USD/CAD Retreats As The U.S. Economy Cools Down

Image Source: Unsplash

In the middle of the week, the USD was one of the worst performers in the FX markets, driven by soft ADP Employment figures and downward revisions of the Gross Domestic Product (GDP) annualised rate. On the CAD’s side, no relevant data was released as investors' eyes are on Friday’s Q2 GDP figures revisions from Canada.

The GDP annualised growth rates figures from the United States was revised lower to 2.1%, while the ADP Employment Change figures missed the consensus in August. They showed that the US economy added 177,000 figures, lower than the 195,000 expected and the previous 371,000. The cooling economy evidence remained investors that Jerome Powell stated last Friday that the Federal Reserve (Fed) would maintain its policy at restrictive levels if the economy didn’t cool down.

According to the CME FedWatch tool, markets are now pricing in that the Federal Reserve will cut rates in June 2024 sooner than the previous expectations, while the odds of a hike in November remain near 40%. For the rest of the week, investors will eye Personal Consumption Expenditures (PCE) figures from July on Thursday and Friday’s Nonfarm Payrolls from August.

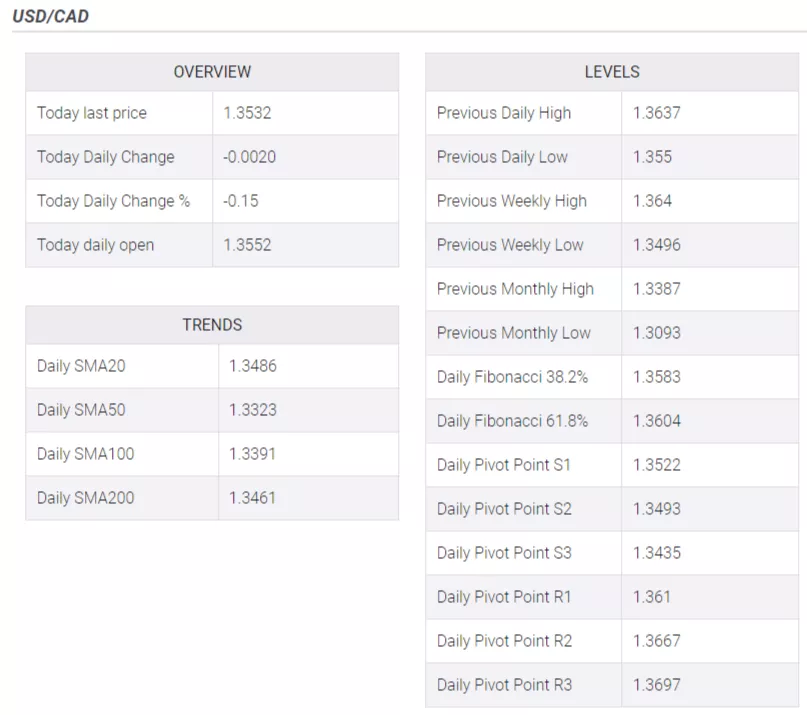

USD/CAD Levels to watch

The daily chart analysis indicates a neutral to a bearish outlook for USD/CAD, as the bears show signs of taking control but still face challenges ahead. The Relative Strength Index (RSI) points downwards in the bullish territory, suggesting a possible trend reversal, while the Moving Average Convergence (MACD) shows weaker green bars. However, the pair is above the 20,100,200-day Simple Moving Average (SMA), pointing towards the prevailing strength of the bulls in the larger context.

Support levels: 1.3495 (20-day SMA), 1.3460 (200-day SMA), 1.3450.

Resistance levels: 1.3575, 1.3590, 1.3600.

USD/CAD Daily Chart

(Click on image to enlarge)

-638290256559674609.png)

More By This Author:

USD/JPY Recovers From Below 146.00 While US Dollar Retreats Ahead Of Labor Market Data

EUR/JPY Eases From One-Week Top, Remains On The Defensive Below Mid-158.00s

AUD/USD Extends Gains Toward 0.6450 Ahead Of The Releases Of US Economic Data

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more