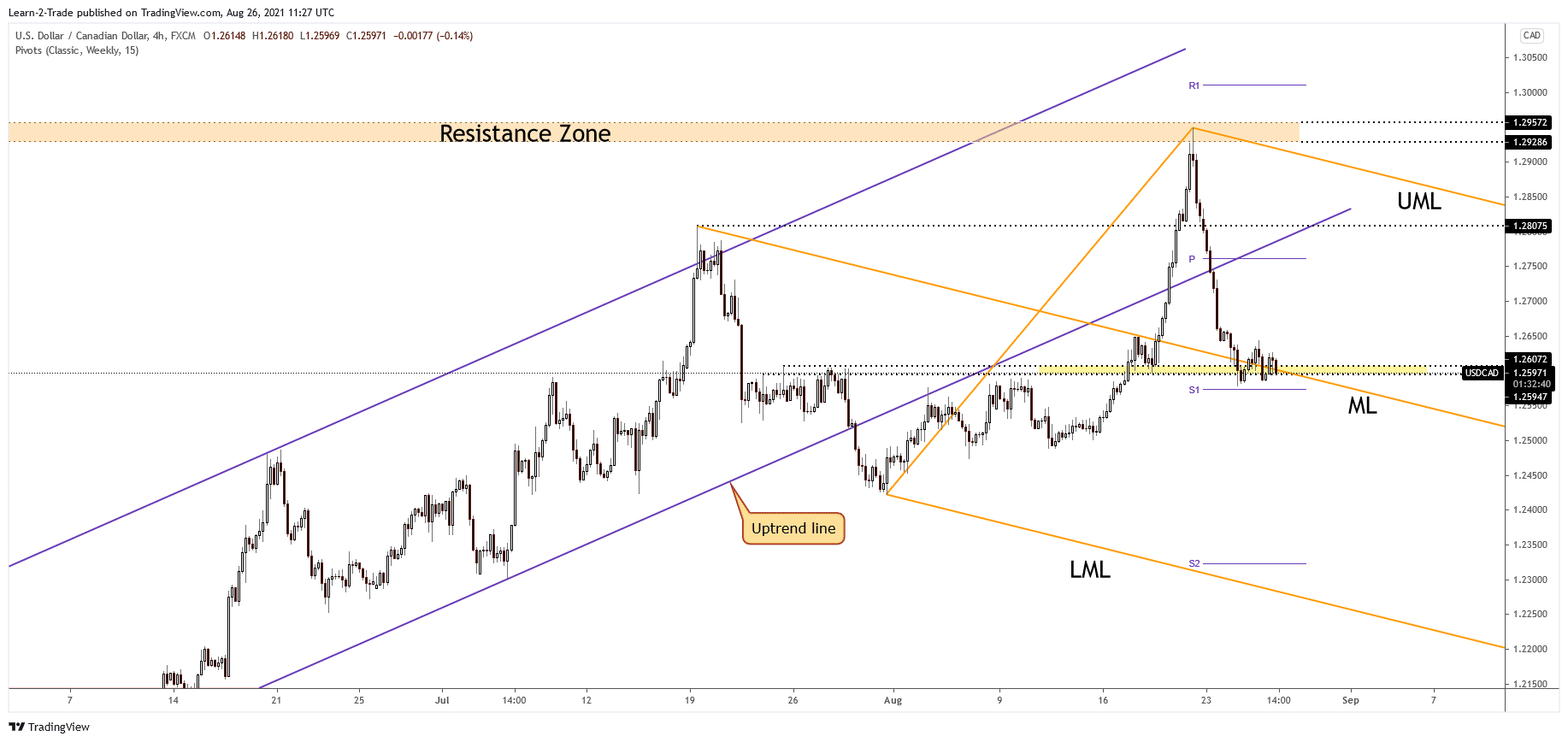

USD/CAD Price Dominated By Bears At 1.26 Ahead Of US Prelim GDP

- The USD/CAD pair failed to reach the weekly S1 (1.2573), which signals a potential growth towards the weekly pivot point.

- A new lower low, dropping and stabilizing under the median line (ML), could signal further drop.

- The US data could move the price, so better than expected figures could boost the USD.

The USD/CAD price is trading in the red at the time of writing. It has registered an impressive sell-off, and now it hovers above a major support zone. It remains to see how it will react after the US data publication.

Photo by Michelle Spollen on Unsplash

The price will be moved by the fundamentals later today, so you should be careful. Anything could happen after the United States Prelim GDP release. The economic indicator is expected to register a 6.7% growth in Q versus 6.5% in Q1. Also, the Unemployment Claims could drop from 348K to 345K in the previous week.

In addition, the Prelim GDP Price Index is expected to rise by 6.0% in the second quarter, the same as in Q1. The Jackson Hole Symposium could also bring some volatility at the end of the week. Fed Chair Powell Speaks is seen as a high impact event on Friday. We cannot exclude sharp movements on all markets around this speech.

USD/CAD price technical analysis: Challenges critical support

(Click on image to enlarge)

USD/CAD 4-hour price chart

The USD/CAD pair continues to pressure the descending pitchfork’s median line (ML). It has dropped as much as 1.2578, and now it moves sideways. Also, the 1.2607 – 1.2594 area represents a support zone. Staying above these levels could bring a new swing higher.

Technically, a temporary rebound, leg higher, is somehow expected after the most recent massive drop. Still, the greenback needs strong support from the US economy to be able to rise again. The Dollar Index is still under some pressure. Some poor US data could force the DXY to drop deeper. This scenario signals USD’s depreciation versus the other major currencies. On the other hand, better than expected US data could boost the US Dollar.

The USD/CAD could develop a larger downside movement if it drops and stabilizes below the median line (ML) and under the weekly S1 (1.2573) level. From the technical point of view, jumping and closing above 1.2643 immediate high indicates an upside momentum. On the other hand, its failure to reach the S1 could signal a potential growth towards the weekly pivot point (1.2761).

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more