U.S. Treasury Yields Ease After 30-year Hits 19-month High On U.S. Deficit Fears

Image Source: Pexels

US Treasury yields retreated on Thursday after the 30-year US bond yields reached their highest level in 19 months amid concerns regarding the increase of the US fiscal deficit, as Trump's “One Big Beautiful Bill” passes the US House of Representatives and is on its way to the Senate.

Long-end Treasury yields retreat as Trump’s tax-heavy budget clears House, pushing fiscal concerns to the forefront

The US House of Representatives approved Trump’s budget by one vote on Thursday. The proposal, which will deliver tax breaks on tips and car loans –manufactured in the USA–is expected to increase the deficit by $3.8 billion, according to the Congressional Budget Office (CBO).

The US 30-year Treasury bond yield hit 5.15% during the trading session, its highest level since November 2023, but it has retreated to 5.05% so far, down three points (bps) from its opening level.

The yield of the US 10-year benchmark note is at 4.545%, down five bps. Nevertheless, the US Dollar Index (DXY), which measures the buck’s value against a basket of six currencies, shrugged off falling US yields and climbed 0.26% to 99.95 at the time of writing.

Moody’s downgraded US government debt from AAA negative to Aa1 stable last week, triggering a spike across the US yield curve.

US President Donald Trump's unpredictable economic policies triggered a jump in Treasury yields across the curve. Tariffs are seen as inflation-prone, and the increase in the US fiscal deficit continues to pressure the bond market.

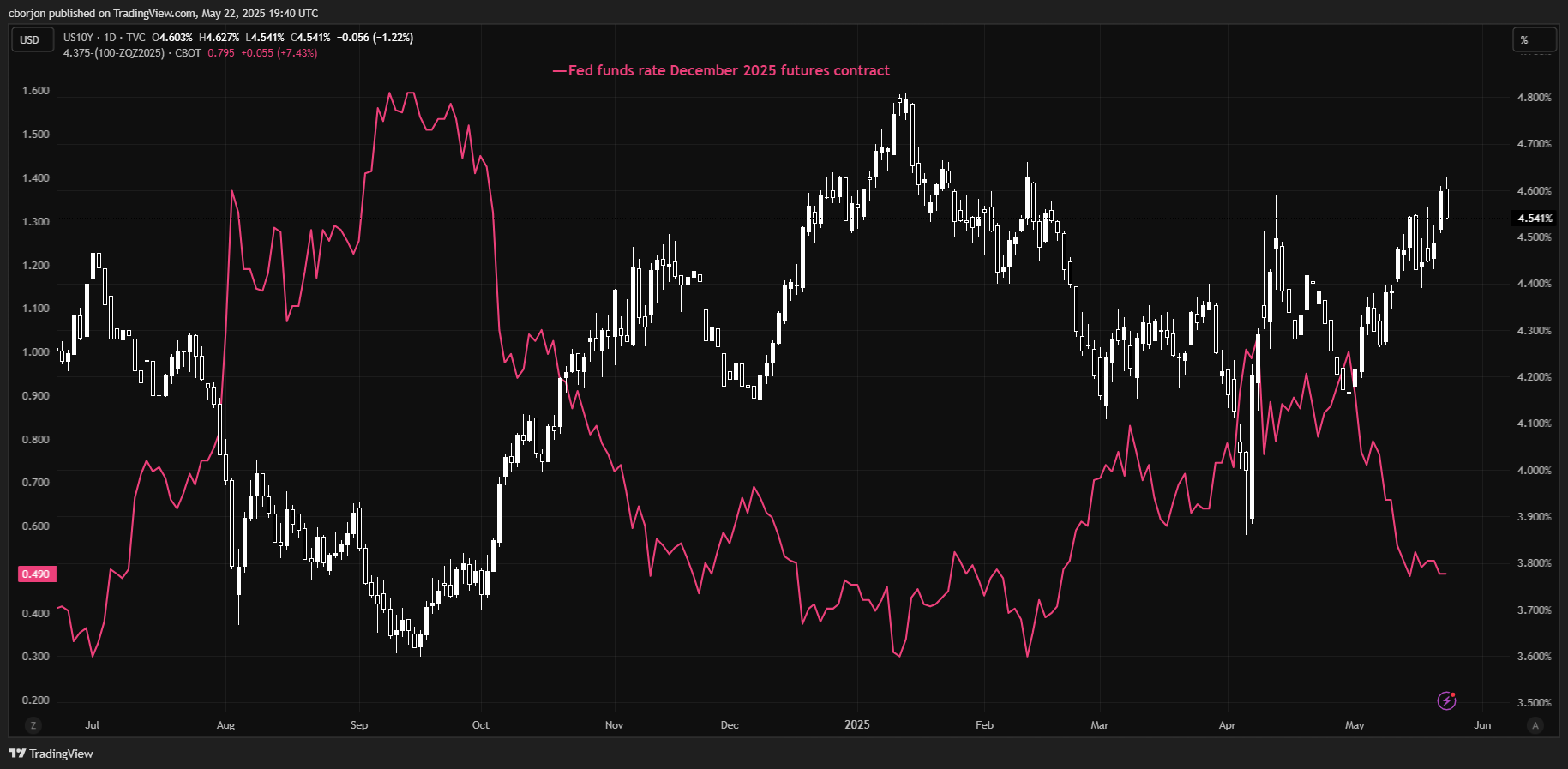

US 10-year yield vs. Fed funds rate December 2025 easing expectations

(Click on image to enlarge)

Source: Tradingview

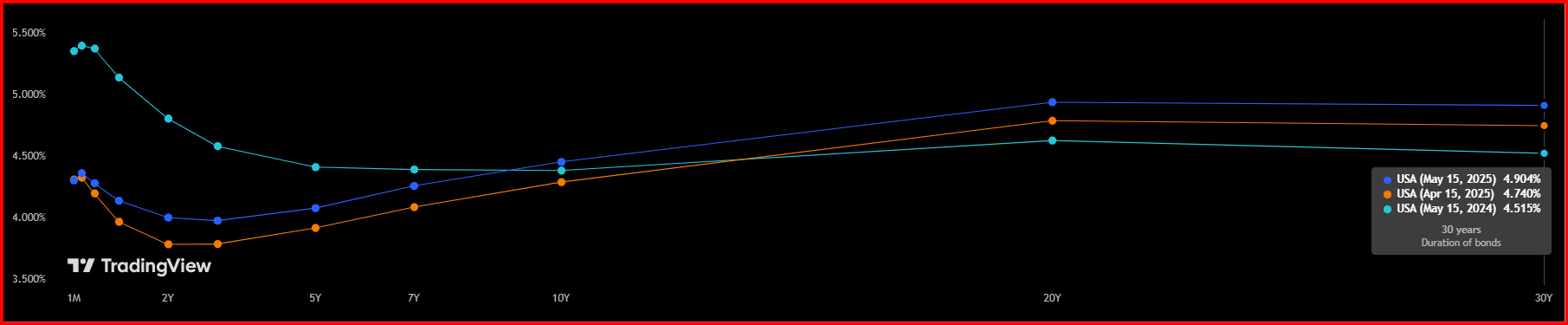

US Yield curve

(Click on image to enlarge)

Source: Tradingview

More By This Author:

EUR/USD Slides Below 1.13 As Strong U.S. Data Undermines Eurozone PMIsGold Price Slips Below $3,300 Amid Firm U.S. Dollar After Trump Budget Vote

Silver Price Forecast: XAG/USD Holds Near $33.50 As US Debt Fears Fuels Haven Demand

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more