US Unemployment May Drop To 4%

Market will be focusing on Fed and jobs report

US job growth is expected to pick up in April, with a 200k jobs growth up from 103,000 from the previous month, based on our projection. Nevertheless, the key attention on jobs report are unemployment rate and wage growth. The unemployment rate is expected to slip to 4%, from 4.1% from the previous month based on the market expectation. The average hourly earnings component is likely to be closely scrutinized as the market watches for signs of inflation heating up. The outcome of average hourly earnings has likely driven the direction of the dollar and US Treasuries.

The expectations for a steeper path for rate rises came amid signs that inflation is picking up, which has been driving the dollar higher for the past weeks. The market’s attention will shift to US monetary policy and its labor market this week. The monetary policy-setting FOMC is widely expected to leave interest rates unchanged even as market participants debate whether the central bank will raise rates an additional two or three times this year. Given the uncertainties over the direction Trump administration will take, many Fed officials have been signaling that they are not ready to adjust their economic outlooks because of trade tension.

The rise in US bond yields in recent weeks has been focused particularly at the front end which caused the yield curve to flatten during the latest bear phase. The terminal rate built into the bond market, following the Fed’s current phase of monetary tightening, has not risen this time. Therefore, the market is saying that Fed will raise short rates more quickly than previously expected, but not to a higher level. This is in contrast to the previous sell-off in January when rates across the entire yield curve rose in parallel, and the assumed terminal rate after the Fed’s tightening cycle also rose.

Now that North and South Korean leaders have agreed to end the formal state of war that has existed for nearly seven decades, suggesting any risk-off driven by the North Korea events in the future would be eliminated.

Though outright conflict is unlikely, it is unclear whether the summit signals the start of a permanent and structural easing of geopolitical tensions on the Korean peninsula, which tends to rise and fall in cycles. The outcome of diplomatic activity in the coming months is hard to predict, and tensions could re-escalate quickly if the US feels that the summit diplomacy is not achieving its aim of de-nuclearization.

