USD/CAD Forecast: Volatility Ahead With Key Data

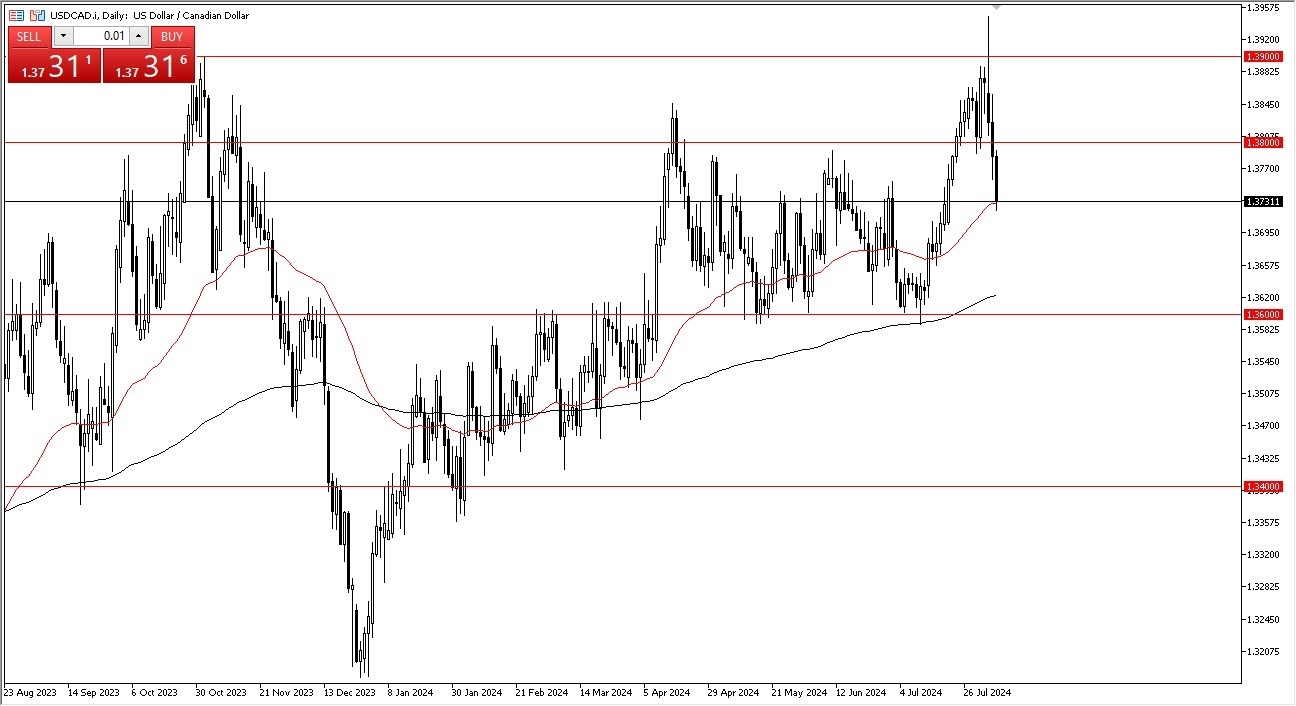

In general, I think this is a market that is going to be very noisy over the next two days, mainly due to the fact that we have initial jobless claims coming out of America on Thursday, and then after that we have employment coming out of Canada on Friday. So, this could be a little bit of ground zero, if you will, going forward for the next couple of days when it comes to volatility. Ultimately though, I think you will continue to see the US dollar strengthen over the longer term. It's worth noting that the 1.39 level above is an area that's been massive resistance multiple times in the past, but at this point it still looks like a market that is trying to get above there over the longer term and I do think that comes into the picture.

On the other hand, though, if we were to break down below the 1.36 level, which would also be just below the 200-day EMA, then this pair would more likely than not fall apart. It would also coincide more likely than not with the US dollar dropping. And if that of course were the case, you would see the dollar drop everywhere.

Bank of Canada, Canadian Employment, and Initial Unemployment Claims

(Click on image to enlarge)

Over the next couple of days, we will have quite a bit of noise to chew through, not the least of which will be the Canadian employment figures on Friday. However, I think you should also pay close attention to the Bank of Canada, and of course the Federal Reserve. Recently, the Federal Reserve has suggested that it is looking at cutting rates, but the Bank of Canada has already done this twice. Given enough time, the interest rate differential will be a driver, but right now I think we have so many different factors going on at the same time that the one thing you can probably count on is going to be choppiness.

More By This Author:

GBP/JPY Forecast: British Pound Rallies Against Japanese Yen On WednesdayWTI Crude Oil Forecast: Continues To Attempt Its Recovery

DAX Forecast: Continues To Look Miserable

Disclaimer: Mr. Christophe Barraud could not be held responsible for the investment decisions or possible capital losses of users. Mr. Christophe Barraud endeavors to provide the most accurate ...

more