Wednesday, May 7, 2025 3:21 PM EST

Image Source: Pexels

The US Treasury yields edged lower across the whole curve, down an average of two and a half to three basis points so far after plunging over seven basis points earlier. However, as Fed Chair Powell answered a question regarding the Fed leaning towards one side of the dual mandate, he said that it is too early to predict.

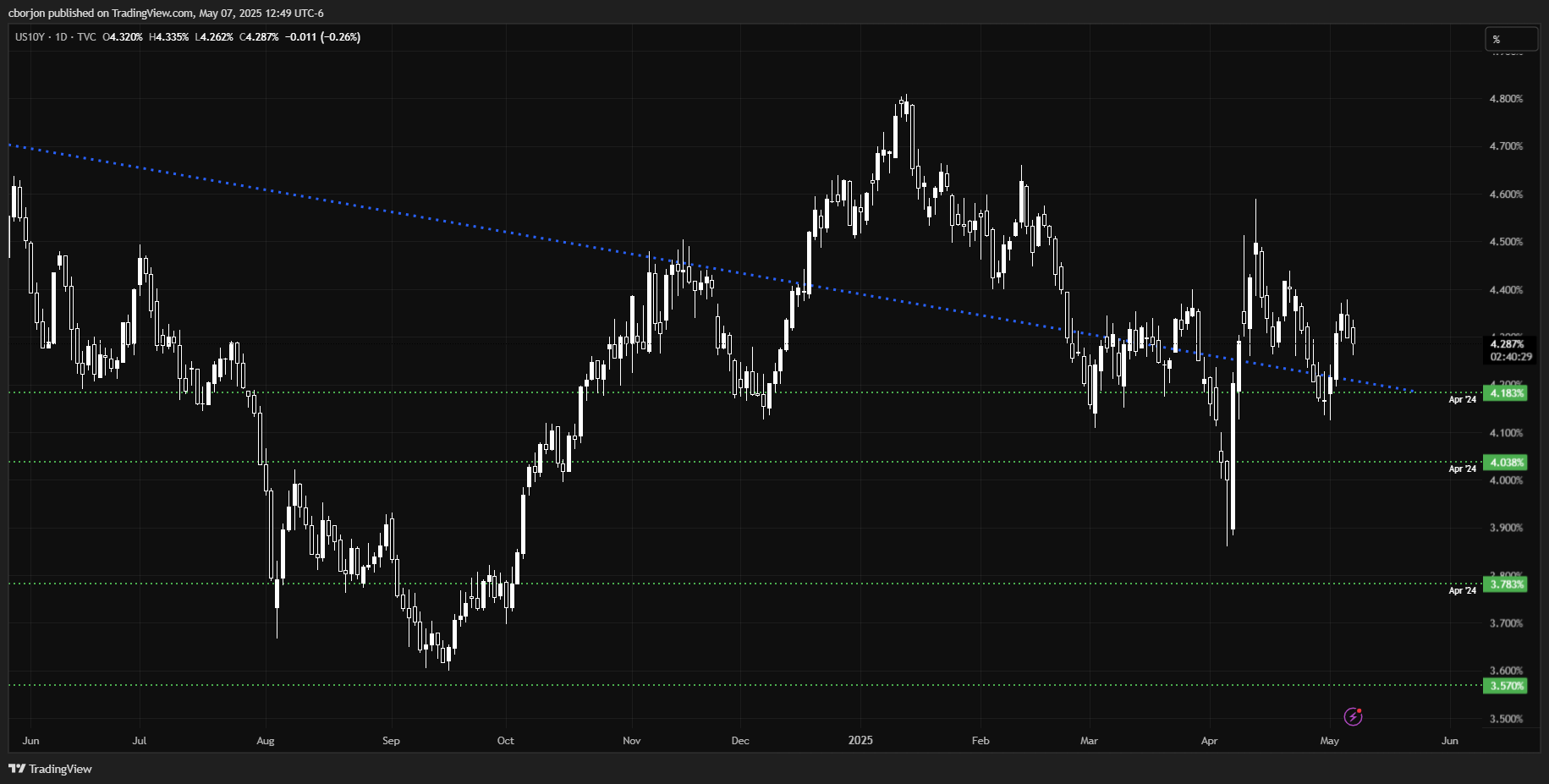

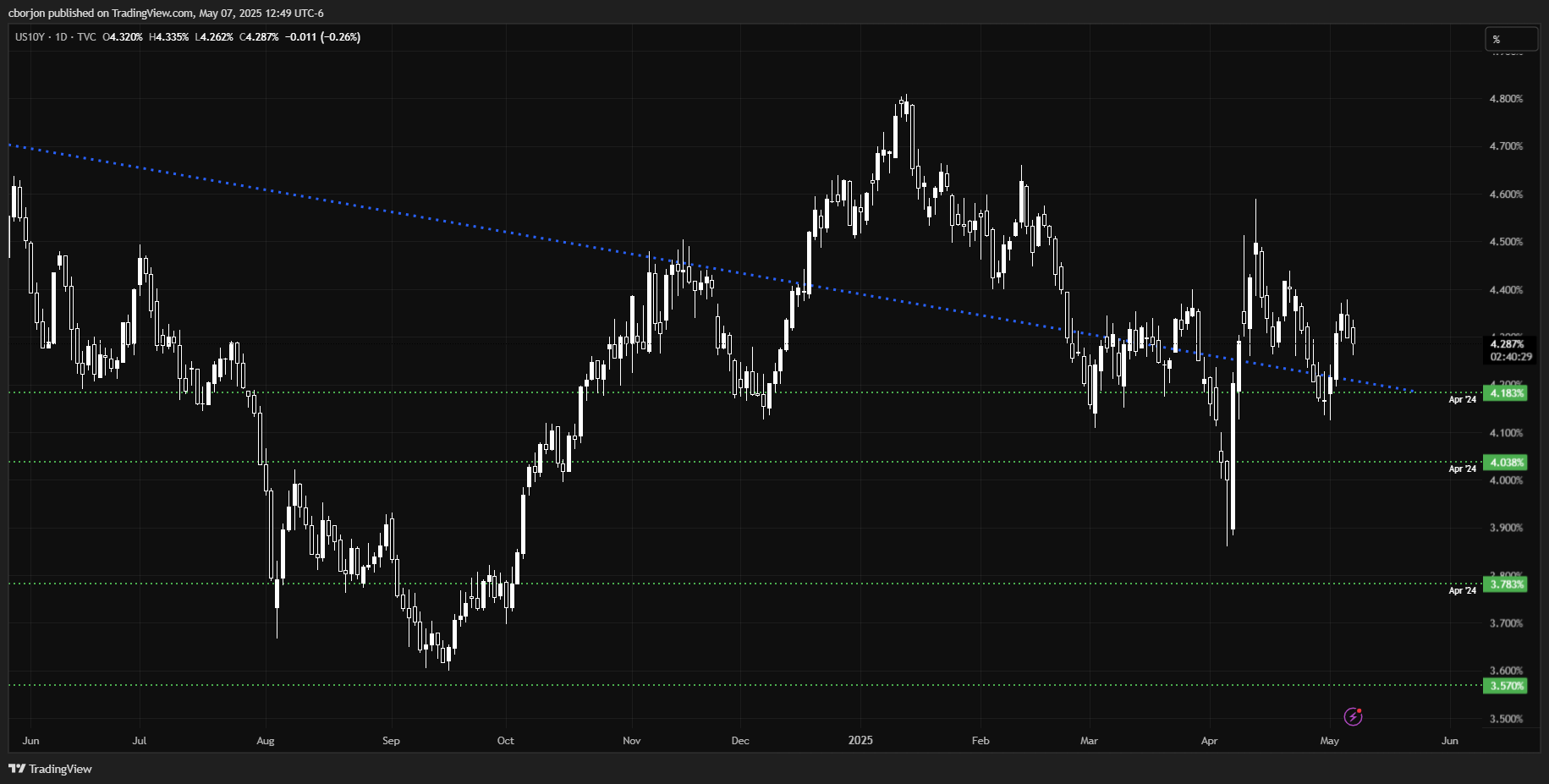

10-year yield falls to 4.27% after Chair Powell downplays urgency for action

The US 10-year Treasury yield falls two and a half basis points to 4.271% at the time of writing, weighing on the Greenback, which has so far retreated from daily highs of 99.63, as depicted by the US Dollar Index (DXY).

The DXY, which tracks the performance of the buck’s value against a basket of currencies, is at 99.51 up 0.12%.

The Fed Chair, Jerome Powell, said that the Fed is in no hurry and can be patient. He noted that current monetary policy is appropriate and that if things develop, “we can move quickly as appropriate.” Powell added, “We won’t make progress on our goals this year if tariffs remain.”

US 10-year yield daily chart

(Click on image to enlarge)

More By This Author:

Gold Price Falls As U.S.-China Tariff Talks Ease Tensions, Fed In Focus Gold Soars To Two-Week High On Trade Jitters, India-Pakistan Tensions Mexican Peso Firms As U.S. Trade Deficit Widens, Trump Softens Tariff Rhetoric

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

less

How did you like this article? Let us know so we can better customize your reading experience.