USD/CAD Forecast: CAD Retreats, USD Advances On Jobs Data

The USD/CAD forecast points northward as the Canadian dollar weakens while the dollar holds on to gains after Friday’s employment figures. Traders are scaling back expectations for a Fed cut in June while simultaneously increasing bets for a BoC cut in June.

On Friday, data revealed that Canada’s economy unexpectedly shed 2,200 jobs in March. Meanwhile, the unemployment rate soared to a bigger-than-expected 6.1% during the same period. This report revealed weakness in the labor market and the economy. Consequently, there is more pressure on the Bank of Canada to cut interest rates. Before the report, there was a 68% likelihood that the BoC would cut rates in June. However, after the report, this figure rose to 75%.

On the other hand, the US dollar strengthened on Friday after another blockbuster jobs report. Unlike Canada, the US added an impressive 303K jobs in March. Additionally, the unemployment rate fell to 3.8, indicating robust labor market conditions. As a result, investors scaled back bets that the Fed would cut interest rates in June.

The rate cut outlook between the Fed and the Bank of Canada has diverged with these latest employment figures. The US economy remains robust, allowing the Fed to hold high rates for longer. Meanwhile, Canada’s economy is weak, and this could prompt the BoC to start cutting rates in June. These fundamentals support further upside for the USD/CAD pair.

USD/CAD key events today

There are no major events today that might cause a lot of volatility. Therefore, the USD/CAD pair might consolidate.

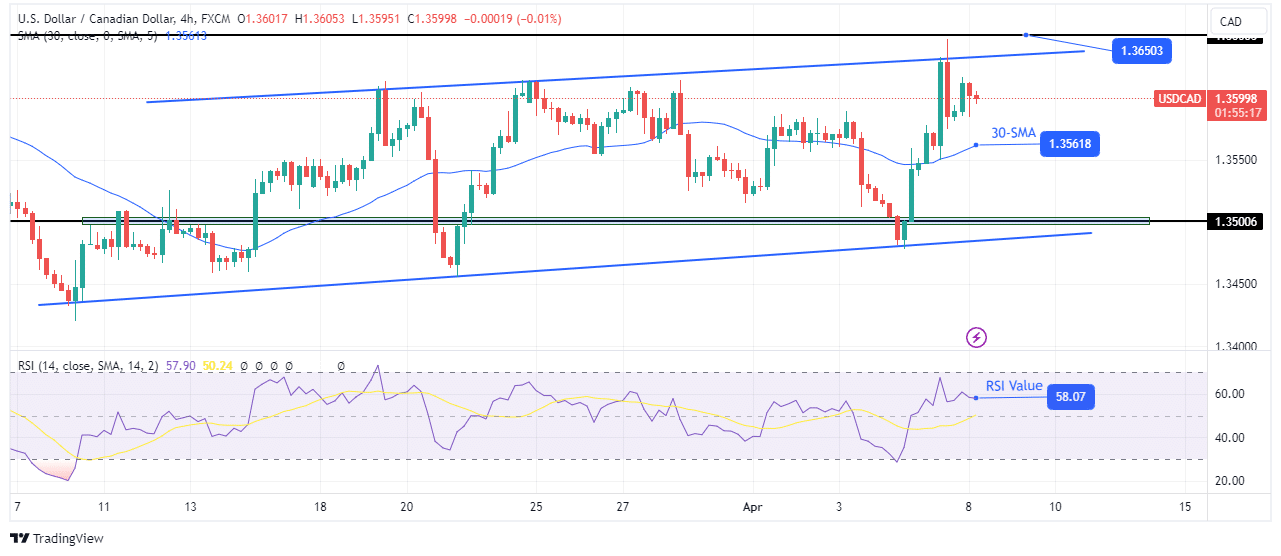

USD/CAD technical forecast: Bullish momentum stalls at channel resistance

USD/CAD 4-hour chart

On the technical side, the USD/CAD price is trading in a bullish channel and recently retested the channel resistance. Moreover, the price sits above the 30-SMA with the RSI over 50, indicating a strong bullish bias.

However, since the price recently rose to the channel resistance, it might now pull back to retest the SMA or the channel support. Still, bulls will remain in control as long as the price stays within the channel. Furthermore, with bulls in the lead, the USD/CAD pair could soon break past the 1.3650 resistance level.

More By This Author:

EUR/USD Forecast: Dollar Softens Amid Signs Of Economic EasingEUR/USD Price Looking To Pierce 1.08, Eyes On US GDP

USD/CAD Forecast: Bank Of Canada Flags Low Productivity

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more