US Leading Indicators Tumble For 18th Straight Month, "Shallow Recession" In 1H24

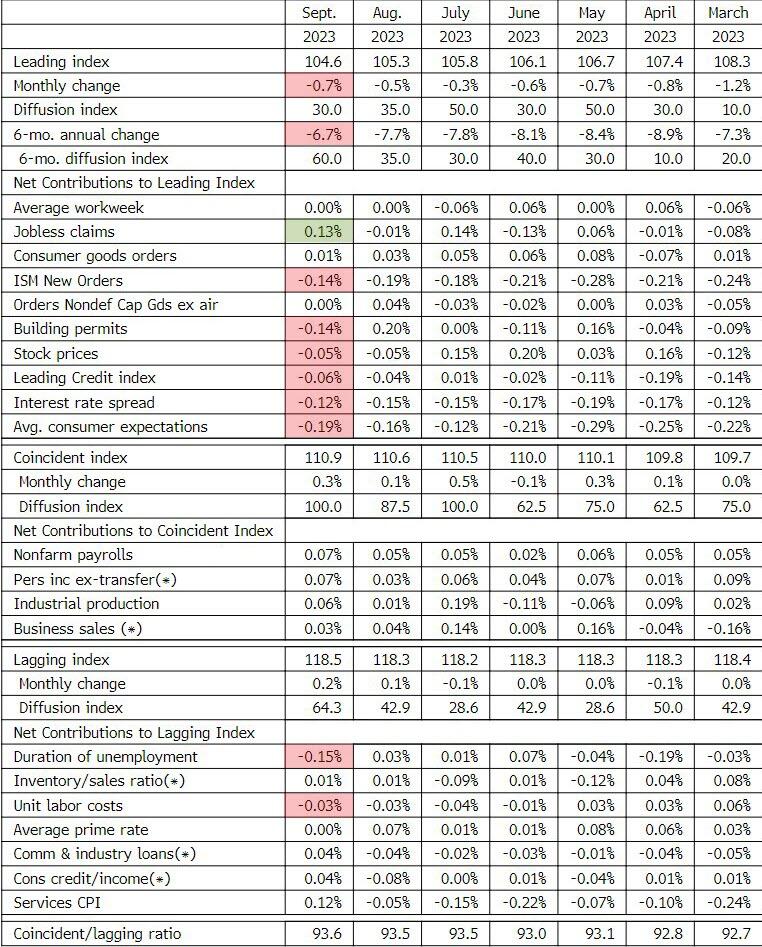

The Conference Board's Leading Economic Indicators (LEI) continued its decline in September, dropping 0.7% MoM (worse than the 0.4% decline expected).

- The biggest positive contributor to the leading index was jobless claims at +0.13

- The biggest negative contributor was average consumer expectations at -0.19

This is the 18th straight monthly decline in the LEI (and 18th month of 19) -the longest streak of declines since 'Lehman' (22 straight months of declines from June 2007 to April 2008).

(Click on image to enlarge)

“The LEI for the US fell again in September, marking a year and a half of consecutive monthly declines since April 2022,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board.

“In September, negative or flat contributions from nine of the index’s ten components more than offset fewer initial claims for unemployment insurance.

Although the six-month growth rate in the LEI is somewhat less negative, and the recession signal did not sound, it still signals risk of economic weakness ahead. So far, the US economy has shown considerable resilience despite pressures from rising interest rates and high inflation.

Nonetheless, The Conference Board forecasts that this trend will not be sustained for much longer, and a shallow recession is likely in the first half of 2024.”

At this rate the Dept of Bidenomics will push GDP to 10% and unemp to 0% by Nov 2024. Unfortunately mortgages will be ~100% by then.

