U.S. Jobs Strength Continues Despite Survey Weakness

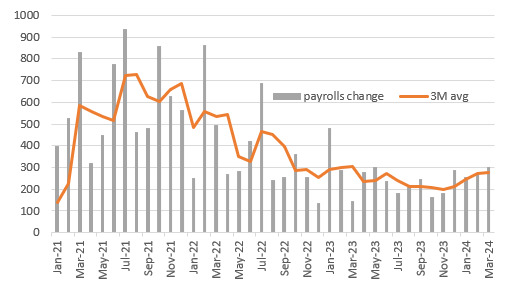

The US added 303,000 jobs in March, which is more than anyone was expecting. With next week’s inflation likely to remain hot, the prospect of a June rate cut from the Fed looks slim. Nonetheless, with business surveys universally pointing to weakness over the next 3-6 months we do expect to see more evidence of cooling by the summer.

Image Source: Pexels

Strong jobs trend continues

US non-farm payrolls rose 303k in March versus the 214k consensus while there were 22k of upward revisions to the past two months of data. 303k was higher than anyone was forecasting in the surveys (74 forecasts of which the high was 290k). The unemployment rate came in at 3.8%, down from 3.9% and average hourly earning rose 0.3% month-on-month/4.1% year-on-year. Undeniably strong throughout with interest rate cut expectations unsurprisingly receding on this newsflow.

Change in non-farm payrolls (000s)

Source: Macrobond, ING

But the composition doesn't look so strong

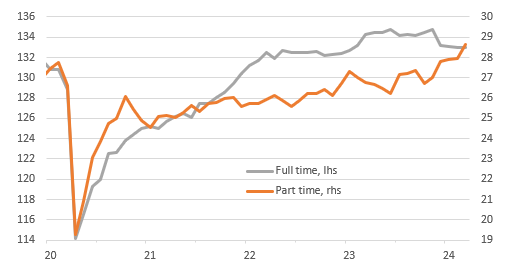

The details show private payrolls rose 232k with manufacturing flat on the month, construction adding 39k, private education and health up 88k, leisure and hospitality up 49k while government payrolls rose 71k. These latter three categories continue to be the main engines of job creation in the US economy. My issue about this is that all three tend to be lower paid than the median and more likely to be part time and are arguably less secure. For a strong vibrant US economy I would like to see full-time tech, business services, transport & logistics, manufacturing, construction to be contributing much more than 25% of jobs, which is what they have averaged over the past 18 months.

Full time versus part time employment levels (millions)

Source: Macrobond, ING

In this regard, the household survey shows that full-time employment fell for the fourth consecutive month (to 132.94mn) which leaves us at the lowest level of full-time employment since January 2023 while part-time employment rose to an all-time high of 28.632mn. Once again, this suggests the details paint a slightly weaker picture than the headlines alone suggest.

The prospect of a June rate cut now looks slim

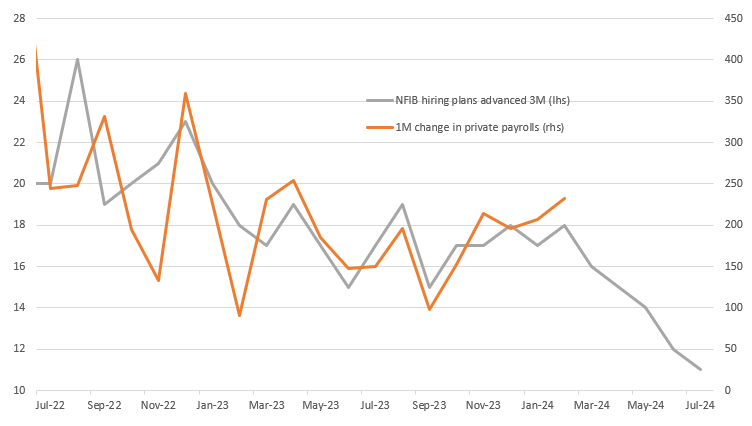

Moreover, with the ISM employment components in contraction territory, the National Federation of Independent Business (NFIB) hiring intentions survey at the lowest level since May 2020 and job lay-off announcements on the rise there are clear contradictions between official data and what businesses are telling survey compilers. That said, the Federal Reserve obviously won't cut rates imminently with jobs this strong and next week's core CPI print likely to remain hot at 0.3% MoM. Our assumption remains that the official data will eventually reflect the views expressed by business, but it may not come in time for the next FOMC meeting in June.

NFIB hiring intentions versus private payrolls changes (000s)

Source: Macrobond, ING

More By This Author:

Key Events In Developed Markets For The Week Of April 8Key Events In EMEA For The Week Of April 8

FX Daily: Clues Vs. Evidence

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more