USD/CAD Price Analysis: Dollar Retreats After Overnight Gains

Today’s USD/CAD price analysis is bearish as the dollar eased from its overnight gains against other currencies. The dollar saw a significant increase overnight following a boost in US retail sales, which rose by 0.6% in August, surpassing the expected 0.2% rise. Still, the Canadian dollar was stronger.

On Thursday, the Canadian dollar strengthened against its US counterpart and other G10 currencies. This rally came due to improved investor sentiment and a rise in the price of oil, a major export for Canada. Oil reached its highest level this year. Notably, US crude oil futures settled 1.9% higher at $90.16 a barrel due to expectations of tighter supply.

Jay Zhao-Murray, a market analyst at Monex Canada Inc., noted, “The move in crude has allowed the Canadian dollar to rebound from oversold conditions.”

Meanwhile, Wall Street experienced gains despite hotter-than-expected economic data. The data did not dampen optimism regarding an anticipated pause in Federal Reserve interest rate hikes later this month.

Simultaneously, the US dollar reached its highest level in six months against a basket of major currencies as the European Central Bank signaled the conclusion of its rate hike cycle. Consequently, the euro weakened, allowing the dollar to strengthen.

Elsewhere, it was reported that Canada’s wholesale trade grew by 0.2% in July compared to June, falling short of the expected 1.4% gain.

USD/CAD key events today

No major economic events from the US or Canada are lined up for today. As such, investors will likely wait for next week’s data.

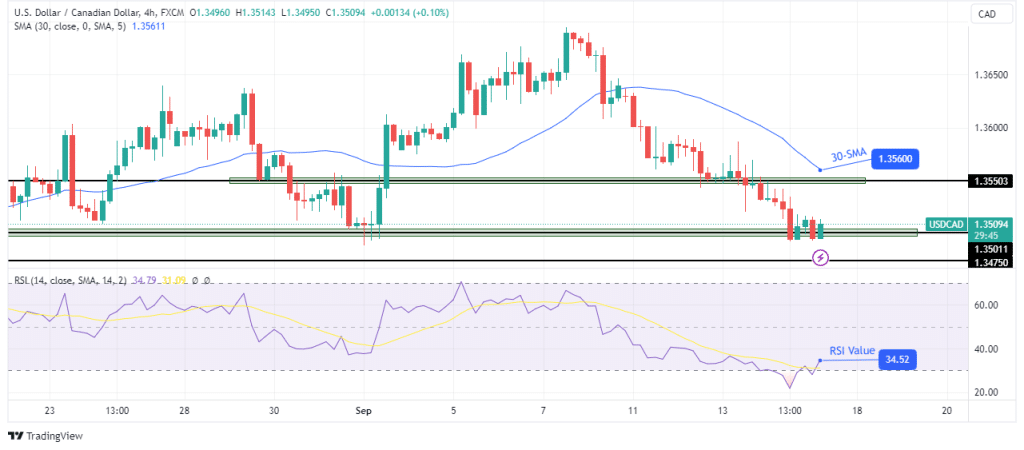

USD/CAD technical price analysis: Bears hit the brakes at 1.3501 support.

USD/CAD 4-hour chart

The USD/CAD price has plunged to the 1.3501 support level on the charts and is on a steep, bearish move. Bears are much stronger than bulls, which has seen the price make very shallow and few retracements. This means the price has traded well below the 30-SMA for some time.

However, the price paused at the 1.3501 support level, where the RSI entered an oversold region. This level has previously caused reversals. Bears might break below if they are strong. Otherwise, we might see a deeper retracement to the 30-SMA or a reversal.

More By This Author:

Gold Price In Sellers’ Territory Ahead Of US PPI, ECB

EUR/USD Forecast: Bounces Off 3-Month Low, Eyes On ECB

GBP/USD Price Hovering Above 1.2445 Support, Eying US CPI

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more