USD/CAD Outlook: OPEC+ Ready To Intervene To Pause Price Decline

Today’s USD/CAD outlook is slightly bearish as the Canadian dollar strengthens on rising oil prices. Tuesday saw an increase in oil prices by more than 1% after falling to nine-month lows the previous day. This rise came after the market indicated that the producer alliance OPEC+ might reduce output to prevent further decline in oil prices.

The dollar dropped on Tuesday from the 20-year highs reached the day before, which supported the oil market and the Canadian dollar.

Oil prices fell due to pressure from the strengthening dollar, which makes petroleum priced in dollars more expensive for buyers using foreign currencies, and growing worries that rising interest rates may lead to a recession, reducing fuel demand.

Ihsan Abdul Jabbar, the oil minister of Iraq, stated on Monday that OPEC and its OPEC+ allies, which includes Russia, were keeping an eye on the oil price situation to keep markets balanced.

According to analysts, OPEC+ could intervene to boost prices by collectively decreasing their supply if oil markets continue to decline. It could mean a stronger Canadian dollar pushing USD/CAD lower.

USD/CAD Key Events Today

Investors will be receiving several news releases from the United States. The core durable goods orders report will show the total value of new orders for long-lasting manufactured goods.

There will also be the CB consumer confidence and new home sales reports. Investors will also be listening to a speech from Fed Chair Powell later in the day.

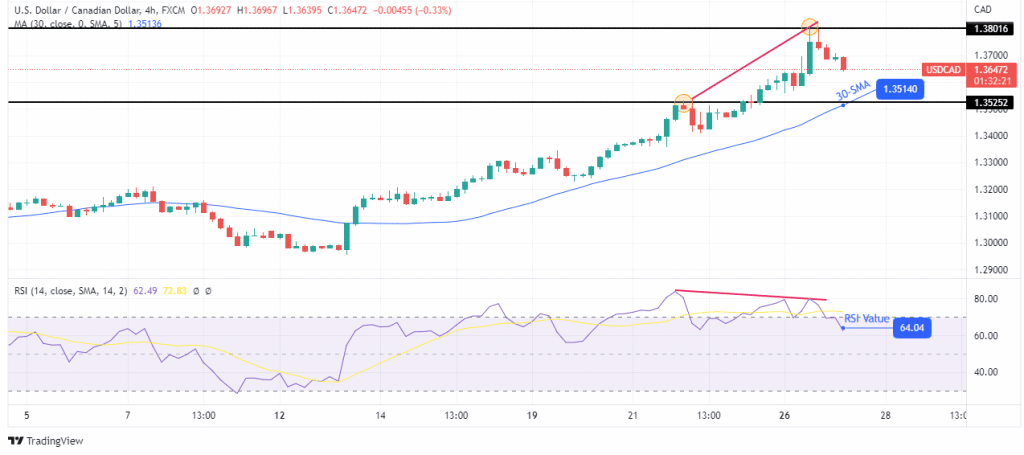

USD/CAD Technical Outlook: Bears Taking Over At The First Sign Of Weakness In The Uptrend

(Click on image to enlarge)

The 4-hour chart shows the price trading above the 30-SMA and the RSI above 50. The trend is clearly bullish. However, buyers are showing weakness, as seen in the bearish RSI divergence. It has allowed sellers to come in at 1.3801 and push the prices lower.

There is no doubt that there are still buyers in the market. This might just be a pause in the uptrend. It will only become a reversal if the price can break below the 30-SMA and the 1.3525 support level, as this is where most buyers are waiting to get back in.

More By This Author:

AUD/USD Forecast: Flight to Safe-haven USD, Dumping AussieEUR/USD Outlook: Europe’s Inflation Expectations on the Rise

GBP/USD Weekly Forecast: Bearish Momentum Ahead Of Fed And BoE

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more