U.S. Manufacturing Continues To Struggle, Amidst Signs Of Jobs Resilience

The ISM manufacturing index remains in contraction territory, but the job vacancy statistics are holding up fairly well and inflation pressures remain elevated. Fed Chair Powell, speaking in Portugal, continues to suggest the committee remains in wait-and-see mode, implying little prospect of a July rate cut.

Image Source: Pexels

Manufacturing ISM continue to point to contraction

Today's US data is a little mixed. The ISM manufacturing index rose to 49.0 from 48.5 (consensus 48.8). Anything below 50 equates to a contraction and this is the 30th sub-50 reading out of the past 32 reports, so nothing particularly surprising here. The production measure did break above 50 though, rising nearly 5 points to 50.3, but with new orders (46.4 versus 47.6) and the backlog of orders (44.3 versus 47.1) both weakening notably, this rise in output is not going to last long. Moreover, employment dropped to 45.0 from 46.8, suggesting a drop in manufacturing employment in Thursday's jobs report.

Labour data remains relatively resilient

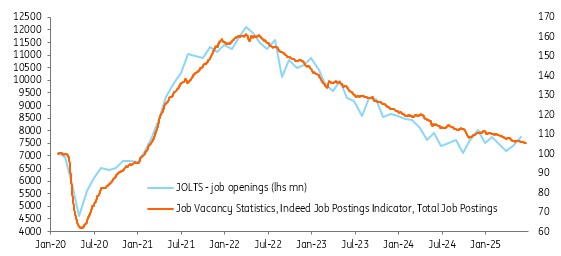

Meanwhile, the JOLTS report showed job openings rising to 7.769m from 7.395m, well above the 7.3m consensus number. However, there is scepticism about the quality of this data relative to other sources, such as the Indeed job website advertisements index that is available daily. The JOLTS is very volatile and swing either side of the Indeed data as the chart below shows. In all likelihood the trend is towards weaker hiring.

JOLTS job openings and Indeed job vacancy statistics

Source: Macrobond, ING

The quits rate picked up and the lay-off rates actually fell so in general this is a stronger report than expected. Note that the ISM prices paid remains very elevated at 69.7 versus the break-even level of 50, suggesting the tariff-induced price hike story remains an important near-term theme for the Fed.

At the margin it diminishes the probability of a July Fed rate cut - which looked pretty remote anyway. Fed Chair Jerome Powell, speaking at the ECB conference in Sintra, Portugal, accepted that a "solid majority” expect rate cuts later this year, but with inflation likely to move higher over the summer the “prudent” thing is to wait to learn more. We doubt very much that the Fed will be cutting interest rates before the September FOMC meeting even though Chris Waller and Michelle Bowman suggest they could vote in favour of action as soon as this month. Markets are pricing barely a 20% chance of this happening, which we agree with.

More By This Author:

Asia’s Manufacturing PMI Improves, But Trade Risks Are LoomingEurozone Inflation Lands Right At ECB Target In June

FX Daily: The Cyclical Vs. Structural Dollar Decline

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more