USD/CAD Analysis: Tight Price Realm Displayed As Crucial Data Awaits

Yesterday’s trading in the USD/CAD continued to display equilibrium in the currency pair for the time being, however important jobs data is coming from the U.S which is sure to stir up volatility.

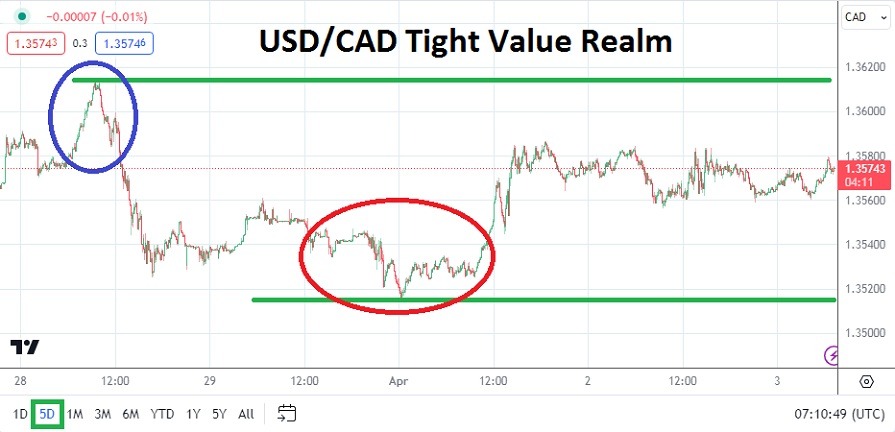

- The USD/CAD is actually trading within a lower price range than the one it occupied last week.

- The current price of the currency pair is near the 1.35760 with support and resistance levels having displayed an ability to maintain a fairly tight range the past two days of trading.

- Yes, Monday’s Forex was extremely light because of holiday conditions, but yesterday’s transactions remained within the 1.35600 to 1.35820 vicinities rather comfortably.

(Click on image to enlarge)

However now is not the time for traders to relax in the USD/CAD, U.S jobs data is coming every day the remainder of this week. The Non-Farm Employment Change results on Friday are certain to shake the USD/CAD out of its known range and cause volatility. The U.S Fed is still talking about cutting interest rates ‘over time’, but the Fed refuses to give a concrete timetable. And the reason for the lack of a framework is because U.S economic data remains troubling.

Higher Range Still in Play for USD/CAD Speculators

The USD/CAD for all of its polite trading yesterday remains within the upper realms of its mid-term technical charts. And the currency pair is still lingering within sight of values that were traversed on the 13th of December, this when the U.S Fed changed its rhetoric to a more dovish tone and caused the USD/CAD to selloff. The downward momentum in the USD/CAD reflected the price action of the broad Forex market, but like the global Forex landscape the currency pair then started to reverse upwards ‘over time’.

The question some speculators may be starting to consider is if current resistance levels will prove durable and if they can be used to ignite selling positions. The next couple of days in the USD/CAD are likely to remain rather choppy. It is on Friday when the U.S gets set to release its Non-Farm Employment Change and Average Hourly Earnings that things are certain to change.

Short-Term Wagers and Realistic Targets in the USD/CAD

While the upside has seemingly run into rather promising resistance the past couple of days, the USD/CAD did trade near the 1.36110 level on Thursday of last week. The potential of the higher ground being seen again in the near-term exist. Traders need to use solid risk management to make sure their wagers to not lose control and become expensive losses.

- If the U.S jobs data comes in weaker than expected on Friday it might ignite some selling of the USD/CAD, but betting on this result is dangerous and risk management is needed.

- If a trader is anticipating that financial institutions may believe the USD/CAD is overbought they might be in good company, but that doesn’t mean they are correct.

Canadian Dollar Short Term Outlook:

- Current Resistance: 1.35790

- Current Support: 1.35680

- High Target: 1.35850

- Low Target: 1.35590

More By This Author:

USD/BRL Analysis: Higher Values And More Volatility Coming Short-TermEUR/USD Monthly Forecast: April 2024

USD/CAD Analysis: Incremental Higher Price Action and a Wider Range

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more