USD Futures Rose To A New High

9:00 am

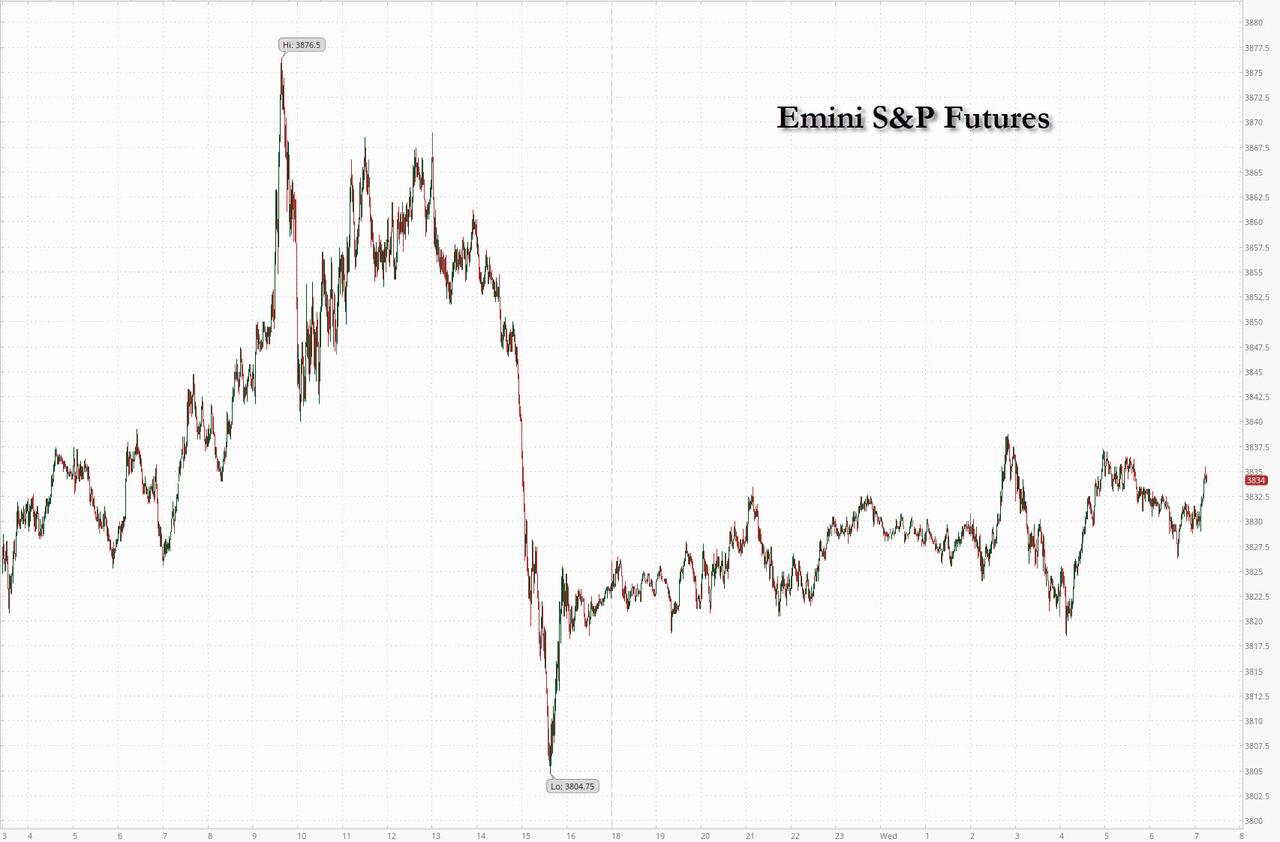

News of an overheated CPI has caused SPX futures to fall through support at 3810.00 to test minor support at 3750.00, where the next large cluster of (4366) put contracts lie. There has been a bounce, but the damage may have already been done. Short gamma may prevail today, sending stocks into a tailspin.

Zerohedge reports, “Well that wasn’t supposed to happen.

It seems ‘peak inflation’ is not here and markets are stunned.

Rate-hike expectations are soaring…

With the odds of a 100bps hike in July now at 30%…”

8:00 am

Good Morning!

SPX futures hit a morning high of 3835.50, remaining near that level until this point. Traders await the CPI report, which may change the outlook on FOMC actions.

In today’s op-ex, Max Pain is at 3845.00 with calls dominating at 3850.00 and above. Long gamma may prevail at 3900.00. Puts hold sway at 3840.00 and below with short gamma coming in strong (7056 contracts) at 3800.00.

ZeroHedge reports, “After yesterday’s last hour stock market puke prompted by a fake CPI “leak” that showed inflation rising more than double digits in June which sent spoons just over 3,800, US index futures advanced ahead of a report that will show inflation hitting a fresh four-decade high according to Bloomberg consensus which expects headline inflation to print 8.8%, ensuring another 75bps rate hike. Contracts on the S&P 500 rose 0.3% by 7:15 a.m. ET after the underlying gauge declined over the past three days. Nasdaq 100 futures were up 0.4% after the tech-heavy index shed 3% this week, reversing most of last week’s gains. The dollar dropped from a 2-year high, bitcoin rose but held below $20,000 and WTI crude oil stabilized at about $96 a barrel after a tumble.”

(Click on image to enlarge)

VIX futures dipped to 27.12 this morning, then recovered somewhat. The Cycles Model suggests a period of strength may be about to begin, lasting through the weekend. Although VIX is elevated above its historical norm, there seems to be little alarm about the upcoming FOMC moves and the dual prospect of a recession looming.

Today’s op-ex in VIX shows Max Pain precisely at 27.00 with short gamma at 26.00 and long gamma starting at 28.00. A very tight spread between risk-on and risk-off.

Bloomberg comments, “Perceptions of risk are diverging in perplexing ways among asset classes.

Volatility in bonds is whipping up just as it trails off in stocks. The ICE BofA MOVE Index, a gauge of costs for Treasury options, rose in four of the last five weeks. A similar measure for equities, the Cboe Volatility Index, or VIX, fell for three straight weeks. The MOVE’s premium over the VIX has widened this month to the most since 2009. ”

TNX remains beneath the 50-day Moving Average at 30.04, but a directional change may be imminent, as a period of strength appears about to begin which may boost TNX back above the 50-day. The current Master Cycle has less than two weeks to go, with a potential target as high as the Cycle Top at 34.48.

The soaring CPI boosted TNX above its 50-day Moving Average as suggested earlier. Higher rates may now be a real concern for the next two weeks.

USD futures rose to a new high at 108.39 this morning. With 4 more weeks to go in its current Master Cycle, one may speculate whether it may exceed its prior all-time high at 121.21. What many investors are unaware of is that money flowing out of stocks is more likely to be parked in the money market (USD) than any other asset.

More By This Author:

Nasdaq Futures Crashed To A New Bear Market LowS&P 500: Looking Positive

The Old Lip Of The Cup With Handle

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more