USD/CAD Outlook: Struggling Under 1.36 Amid Surging Oil Prices

Embark on Tuesday’s market journey, where the USD/CAD outlook took a bearish turn, driven by the Canadian dollar’s ascent amid surging oil prices. Moreover, investor sentiment was shaped by expectations of the Fed holding steady on interest rates on Wednesday.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Financial markets were calm ahead of the release of US consumer price index data on Tuesday and the Fed meeting on Wednesday. Both events will shape investor confidence in interest rate cuts next year.

The US Federal Reserve will likely keep rates unchanged on Wednesday. However, the November Fed minutes revealed lingering concerns among policymakers about stubborn inflation. Therefore, there is room for additional tightening if necessary.

Darren Richardson from Richardson International Currency Exchange noted, “Economists expect the Fed to keep rates steady and begin cutting interest rates in early to mid-2024. Moreover, lower interest rates typically boost risk appetite and weaken the USD.”

Given Canada’s significant role as a commodities producer, particularly in oil, the Canadian dollar is sensitive to shifts in risk appetite.

Meanwhile, oil prices increased on Tuesday. However, investors remained cautious ahead of crucial interest rate decisions and inflation data releases. Moreover, worries about excess supply and slowing demand growth continued to limit potential gains.

Elsewhere, data from the US Commodity Futures Trading Commission on Friday showed speculators reduced bearish bets on the Canadian dollar.

USD/CAD key events today

- US Core Consumer Price Index m/m

- US Consumer Price Index m/m

- US Consumer Price Index y/y

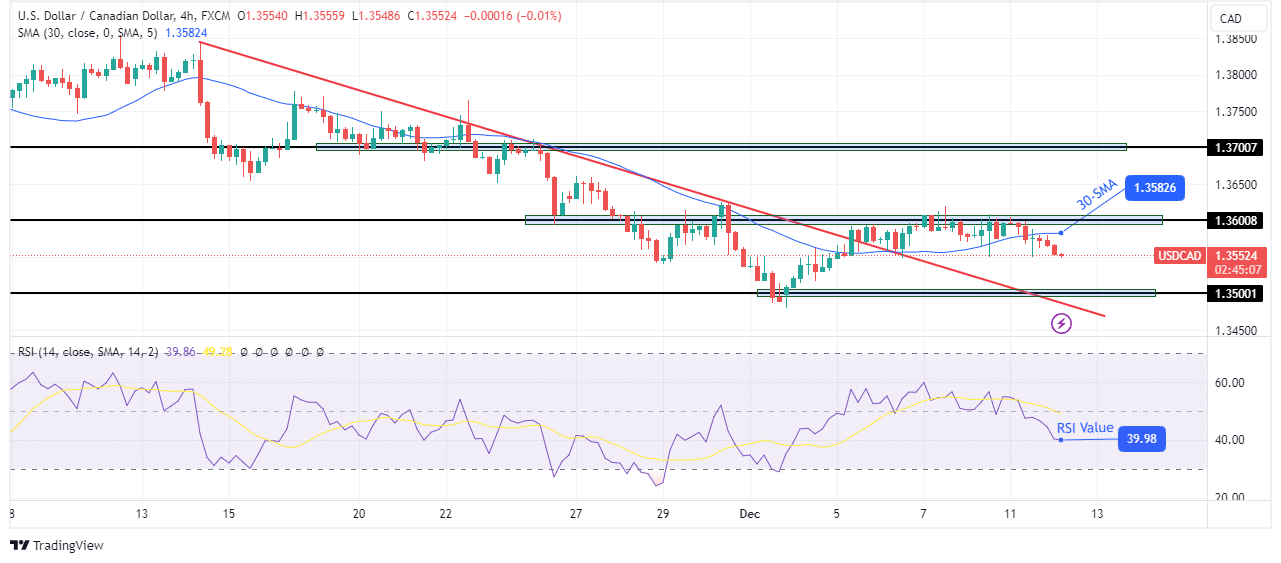

USD/CAD technical outlook: Price breaks through resistance trendline as bears weaken

(Click on image to enlarge)

USD/CAD 4-hour chart

The pair is trading above its resistance trendline, a sign that bears have weakened, allowing bulls to get the upper hand. However, despite the break above the trendline, bulls are yet to find their footing. The bullish move paused at the 1.3600 key resistance level. Bulls made many attempts to break above this level but failed.

Consequently, the price broke below the 30-SMA, and the RSI returned to bearish territory. The price might retest the trendline and make a double bottom before the bulls take over. However, the bearish trend will continue if the price breaks below the 1.3500 support.

More By This Author:

GBP/USD Price Recovers From US NFP-Led LossesEUR/USD Outlook: Euro Hovers Near Three-Week Low

USD/JPY Forecast: Dollar Recovers Ahead Of Inflation, Fed

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more