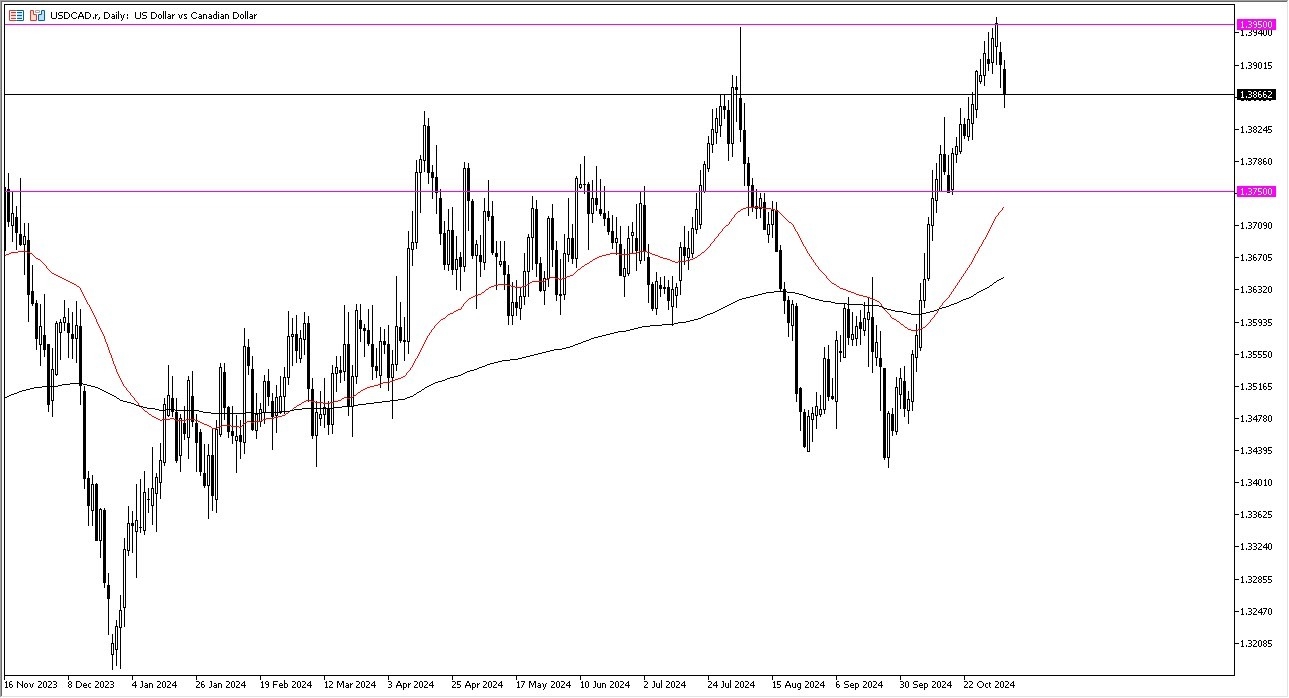

USD/CAD Forecast: Eases Amid Profit-Taking

The market rallied all the way from the 1.35 level to the 1.3950 level in the course of a couple of weeks. Keep in mind that oil markets are somewhat soft, but ultimately, they are bouncing due to the fact that we had been in a two-year range and at the bottom of it. So, with that being said, I think a pullback to the 1.3750 level, then we have a massive amount of support, not only due to the previous action, but the fact that the 50 day EMA comes into the picture as well.

Value Hunters Will Still Influence This Pair

(Click on image to enlarge)

In general, I think this is a situation where value hunters are going to come into this market center later. If we were to break above the 1.3950 level, then the market could go looking to the 1.40 level. The 1.40 is an area that is a large round psychologically significant figure, and if we can break above there then the market really could take off. However, this is a situation where the market has been very noisy overall, but I think ultimately this is a little bit of consolidation after a huge move to the upside. I still favor the upside. I just don't favor chasing it at these higher levels, which is a situation where the market is simply overdone overall.

More By This Author:

Natural Gas Forecast: Natural Gas Pulls Back On TuesdayGBP/USD Forecast: Pound Awaits Big Moves Amid Uncertainty

NZD/USD Forecast: Continues To Stabilize

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more