USD/CAD Outlook: Dollar Mounts A Comeback Post Powell

On Monday, there was a bullish shift in the USD/CAD outlook.

The dollar staged a comeback, although investors digested cautious remarks from Fed Chair Jerome Powell. Moreover, they awaited a crucial employment report later in the week that could impact the US interest rate outlook.

Meanwhile, the Canadian dollar surged to a two-month high against the US dollar on Friday. This move came after positive domestic data that revealed the economy added more jobs than anticipated last month.

In November, Canadian employment increased by 24,900 jobs, surpassing economists’ expectations of a 15,000 gain. However, hours worked declined, and the jobless rate increased to 5.8%.

This jobs data contributed to the positive sentiment surrounding the Canadian dollar. Notably, the currency had already benefited from the recent broad-based weakness in the US dollar.

Additionally, data indicated that Canada’s manufacturing sector contracted in November due to global industrial weakness affecting output and new orders.

Simultaneously, the US dollar weakened against a basket of major currencies as Federal Reserve Chair Jerome Powell cautioned about further interest rate adjustments. Furthermore, the price of oil, a significant Canadian export, settled 2.5% lower. This decline was due to concerns about the latest round of OPEC+ production cuts in the market.

USD/CAD key events today

The pair will likely move sideways as there won’t be any key economic reports from Canada or the US.

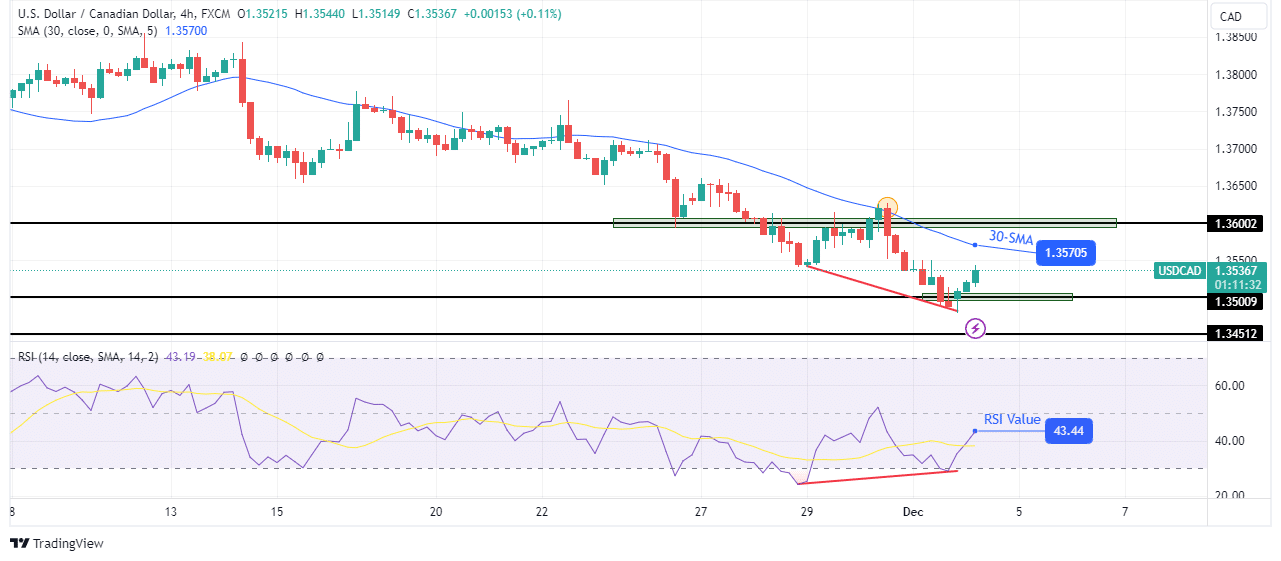

USD/CAD technical outlook: 1.3500 support triggers rebound

USD/CAD 4-hour chart

On the charts, the bias is bearish. However, the price is recovering after respecting the 1.3500 key support level. Bears have been in the lead for long, pushing the price to new lows. At the same time, bulls kept challenging the uptrend at the 30-SMA but failed to push above.

The downtrend has paused at the 1.3500 key level, a new low in the decline. However, the RSI shows weaker momentum at this level, which has allowed bulls to emerge for a rebound. Still, since the bearish bias is strong, bulls might pause at the 30-SMA resistance, where bears will resume the decline. A break below the 1.3500 key level would allow the price to retest the 1.3451 level.

More By This Author:

AUD/USD Forecast: Markets Reflect On Powell’s Cautious RemarksUSD/CAD Weekly Forecast: US Inflation Data Weakens Dollar

USD/JPY Price Accumulating Bullish Energy Ahead Of US ISM

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more