USD/CAD Forecast: US Dollar Continues To Crush Canadian Loonie

(Click on image to enlarge)

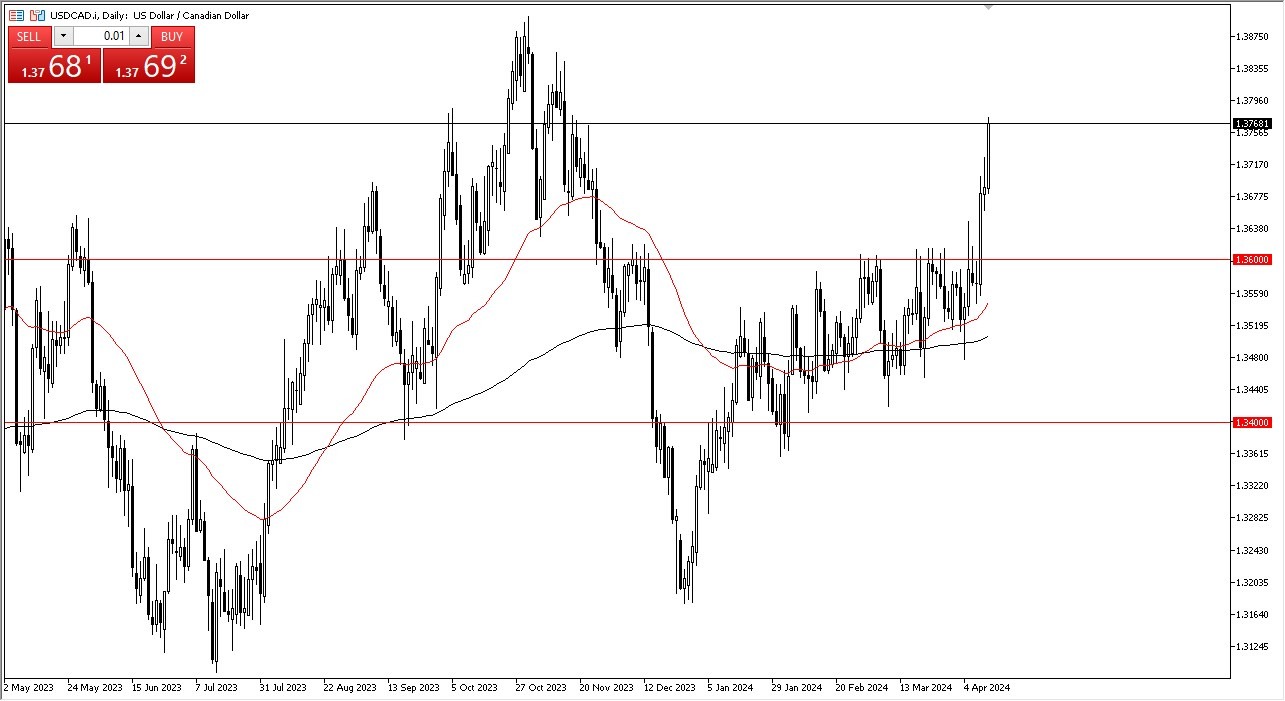

Having said that, keep in mind that this is a pair that typically is very choppy, and then suddenly has a sharp move like we have just seen. After that we go right back to the choppiness. Because of this, I think you need to see a little bit of a pullback in order to get involved, as it could offer “cheap US dollars. Underneath, I believe the 1.36 level is an area that previously had been resistance, and now should be supported based upon “market memory.”

The size of the candlestick for the trading session on Friday shows real conviction, just as the candlestick on Wednesday did. Thursday was a little bit of hesitation, but now that anybody that sold their position on Thursday is now either chasing it or losing if they are short the market, suggest that we will see more momentum over the longer term. Ultimately, I am a buyer of dips.

Crude Oil Doesn’t Matter Anymore

Crude oil doesn’t matter anymore for the Canadian dollar, at least not when priced in US dollars. Quite frankly, the United States produces enough of its own crude oil to for the most part take this out of the equation. Furthermore, the Bank of Canada is likely to cut rates much sooner than the Federal Reserve will, and that will continue to put upward pressure on this pair. Whether or not we can break above the recent highs near the 1.39 level remains to be seen, but as somebody who has been to Canada multiple times over the last couple of years, I can tell you that there are a lot of concerns in the Canadian economy at the moment, not only in the housing market, but also on the streets of Toronto, Québec city, Montréal, and beyond.

More By This Author:

BTC/USD Forecast: Noisy Market AheadPairs in Focus - USD/CAD, DAX, GBP/CHF, Gold, AUD/USD, USD/MXN, EUR/JPY, Bitcoin

GBP/USD Forecast: British Pound Gives Up Initial Gains On Thursday

Disclaimer: Mr. Christophe Barraud could not be held responsible for the investment decisions or possible capital losses of users. Mr. Christophe Barraud endeavors to provide the most accurate ...

more