U.S. Soft Landing Still Threatened By Turbulence

With GDP growth and jobs numbers beating all expectations and core inflation running too hot for comfort, 2024 market interest rate cut expectations have been pared back by 100bp since mid-January. The "soft landing" is now the widely held view, but we believe sizeable interest rate cuts are part of the package needed to deliver such an outcome.

Image Source: Pexels

Strong data dampens the prospect of near-term rate cuts

Fourth-quarter GDP growth and the January jobs report beat all expectations in the market while the 0.4% month-on-month core CPI was predicted by only 3 banks out of 68 surveyed by Bloomberg. Having priced 175bp of rate cuts for the year starting in March, hot data has led the market to swing back the other way and is now looking for merely 75p of cuts this year, in line with the Federal Reserve’s December in-house projections.

While this strong performance has not been seen in other business surveys – and anecdotally, there have been increasing job lay-off announcements from the likes of Xerox, Snapchat, PayPal, UPS and Cisco – these official data prints command the Fed’s attention, and it will want to see clear cooling trends before cutting rates. We had expected the first interest rate cut to come in May, but we are now thinking June is a more likely starting point. Nonetheless, monetary policy is in restrictive territory, with the Fed funds ceiling at 5.5% versus the 2.5% “neutral” rate suggested by the Federal Reserve. This suggests significant scope for policy easing once the central bank becomes more relaxed with the economic environment.

But a soft landing is the favoured outcome

The combination of tight credit conditions and the most aggressive period of monetary policy tightening for 40 years will eventually slow the economy. Pandemic-era accrued household savings are close to being exhausted and will provide less support to growth, while high consumer borrowing costs are intensifying the pressure on household finances, with delinquency rates on credit cards and car loans rising quickly.

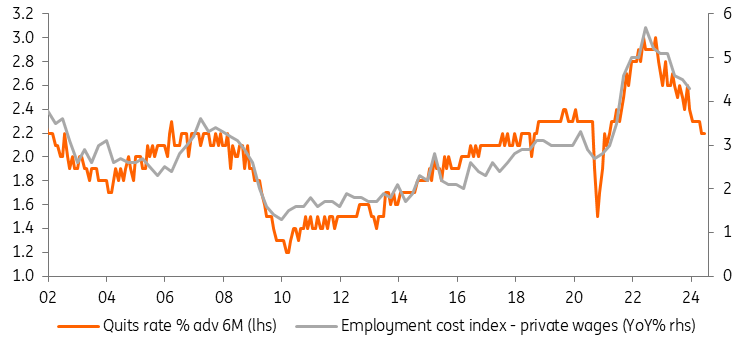

The number of job loss announcements is on the rise and is likely to mean payrolls growth slows markedly from January's 353,000 increase in the coming months. Labour market costs are also looking far less troubling, with declining quit rates amongst the workforce indicating that while there are large numbers of jobs being advertised, they are not particularly attractive either financially or in terms of role. This also means that businesses are seeing lower turnover rates of staff, so there isn’t as much pressure to pay as much to retain employees. This relationship suggests the Employment Cost Index is slowing towards pre-pandemic norms and implies cooling supply-side pressure on service sector inflation.

Slowing quit rates suggests inflation pressures are cooling in the labour market

Macrobond, ING

In this regard, inflation is expected to revert to more benign 0.2% MoM prints in the coming months, with moderating housing rents and vehicle prices set to become more apparent in the data and reduced corporate pricing power also acting as a brake. This, we believe, will give the Federal Reserve the scope to cut interest rates from June onwards in 25bp increments. The Fed funds ceiling is predicted to end 2024 at 4.25% with a further 100bp of rate cuts in the first half of 2025. This will hopefully allow the economy to avoid a painful recession and instead achieve the fabled “soft landing”.

The risks of a bumpier landing remain

The most probable risk to this relatively gentle narrative is that the Federal Reserve errs on the side of caution and keeps interest rates higher for longer. After all, the economy is still growing, the labour market is tight and inflation is still well above 2%. As markets continue to price out rate cuts, 10Y Treasury yields rise back towards 4.75% or even 5%, pushing up borrowing costs for households and businesses. Under this scenario, the pain for the household sector likely intensifies, while commercial real estate (CRE) loan losses mount and this reignites concerns about small bank solvency in the US economy. Credit conditions tighten significantly and the US potentially falls into recession, dampening inflation and forcing the Fed to cut interest rates aggressively.

So, while the market increasingly believes in a soft landing, it risks being a bumpier ride than many expect.

More By This Author:

Eurozone Inflation Dropped Less Than Expected In February

Asia Week Ahead: China’s Two Sessions Meeting And Australian GDP Numbers Out Next Week

Italian Inflation Stable In February

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more