USD/CAD Climbs To Three-Month Highs As Powell Eyes Additional Hikes

USD/CAD edged higher for the second straight day and refreshed three-month highs at 1.3640, following the Federal Reserve Chair Powell’s hawkish speech, which triggered volatility across the board. Later, Patrick Harker from the Philadelphia Fed emphasized rates are at a restrictive stance. The USD/CAD is trading at 1.3613, printing gains of 0.36%.

Federal Reserve’s restrictive stance, emphasized by Fed officials and weak Canadian data, weighs on the Loonie

Opening remarks from the US Federal Reserve Chair Jerome Powell showed the central bank is still worried about high inflation, as he mentioned that further rate hikes could be ”appropriate,” though they would remain data dependent. Powell stated that although two months of good data on inflation are reasonable, there’s a long way to go, as he emphasized the Fed’s 2% inflation target.

Regarding the solid economic growth and a tight labor market, Fed Chair Powell warranted additional tightening. Further rate increases are justified if those economic indicators do not show signs of easing. Powell acknowledged the risks of over and under-tightening while foreseeing the July Personal Consumption Expenditure (PCE) at 3.3% and core PCE at 4.3%.

Of late, a slew of his colleagues are crossing the wires. Philadelphia Fed Patrick Harker noted that rates are already restrictive, and if inflation stalls, then more rate increases may be needed. On the other hand, Cleveland Fed President Loretta Mester acknowledged the economy had gathered momentum as shown by GDP and labor market figures stating that below growth would be needed to cool down inflation. She stressed the debate is if current rates are restrictive enough to achieve the inflation target.

On the Canadian front, stagnant June retail sales stood at 0.1% MoM, compared to the previous reading, suggesting that Canadians are spending less, despite more robust than expected figures earlier in the year, which warranted additional tightening by the Bank of Canada.

Next week, the US economic docket will feature the CB Consumer Confidence, JOLTs report, preliminary GDP data, inflation figures, and ISM PMIs. On the Canadian front, the agenda will reveal GDP

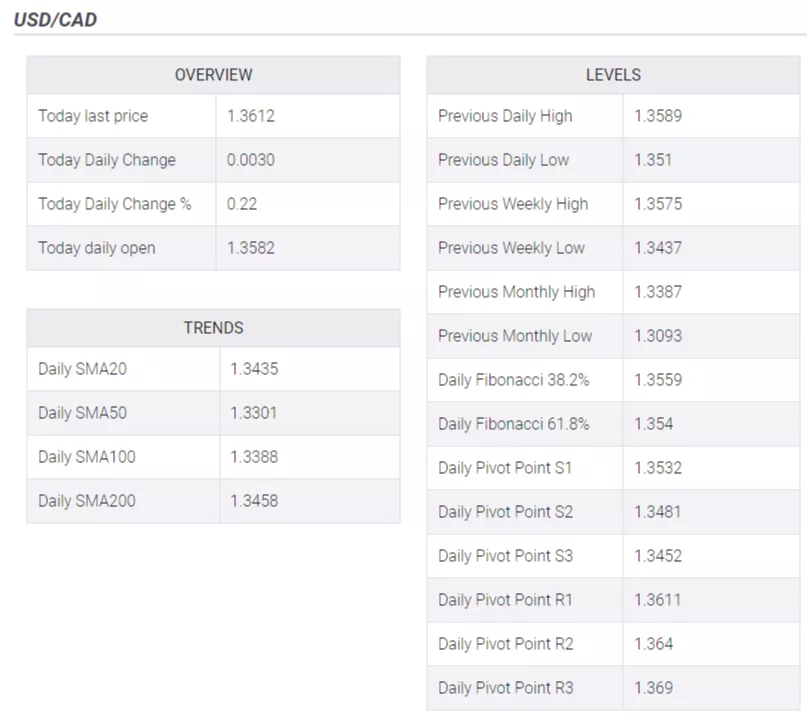

USD/CAD Price Analysis: Technical outlook

From a technical perspective in the short term, the USD/CAD has peaked so far at around the R2 pivot point at 1.3640, retraces towards the confluence of the R1 daily pivot and the 38.2% Fibonacci retracement at 1.3610/12. Dip buyers could emerge at the latter, or the 50% Fibonacci retracement, at around 1.3603 before diving below the 1.3600 figure. Contrarily, a drop below the day’s low of 1.3567 could pave the way for further downside, exposing the 200-hour Moving Average (HMA) at 1.3539.

USD/CAD Hourly chart

(Click on image to enlarge)

More By This Author:

EUR/JPY Keeps The Red Near Mid-157.00s After German IFO Survey, Lacks Follow-Through

Gold Price Forecast: XAU/USD Buyers Stay Hopeful Above $1,900 As Fed Chair Powell’s Speech Loom

USD/JPY Rebounds Above 145.00 On Fed Hawkish Comments And High U.S. Yields

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more