Our Picks

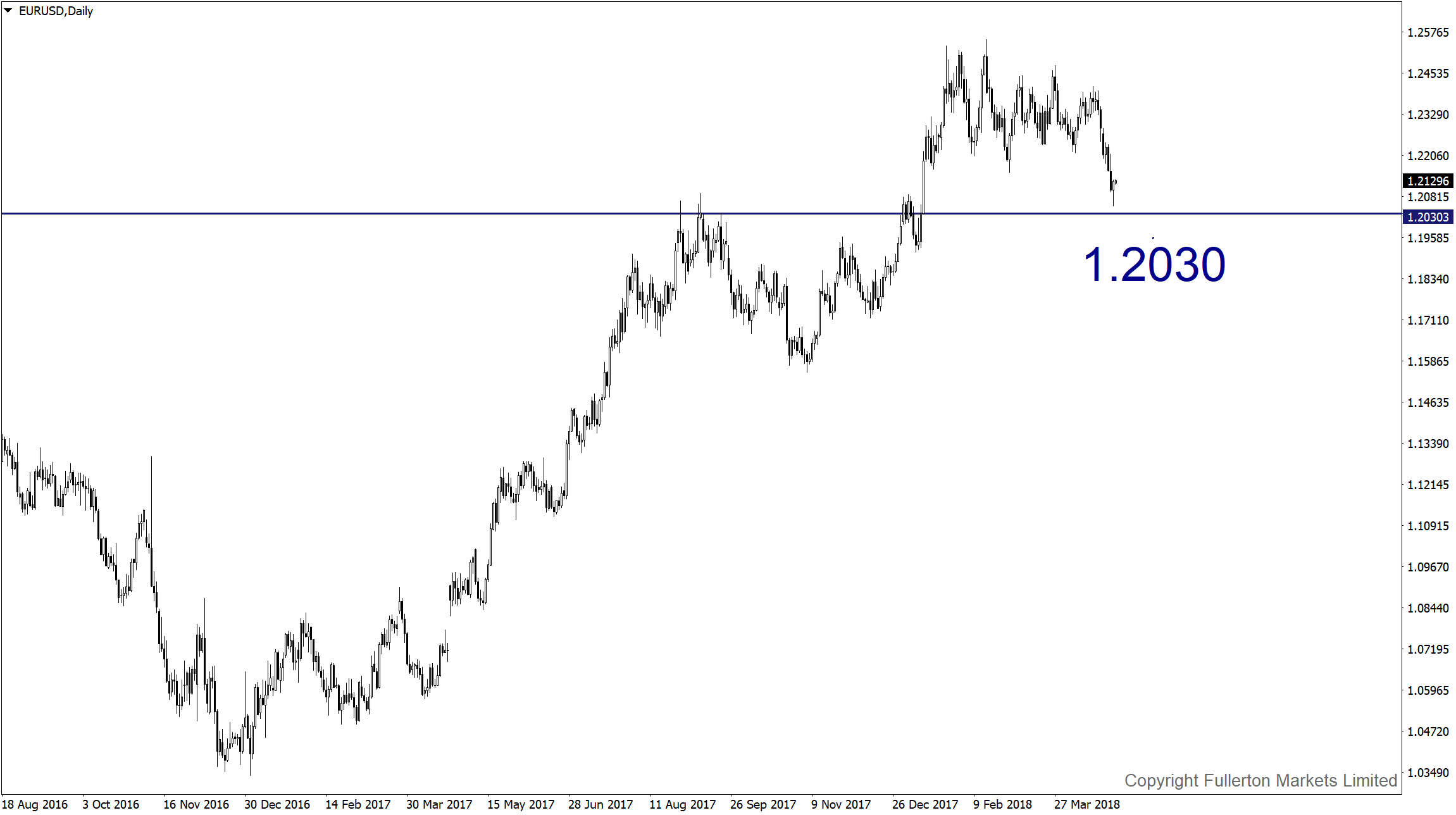

EUR/USD – Slightly bearish.

Soft data in eurozone will continue to pressure this pair towards 1.2030.

USD/JPY – Slightly bearish.

We expect this pair to move lower towards 108.65 amid muted Fed this week.

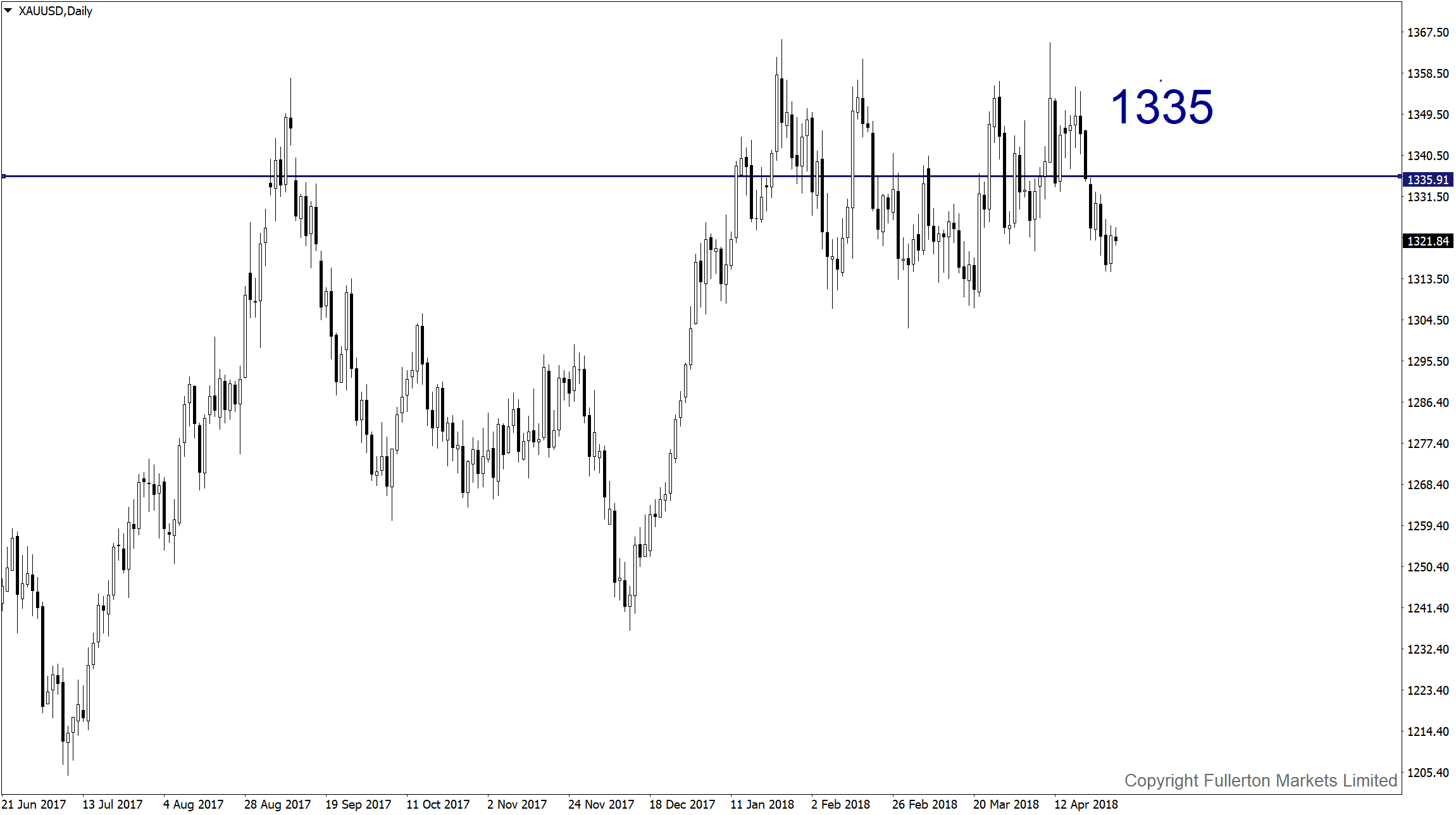

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1335 this week.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more

What's been driving the recent job growth?

US economic recovery is in a pretty matured stage. Under the current business cycle, jobs growth and inflation tends to rise, and Trump's tax stimulus effect also starts kicking in.

That makes a lot of sense, thanks!