USD/CAD Outlook: Weak Recovery, Holding Near Monday’s Lows

Today’s USD/CAD outlook is bearish. The pair recovered slightly but stayed close to lows hit on Monday. The Canadian dollar rose against the dollar on Monday, continuing a rebound from a five-month low. Increased risk appetite put pressure on the safe-haven dollar. Meanwhile, the dollar dropped against a basket of major currencies, while Wall Street rose as investors awaited inflation data from the US.

On the other hand, the price of oil, one of Canada’s main exports, ended Monday lower 0.3% at $87.29 a barrel but held near 10-month highs. Notably, the rally in the loonie came after stronger-than-expected domestic employment data on Friday.

Consequently, it kept alive the chances of another rate hike by the Bank of Canada. The BOC left its policy rate on hold at its last meeting.

However, the rebound in the Canadian dollar might not last long. Resilient growth in the US has fueled another recovery in the dollar. However, the rally will be tested by more economic data and the Fed’s policy meeting later this month.

Notably, the dollar, which measures the currency against a number of its peers, has risen 5% since late July and is currently at its highest in nearly half a year. Most investors had expected the US economy to weaken this year under the pressure of multiple Fed rate increases. However, that did not happen.

Although the dollar weakened slightly over the summer, growth has been weak in most of the world’s major economies. On the other hand, the United States economy has remained comparatively strong.

USD/CAD key events today

The pair will likely remain quiet as neither the US nor Canada will release important economic reports.

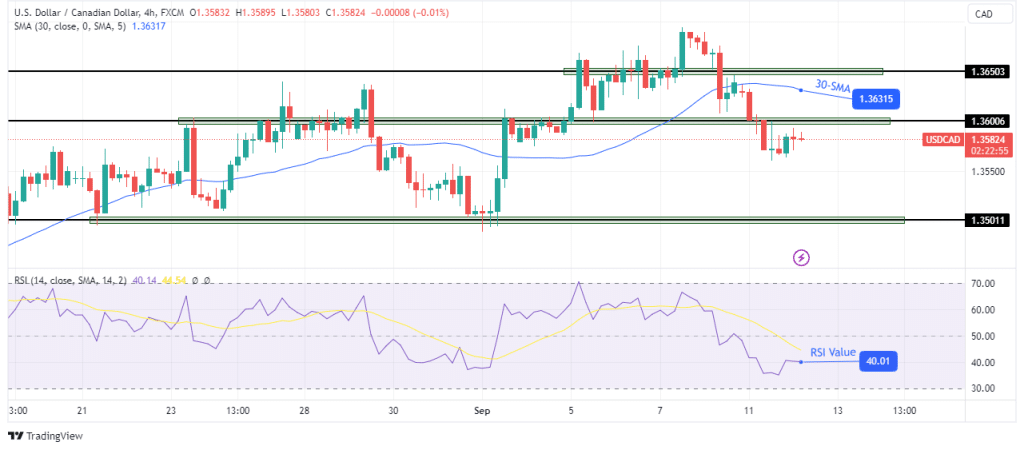

USD/CAD technical outlook: Bulls stage a feeble rebound.

(Click on image to enlarge)

USD/CAD 4-hour chart

On the technical side, USD/CAD’s decline has paused below the 1.3600 key level. Bulls have recovered slightly but are weak. Therefore, they might not have enough strength to push above the 1.3600 resistance level.

Even if the price goes above this level, there will be resistance from the 30-SMA. This means that bears might soon return to continue the decline. If bears return, the price will likely target the next support level at 1.3501.

More By This Author:

USD/JPY Forecast: Downside Risk Soars After BoJ’s RemarksEUR/USD Weekly Forecast: ECB Expected To Retain Rates

USD/CAD Weekly Forecast: BoC Hike Odds Rise On Jobs Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more