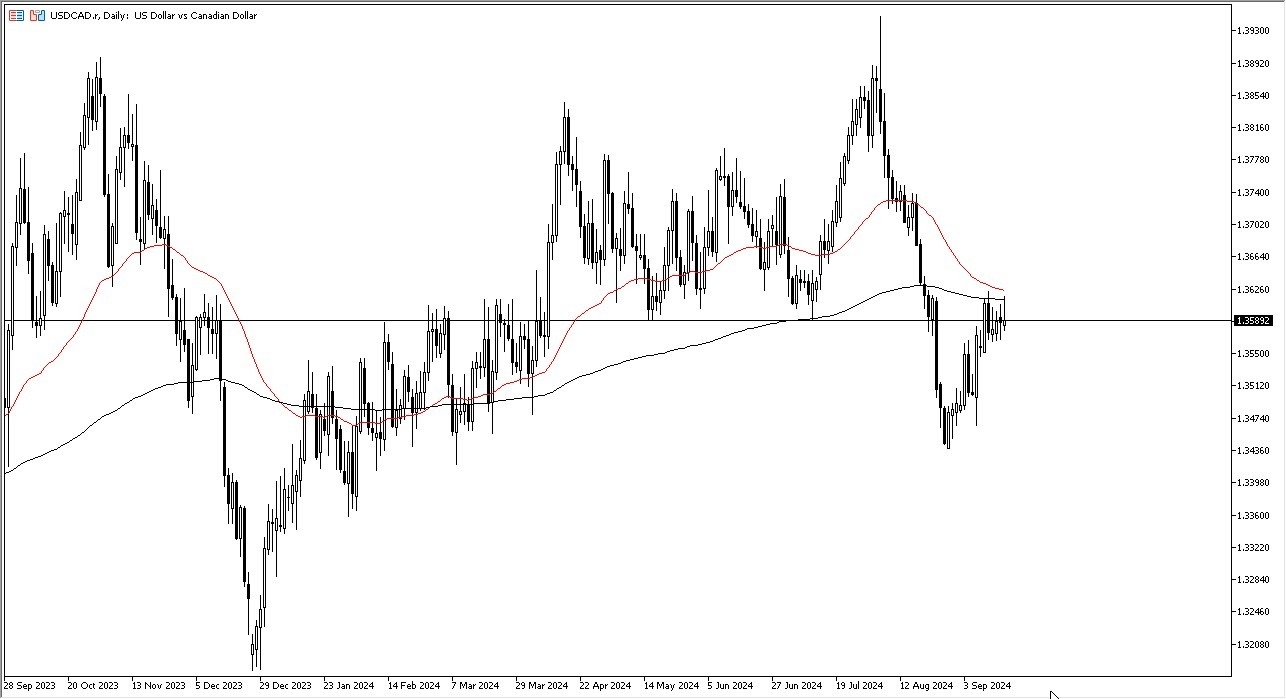

USD/CAD Forecast: US Dollar Tests 200 Day EMA Against Canadian Dollar

If we were to break above the 1.3650 level, then the market is likely to go 1.3750 level above, which of course has seen a lot of resistance previously. If we can break above there, then the next target would be the 1.39 level. The 1.39 level is a major area of resistance on longer-term charts, so does make a certain amount of sense that we would see that as a level that a lot of people will be very cognizant of, so breaking above there would obviously be extraordinarily negative for the Canadian dollar. I do not think that will happen anytime soon though.

FOMC Interest Rate Decision and Press Conference

During the trading session on Wednesday, we will get the Federal Reserve interest rate decision and of course the press conference that occurs after that decision. All things being equal, the USD/CAD market is a one that continues to be very noisy, but it also has a lot of crosscurrents that will be pushing markets back and forth.

Keep in mind that the Canadian dollar is highly sensitive to the crude oil market, so that has a certain amount of influence as well, but you also need to pay attention to the fact that the Canadian economy is highly sensitive to the US economy, as the United States is by far the largest destination of Canadian exports, so it does make a certain amount of sense that if the US economy starts to fall apart, that will actually benefit the US dollar is set of the Canadian dollar. In the short term though, interest rates dropping in America could help the Loonie.

More By This Author:

EUR/JPY Forecast: Bottoming Out?EUR/USD Forecast: Rallies Ahead Of FOMC

Crude Oil Forecast: Gives Up Early Gains On Friday