USD/CAD Outlook: Bullish As BoC-Fed Divergence Widens

The USD/CAD outlook shines brighter with bullish prospects as the outlook for rate cuts between Canada and the US continues to diverge. On Wednesday, the US released the CPI report showing a jump in inflation. Meanwhile, the Bank of Canada signaled the start of rate cuts in June.

As more data comes in, it is clear that the Bank of Canada will be ready to cut rates earlier than the Fed. Notably, annual and monthly US inflation figures came in higher than expected, indicating a pause in the downtrend. Headline inflation rose 0.4% monthly and 3.5% on an annual basis. Consequently, rate-cut bets fell sharply, with investors now expecting the first Fed cut in September. Furthermore, there is a chance the Fed will only cut rates two times this year.

Fed policymakers have been waiting to assess data for confidence that inflation will reach the 2% target. However, after three months of hot figures, policymakers and investors have lost confidence. Moreover, the labor market has remained resilient, with the last jobs report beating forecasts.

Meanwhile, the situation in Canada is the complete opposite. Data on the labor market revealed a deteriorating economy that is putting pressure on the Bank of Canada to start cutting interest rates. At the policy meeting on Wednesday, the BoC held rates at 5% as expected. However, Governor Tiff Macklem said that the central bank would likely cut rates in June if inflation continues easing.

USD/CAD key events today

- US core PPI m/m

- US PPI m/m

- US unemployment claims

- US 30-y bond auction

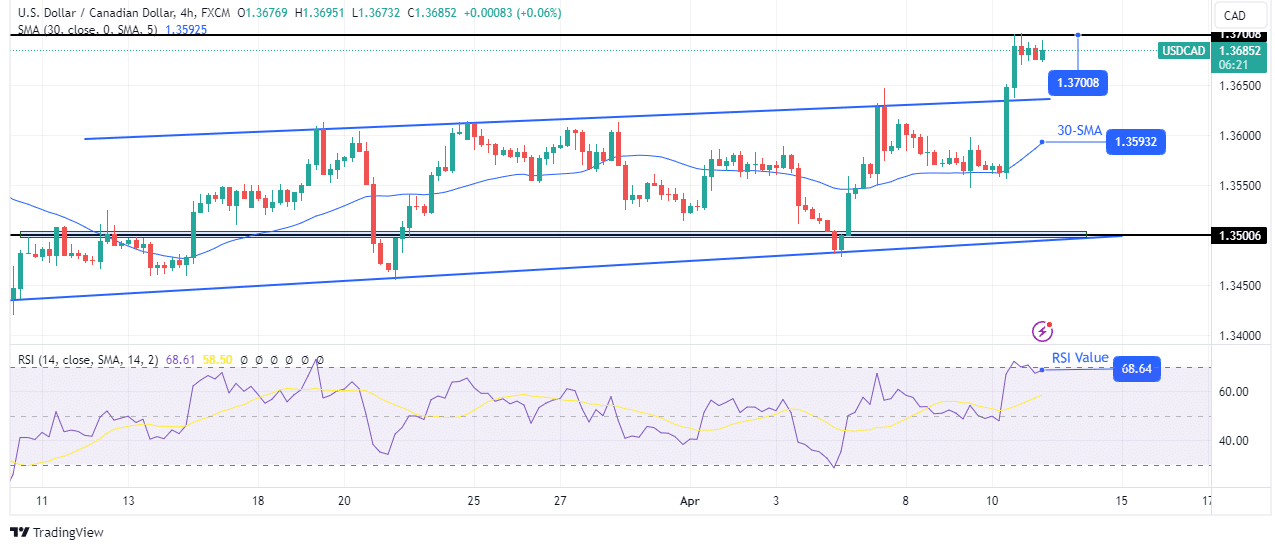

USD/CAD technical outlook: Channel breakout signals momentum surge

(Click on image to enlarge)

USD/CAD 4-hour chart

On the charts, the USD/CAD price has broken above its bullish channel, showing a surge in momentum. Consequently, this might be the start of a stronger bullish trend. The rise in momentum came when the price paused at the 30-SMA support. From here, it made a bullish engulfing candle that broke above the channel resistance. At the same time, the RSI rose to the overbought region.

Currently, the price has paused at the 1.3700 key resistance level. It might consolidate below this level as the SMA catches up before breaking above.

More By This Author:

USD/CAD Forecast: CAD Retreats, USD Advances On Jobs DataEUR/USD Forecast: Dollar Softens Amid Signs Of Economic Easing

EUR/USD Price Looking To Pierce 1.08, Eyes On US GDP

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more