USD/CAD Forecast: Middle East Chaos Lifts Safe-Haven Dollar

On Monday, the safe-haven dollar rose slightly, but the USD/CAD forecast remained bearish as the Canadian dollar held on to recent gains. There were heightened concerns in the Middle East that unsettled financial markets. Consequently, risk sentiment remained fragile, supporting the dollar.

There were clashes between Israeli forces and gunmen affiliated with the Palestinian group Hamas over the weekend. These clashes came shortly after militants launched a surprise attack on Israel, marking the deadliest outbreak of violence in the country in half a century.

Meanwhile, the Canadian dollar gained strength against the US dollar on Friday, recovering from its weekly decline. This recovery came from robust domestic jobs data, which increased expectations of further interest rate hikes by the Bank of Canada. However, over the week, the Canadian dollar fell 0.5% due to global investor concerns amid a surge in bond yields.

Notably, Canada’s economy exceeded expectations by adding 63,800 jobs in September, while wages continued to rise. This data heightened the likelihood of another interest rate hike. Meanwhile, the jobless rate held steady at 5.5% for the third consecutive month, according to Statistics Canada.

As a result, money markets now indicate approximately a 40% probability of a BOC hike on October 25, up from 28% before the release of this data. On the other hand, despite strong US job growth in September, the US dollar could not sustain its previous gains against a basket of major currencies.

USD/CAD key events today

The pair might not make any big moves today as Canada observes a holiday. Moreover, the US will not report on any major economic indicators.

USD/CAD technical forecast: 1.3550 support level on the horizon.

USD/CAD 4-hour chart

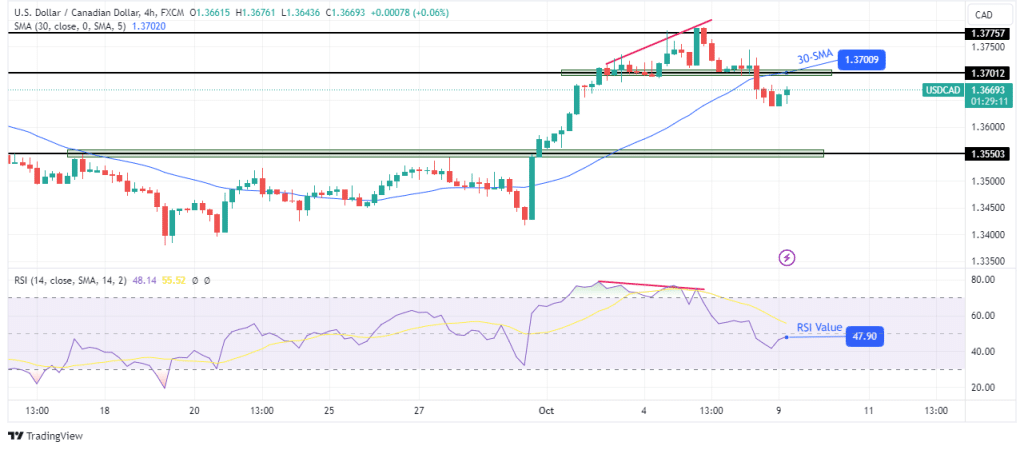

The USD/CAD bears have taken over in the 4-hour chart by breaking below the 30-SMA support. Bears emerged around the 1.3775 resistance level after the RSI recorded weaker bullish momentum. A bearish divergence in the RSI was a sign that bulls had weakened.

Now that the price trades below the 30-SMA, bears will look to start making lower lows. At the moment, the path is clear for the price to retest the 1.3550 support level. However, we might see the price retest the recently broken 1.3701 level before dropping.

More By This Author:

EUR/USD Price Ticks Above Mid-1.05 As NFP LoomsGold Price Consolidating Losses, NFP Remains The Key

GBP/USD Price Gains Above 1.21 As Dollar Takes Breather

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more