USD/CAD Eyeing Upside Breakout Following Dovish BoC Rate Hike

USD/CAD FUNDAMENTAL OUTLOOK

The Canadian Dollar has all but surrendered yesterday’s gains against the greenback following a dovish 50bps hike by the Bank of Canada. USD/CAD dropped 60-odd pips in the immediate aftermath of the announcement before rallying higher during the Asian session and into the European open, currently trading just shy of the one-month high around the 1.37000 handle.

The Bank of Canada signaled that the hiking cycle may be approaching its end as it deals with signs of an economic slowdown. The loonie faced further pressure as oil prices continue their decline printing fresh YTD lows on the back of demand and recession fears. This resulted in a return of haven demand which has kept the US dollar on the offensive as well with higher prices for the pair looking all the more likely.

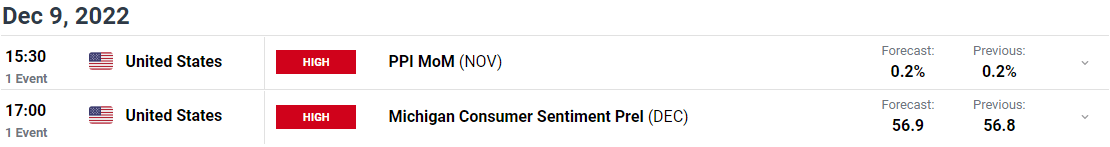

The recent batch of US data suggests the Federal Reserve may hike rates for longer even if it is in smaller increments. This does not bode well for the Canadian Dollar as continued hiking by the FED and a pause by the Bank of Canada could push USD/CAD higher as we head into the new year. Tomorrow brings US PPI as well as the Michigan consumer sentiment data which could add some dollar strength and perhaps facilitate a move higher for USD/CAD.

(Click on image to enlarge)

For all market-moving economic releases and events, see the DailyFX Calendar

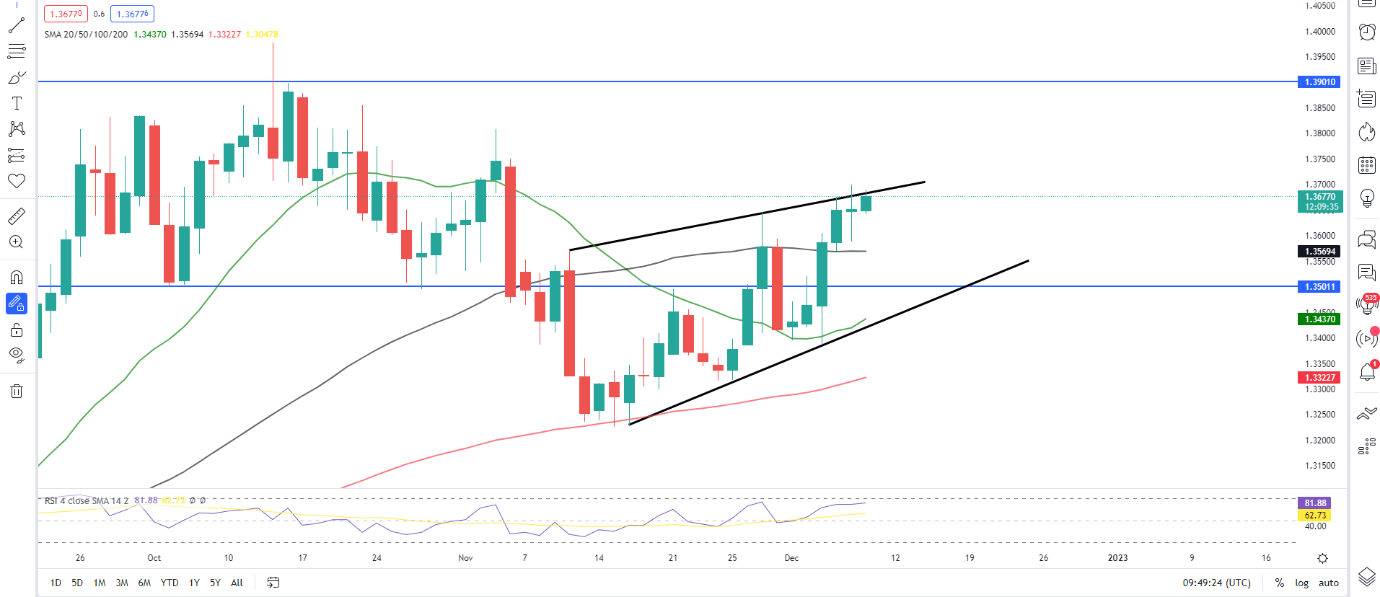

From a technical perspective, USD/CAD is trading at one-month highs with yesterday’s daily candle closing as a doji candlestick highlighting some degree of indecision. As you can see on the chart below the pair is currently testing the top of the wedge pattern and given yesterday's daily close could see a slight consolidation or even a pullback before breaking higher. Further supporting this narrative is next week’s Federal Reserve meeting which could see dollar bulls remain on the side-lines as the meeting approaches. A retracement may find support at the 50-day MA around 1.35700 with a break lower opening up a test of the ascending trendline of the wedge pattern.

Alternatively, an upside break of the wedge pattern could result in an upside rally around 250-odd pips. To complete a move of that size USD/CAD might require a catalyst such as the FOMC decision due next week.

USD/CAD Daily Chart, December 8, 2022

Source: TradingView, Prepared by Zain Vawda

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently SHORT on USD/CAD, with 68% of traders currently holding SHORT positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are SHORT suggests that USD/CAD may continue to rise.

More By This Author:

Crude Oil Price Outlook: WTI Set for Worst Week Since March? Falling Wedge In FocusGold Builds Range But Fed Rate Decision And Recession Risk Adding Pressure

WTI Crude Oil Slumps To Fresh Yearly Low Amid Recessionary Fears

Disclosure: See the full disclosure for DailyFX here.