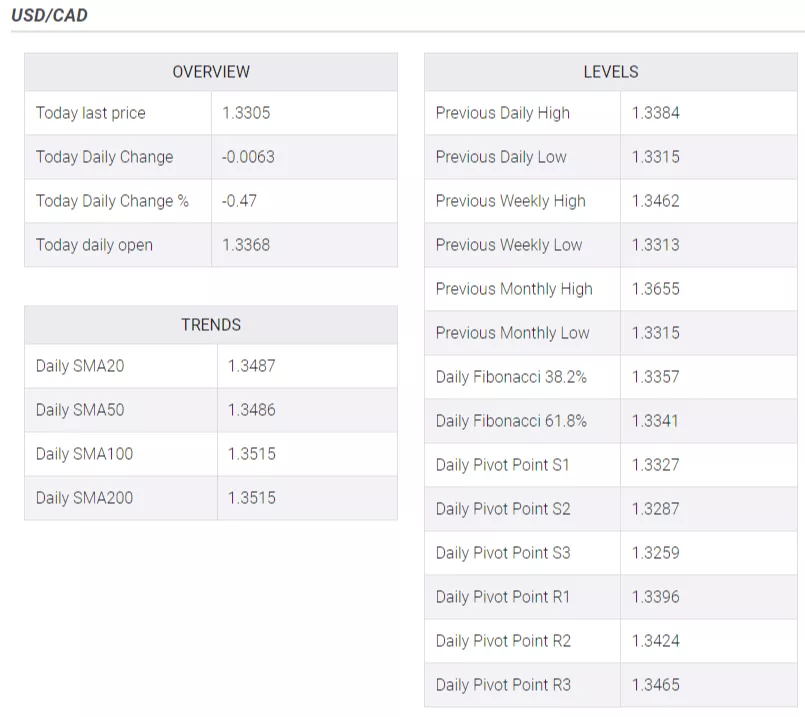

USD/CAD levels to watch

Based on the daily chart, the USD/CAD shows a bearish bias in the short term, as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest that the sellers are in control, while the pair trades below its main moving averages.

Upcoming resistance for USD/CAD is seen at the zone at 1.3350 level, followed by the 1.3380 area and the psychological mark at 1.3400. On the other hand, support levels are seen at the 1.3300 area, followed by April’s low at 1.3273 and the 1.3250 zone.

USD/CAD daily chart

(Click on image to enlarge)

-638222686795026459.png)

More By This Author:

AUD/USD Price Analysis: Seems Poised To Test May Swing High, Around 0.6815-20 Zone

XAG/USD Hits A Four-week High But Retreats As Gravestone Doji Emerges

USD/JPY Price Analysis: Bounces Off Weekly Lows, Further Upside Above 140.00

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more