— zerohedge (@zerohedge) October 19, 2023

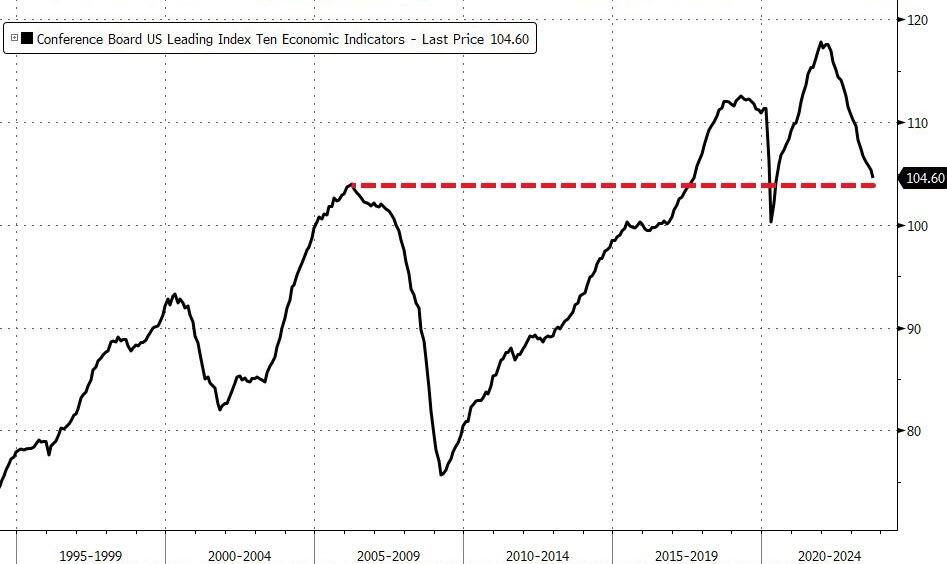

Despite 'soft landing' hype, the LEI is showing no signs at all of 'recovering', tumbling back in line with the peak in March 2006...

(Click on image to enlarge)

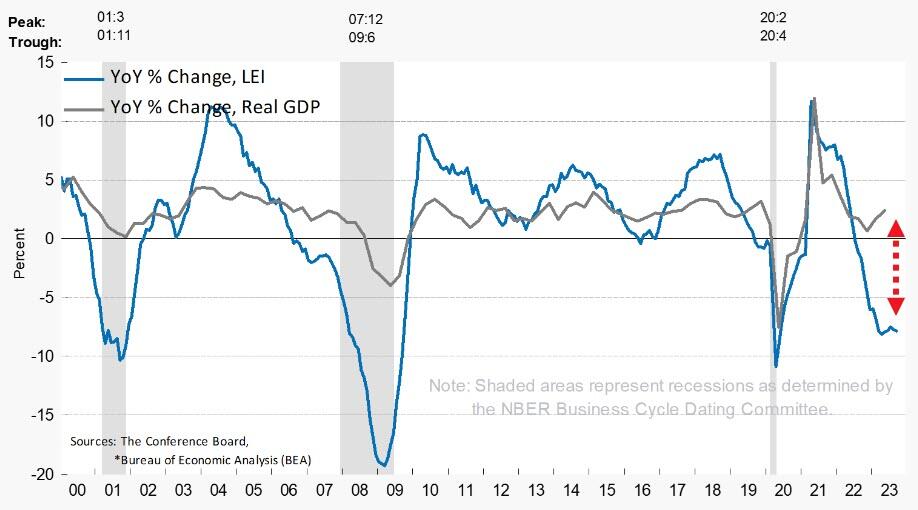

And on a year-over-year basis, the LEI is down 7.8% - close to its biggest YoY drop since 2008 (Lehman) outside of the COVID lockdown-enforced collapse...

(Click on image to enlarge)

Not a good sign for Real GDP. (The annual growth rate of the LEI remained negative, confirming weaker economic activity ahead)...

(Click on image to enlarge)

The trajectory of the US LEI continues to signal a recession over the next 12 months

(Click on image to enlarge)

Is this the cleanest view of The Fed's tightening impact on the US economy? Certainly doesn't look like a 'soft' landing...

More By This Author:

Philly Fed Future Expectations For Shipments/CapEx Near 'Worst Since Lehman' LevelsTSLA Shares Rise On AI & Cybertruck Optimism After Top- & Bottom-Line Miss

Beige Book Find "Little Change" As Outlook Turn Weaker But "Recession" Mentions Tumble

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more