USD/CAD Outlook Remains Bullish – Currency Pair Of The Week

Photo by Michelle Spollen on Unsplash

Our bullish USD/CAD outlook will be tested this week, with key events from Canada to look forward to, as well as a couple of potentially market-moving data from the US. The USD/CAD was understandably trading within small ranges on Monday with both North American nations on holiday, but the bullish trend remained in place.

The USD/CAD found renewed support on Friday on the back of poor growth and manufacturing PMI data from Canada. Meanwhile the dollar index rose even though the mixed US jobs report boosted speculation that the Fed would be keeping interest rates on hold at the coming meetings. Indeed, money markets imply that rate hikes have finally reached a peak, with the 30-day Fed Fund futures implying a 93% chance of the Fed holding rates steady in September. Although 187K jobs were added into the economy, which was above the 170K expected, the unemployment rate rose to its highest level since February 2022 at 3.8% and average hourly earnings rose 0.2% month-over-month instead of 0.3% eyed.

USD/CAD outlook: key data to watch this week

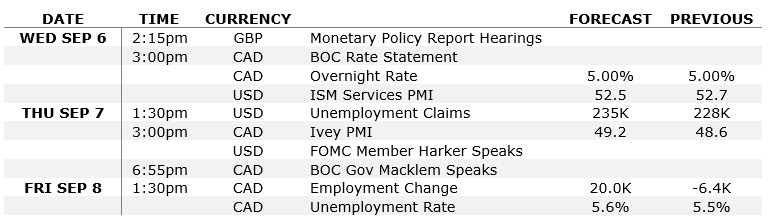

The key data releases to watch for the USD/CAD pair this week are highlighted in the table below.

Among the above data highlights, we have the BOC rate decision in mid-week, when the central bank is widely expected to hold interest rates unchanged at 5%. Only a few analysts expect to see a 25-bps rate increase, the odds of which stand at a lowly 15% according to overnight index swaps.

The BOC’s decision is unlikely to be swayed by inflation surprising to the upside in July. This is because Canada’s economy contracted surprisingly in the second quarter with output falling 0.2% on an annual basis versus expectations of a 1.2% increase. Growth was weighed down by a sharp slowdown in consumer spending and residential investment. On top of this, the more forward-looking manufacturing PMI data followed the global trend and slipped further into the contraction territory (to 48.0 from 49.6), now in its fourth consecutive reading of below 50.

Meanwhile, Canada’s labour market has also been cooling, and the unemployment rate is expected to edge further higher to 5.6% from 5.5% previously, when fresh employment data is released on Friday.

USD/CAD outlook: Technical analysis

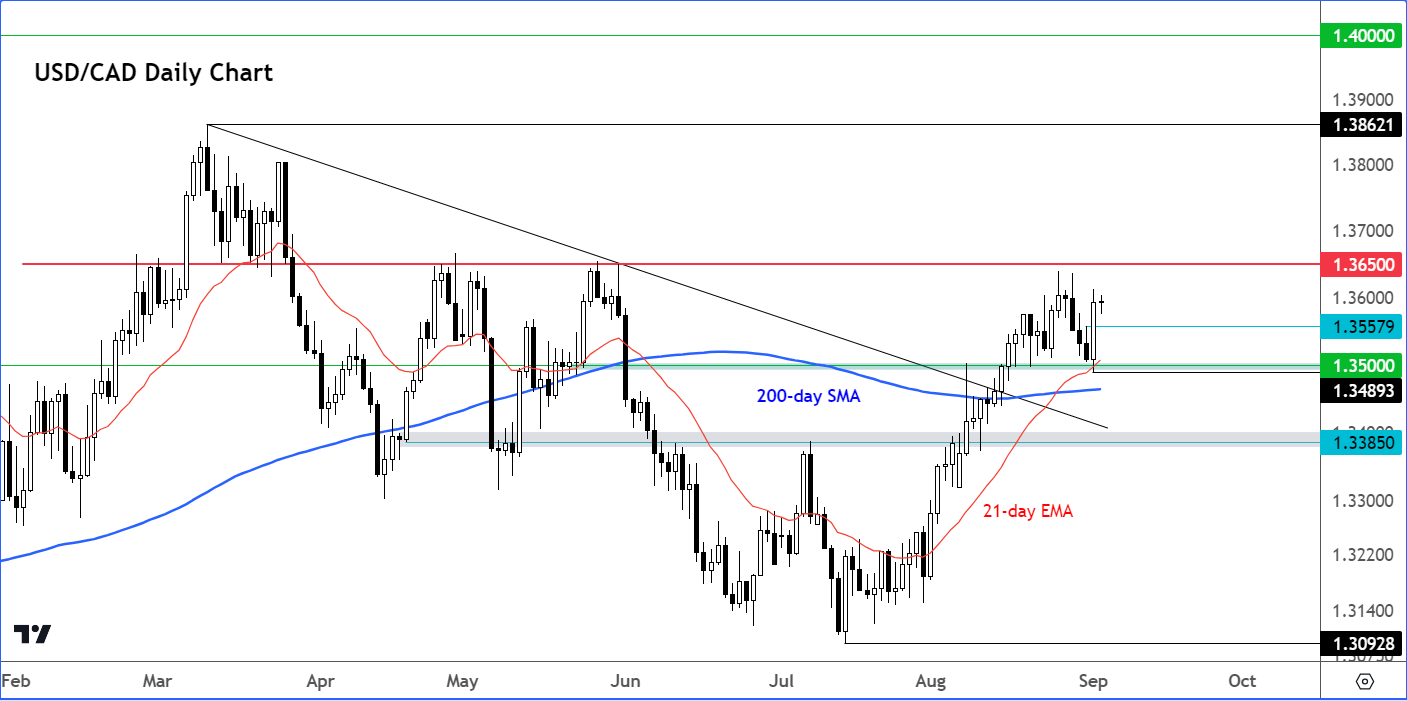

(Click on image to enlarge)

Source: TradingView.com

The higher lows observed in recent weeks means the USD/CAD outlook remains bullish for now. A new bullish signal was formed on Friday when the USD/CAD printed a large bullish engulfing candle on the daily time frame, as support around 1.3500 held firm and led to a 100-pip recovery from the lows. Rates eventually ended Friday’s session near the day’s high around 1.3600. This suggests more gains could be on the way this week, as the momentum is clearly to the upside. Although with Monday being a bank holiday in both North American nations, don’t expect too much action today. But later in the week, a move towards the next resistance at 1.3650 looks more likely than a sell-off. Near-term support comes in around 1.3555ish, which marks Thursday’s high.

More By This Author:

Stocks Regain Ground But Big Risk Events AheadDollar Analysis: EUR/USD And DXY Approaching Key Levels - Forex Friday

Stocks Drop To Fresh Multi Week Lows As Selling Gathers Pace

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more