USD/CAD Forecast: Loonie Stalls Gains Led By Soaring WTI

Today’s USD/CAD forecast is bearish as the oil rally has boosted the loonie. The Canadian dollar pulled back slightly against the dollar on Monday. However, it remained strong amid higher oil prices. The rise in oil comes amid the extension of output cuts by Saudi Arabia and Russia.

On Friday, the Canadian dollar lost value against the US dollar. Still, it retained most of its weekly gain due to rising oil prices and investor focus on domestic inflation data.

Moreover, a significant part of the currency’s weekly increase can be attributed to the selling of EUR-CAD, as explained by Amo Sahota, director at Klarity FX in San Francisco. The European Central Bank indicated on Thursday that it is likely ending its cycle of interest rate hikes. Consequently, the euro weakened significantly.

Meanwhile, the price of oil, a crucial Canadian export, settled at $90.77 per barrel, marking a 10-month high. This surge was driven by tight oil supplies resulting from Saudi Arabian production cuts. Additionally, there was optimism surrounding Chinese demand.

Sahota mentioned his interest in monitoring the performance of US vs. CAD yield spreads after releasing the Canadian inflation report and the FOMC decision next week. Economists anticipate that Canada’s inflation report will reveal an increase in inflation, with an annual rate of 3.8% in August, up from 3.3% in July.

Meanwhile, the Federal Open Market Committee will likely maintain the US benchmark interest rate within the 5.25%-5.50% range.

USD/CAD key events today

Investors are not expecting any big economic events in the US or Canada. Therefore, they will keep waiting on Canada’s inflation report.

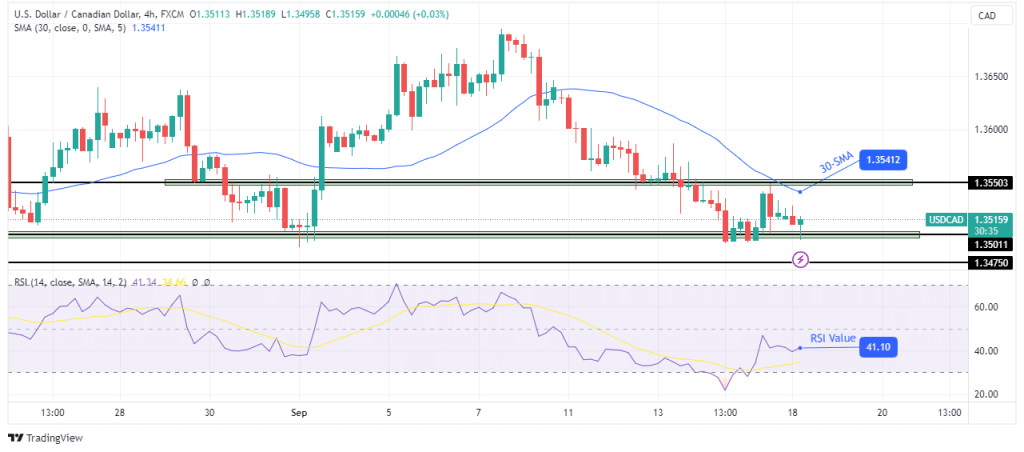

USD/CAD technical forecast: Bears retarget 1.3501 support.

(Click on image to enlarge)

USD/CAD 4-hour chart

On the charts, the downtrend paused at the 1.3501 support level, allowing bulls to retrace the recent move. Moreover, the pullback retested the 1.3550 resistance level. At this level, bears resurfaced to resume the downtrend and are approaching the 1.3501 support level.

A break below this level would allow the price to take out lower support levels, like 1.3475. However, if bulls suddenly take control at this level, as they have done before, we might see a reversal with a break above the 30-SMA and the 1.3550 resistance.

More By This Author:

USD/JPY Forecast: Yen Stalls With Japanese Markets On Holiday

AUD/USD Price Finds Traction Above 0.6449

EUR/USD Outlook: Hovering Near Recent Lows Post-ECB Meeting

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more