USD/CAD Continues To Decline On Higher Oil Prices

On Thursday’s session, the USD/CAD continued its downward path, failing nearly to 1.3510, seeing 0.30% losses. On the CAD’s side, its strength may be explained by higher Oil prices as Canada is a leading exporter, while the USD measure by the DXY index rose to fresh highs around 105.20 after the release of mid-tier data. In line with that, the downside may be limited for the pair.

On the data front, the Greenback gained momentum after it was reported that Retail Sales rose 0.6% MoM in August, much better than the 0.2% anticipated and higher than the previous 0.6%. In addition, the Producer Price Index (PPI) jumped from 0.7% MoM to 1.6% YoY in August, also beating expectations. Moreover, Jobless Claims for the second week of September accelerated but below the expectations at 220,000, higher than the previous weekly reading of 217,000 but below the expected 225,000.

As a reaction, US Treasury yields advanced with the news, with the 2-year note offering nearly 5% and boosting demand for the American dollar, whose DXY index continues to trade at highs since early March. On the expectations front, the CME FedWatch tool suggests that the odds of one last hike in 2023 by the Federal Reserve (Fed) declined to nearly 35% from 40% in the previous sessions. Attention now turns to next week’s decision, where markets have already priced in a pause, but the statement and Chair Powell’s presser will be closely monitored.

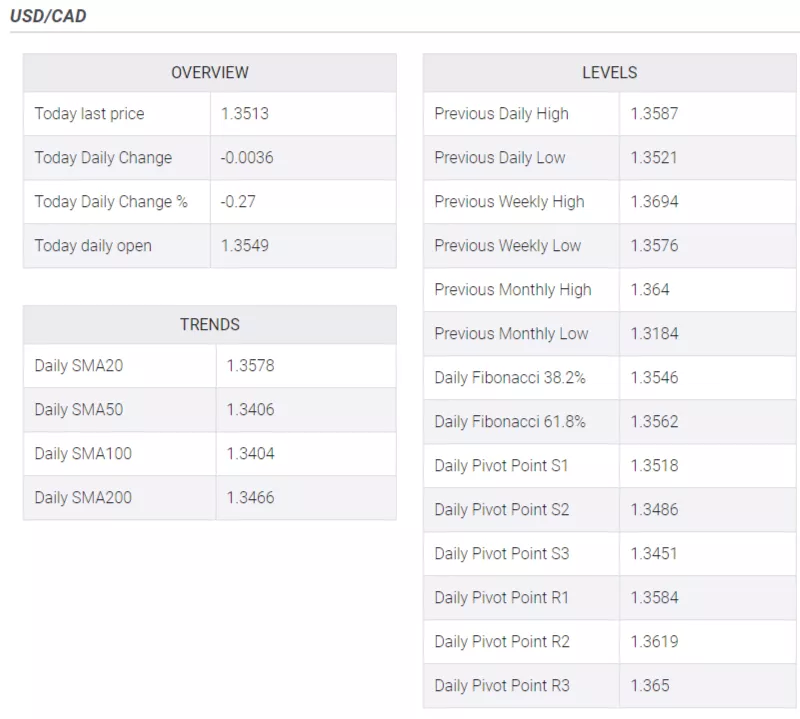

USD/CAD Levels to watch

The short-term view for USD/CAD suggests a bearish outlook based on the daily chart analysis. The Relative Strength Index (RSI) is positioned below its midline and displays a southward slope, while the Moving Average Convergence Divergence (MACD)exhibits red bars, signalling an increasing bearish momentum. On the other hand, the pair is below the 20-day Simple Moving Average (SMA) but above the 100 and 200-day SMAs, pointing towards the prevailing strength of the bulls in the larger context.

Support levels: 1.3500, 1.3490, 1.3463 (200-day SMA).

Resistance levels: 1.3576 (20-day SMA), 1.3600, 1.3630.

USD/CAD Daily Chart

(Click on image to enlarge)

-638303042577466230.png)

More By This Author:

ECB’s Lagarde Holds Press Conference As Euro Weakens Despite Rate Hike

US Dollar Flat Ahead Of ECB Meeting

EUR/JPY Flat-Lines Above 158.00 Mark

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more