USD/CAD Outlook: Loonie Strengthens Following Oil Price Surge

The USD/CAD outlook is dim on Thursday as the Canadian dollar gains momentum, riding high on a substantial oil price surge from the previous session. Meanwhile, the US dollar treads cautiously as investors brace for crucial economic data

USD/CAD traded near lows hit on Wednesday as oil prices rallied. Notably, the rally in oil prices came after the EIA reported a higher-than-expected draw in crude inventories last week. At the same time, gasoline stocks had a bigger-than-expected decline, showing increasing demand.

At the same time, the Canadian dollar remains strong amid a robust economy and slightly hawkish policymakers. Last week, the Bank of Canada held rates and said it was too early to consider rate cuts. Meanwhile, other major central banks, including the Fed, are inching closer to rate cuts.

Additionally, employment data from Canada revealed a robust labor market that will give the BoC enough room to hold higher interest rates. Investors are now expecting data on manufacturing sales. This might give more clues on the state of the economy.

Meanwhile, the dollar was range-bound as traders stayed on the sidelines ahead of key economic data. Bets for a June Fed rate cut have fallen from 71% to 65%. Notably, recent data has had little impact on the outlook for Fed policy. The US has released mixed data showing a weaker labor market and still high inflation.

Currently, traders are awaiting data on wholesale inflation, retail sales, and initial jobless claims. These reports might change the outlook for Fed policy ahead of next week’s Fed meeting.

USD/CAD key events today

- US retail sales

- US wholesale inflation

- US jobless claims

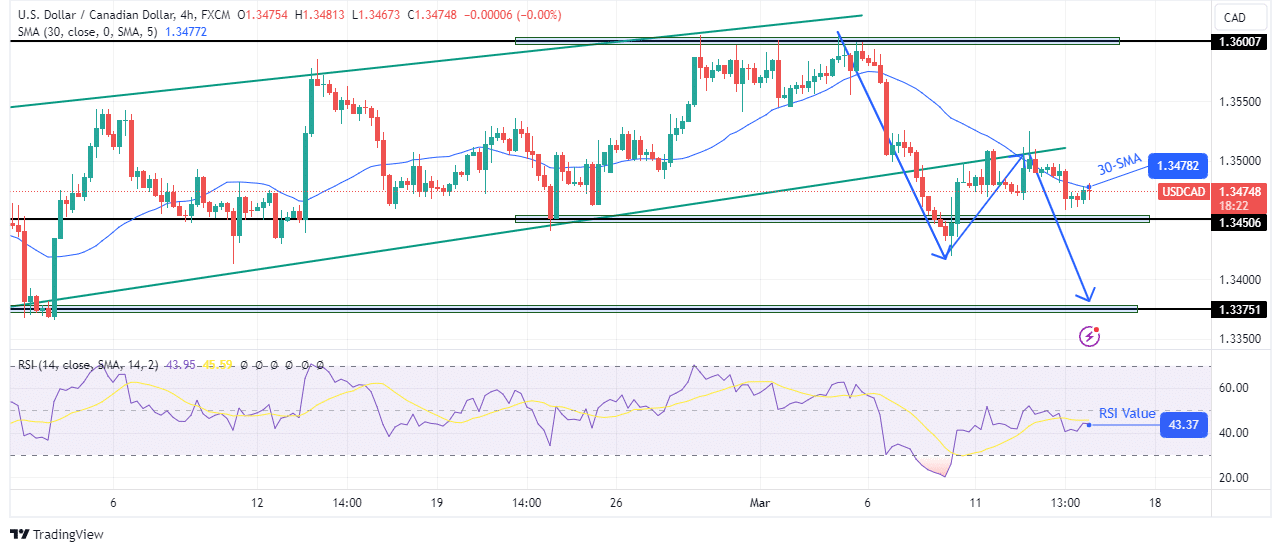

USD/CAD technical outlook: Price reverses after retesting channel support.

(Click on image to enlarge)

USD/CAD 4-hour chart

On the charts, USD/CAD is bouncing lower after retesting the recently broken channel support. At the same time, the price retested and respected the 30-SMA resistance. Meanwhile, the RSI has stayed below the pivotal 50 level, showing solid bearish momentum.

However, bears have yet to confirm the recent channel breakout. They must push below the 1.3450 key support level to make a lower low to do this. If this happens, the price will likely retest the 1.3375 support level and start a downtrend.

More By This Author:

Gold Price Loses Strength, US Retail Sales, PPI In FocusUSD/CAD Price Analysis: Strengthens Following Upbeat CPI

GBP/USD Price Corrects Gains After Mixed US NFP Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more