U.S. Vacancy Rates Slow Sharply As Boardroom Caution Spreads

The jobs market remains tight with 4 million more job vacancies than there are unemployed Americans to fill them. Nonetheless, the 1mn drop in vacancies is an early warning that corporate sentiment is shifting with the uncertain economic outlook prompting firms to instigate hiring freezes. With more pain to come job losses are on the cards for 2023.

Job losses are on the cards for 2023

Job vacancies starting to be pulled

The US JOLTS (Job Opening and Labour Turnover Statistics) data shows firms are starting to pull vacancies as a deteriorating global growth outlook prompts caution in corporate boardrooms. The number of job openings falling from 11.2mn in July to 10.053mn in August, the biggest drop since April 2020 when the pandemic resulted in the economy grinding to a halt. The consensus had predicted little change – 11.1mn.

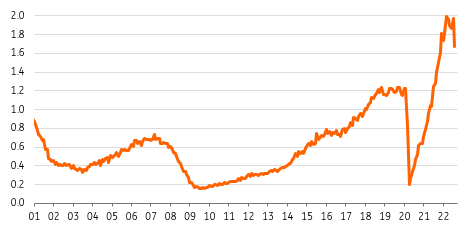

This data echoes the headlines from this morning’s KPMG CEO survey whereby 39% of top CEOs have reportedly instigated hiring freezes. It also means that the ratio of job vacancies to the number of unemployed Americans falls from 1.97 to 1.67. Nonetheless, we have to remember that even after today’s drop there are still 4mn more job vacancies than there are unemployed American while the job opening/unemployed Americans ratio is still more than double the average 0.6 figure seen over the past 20 years. Hence there are still plenty of jobs out there and people are still prepared to move roles for better pay and conditions, with the quit rate staying at 2.7%.

Ratio of job vacancies to the number of unemployed Americans

Source: Macrobond, ING

Momentum is weakening with job losses a threat for 2023

As such the jobs market is still incredibly tight, but the Fed will take some satisfaction in today’s direction of travel. While business caution is likely to spread, firings are still a way off – note last week's initial and continuing claims remain very low by historical standards. Payrolls are still set to post a decent increase on Friday – the market is looking for 265,000 – but with the ISM employment index back in contraction territory and the vacancy data softening the momentum will weaken further in coming months.

The Fed has acknowledged the need for a weaker labour market to get inflation back to target with their median prediction for the unemployment rate rising to 4.4% next year from 3.65% in August in their September update. Assuming labour supply remains unchanged this equates to around 1.2mn people losing their job over the next year – obviously less if labour supply suddenly accelerates. As such with the Fed seeking to tighten financial conditions even further it points to more economic pain ahead and a high chance that the Fed eventually switches to rate cuts in the second half of 2023.

More By This Author:

The Commodities Feed: OPEC Output Edges HigherTurkey’s CPI Below Consensus In September

Korea: Export Growth Slowed More Than Expected In September

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more