USD/CAD Signal: Dollar Bounces Against Loonie

All things being equal, I would anticipate a lot of noise in this market, but I do think that we are starting to enter a potential “buy on the dips” scenario.

The US dollar initially fell against the Canadian dollar during trading on Wednesday session, but as the Bank of Canada chose to keep its interest rate at 5%, and perhaps more importantly has dropped the concerns of inflation out of the statement, it looks like the Bank of Canada is done tightening its monetary policy.

While the Federal Reserve is expected to be done tightening its policy as well, the reality is now the Canadian dollar could end up being attached to the oil markets more than anything else again, and if that’s the case, the Canadian dollar is probably in a significant amount of distress, due to the fact that crude oil markets are falling quite drastically.

Bank of Canada and the Federal Reserve

- If both of the central banks are in fact going to stand pat with monetary policy, and then eventually start cutting, it not only has the Canadian dollar highly attached to the oil market in the future, but the reality is also that the US dollar is considered to be a safety currency simultaneously, meaning that if we start to see emergency rate cuts, the Canadian dollar will probably be in trouble.

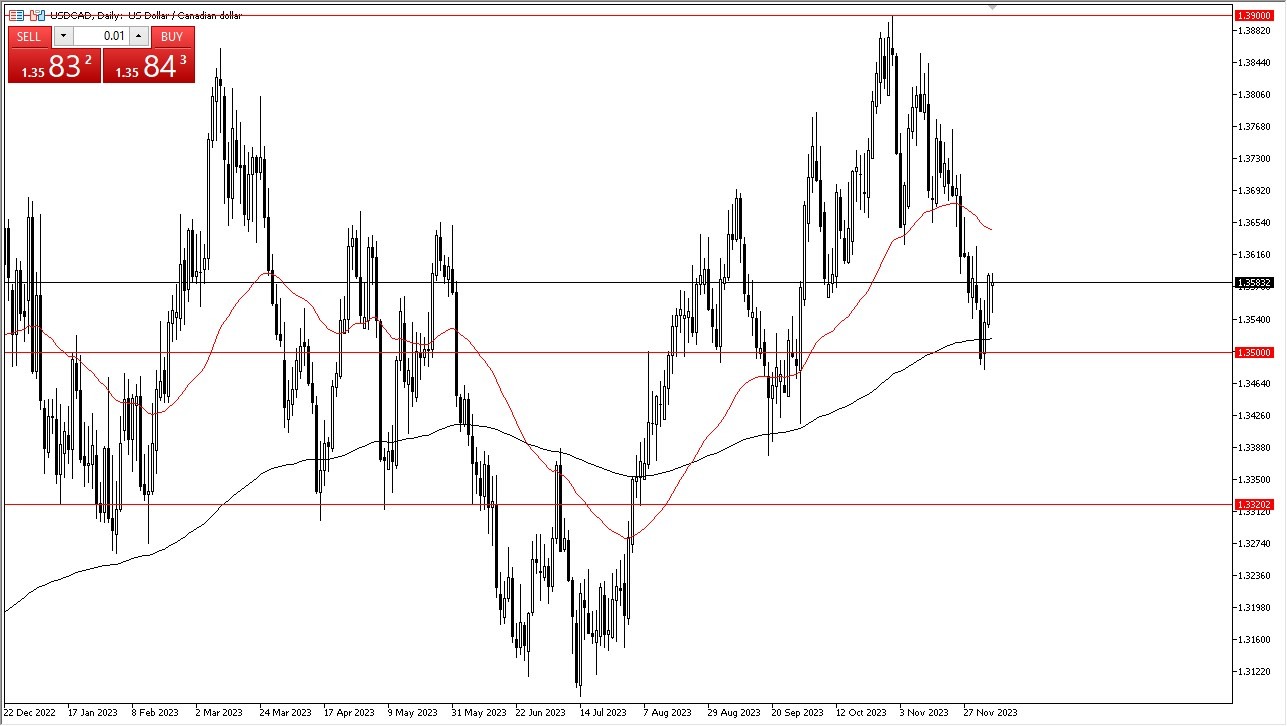

- The 50-Day EMA above is a potential target, which is at the 1.3650 level.

All things being equal, I would anticipate a lot of noise in this market, but I do think that we are starting to enter a potential “buy on the dips” scenario, especially as the 200-Day EMA sits just above the psychologically important 1.350 level. This of course is an area that will attract a lot of attention, and where we bounce from previously. We have the jobs number coming out on Friday, so that has a huge catalyst as to where we go next. If the US employment figures come out stronger than anticipated, that probably sends us market much higher. Thursday might be a little bit quiet as we continue to try and form some type of basing pattern, so I do think that this is probably a scenario where you set up for an explosive move on Friday more than anything else.

I favor the outside, but I also recognize that this pair is notoriously choppy under most circumstances, and I don’t know if that’s going to change anytime soon. Pay close attention to crude oil, I could also give you a bit of a “heads up.”

Potential signal: I am a buyer on a break above the 1.3650 level, with a stop loss at the 1.3522 level. I would aim for 1.3810 above.

(Click on image to enlarge)

More By This Author:

Silver Forecast: Looks For The Bottom

USD/JPY Forecast: Fluctuates Against The Yen On Wednesday

Ethereum Forecast: Market Dynamics Reflect Uncertainty

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more