U.S. Jobs Report Heightens Chances Of An Extended Fed Pause

Yet another upside surprise on US jobs numbers will intensify the belief that Federal Reserve officials are under no pressure to cut interest rates in the near term. We will get the benchmark jobs revisions next month, which could change the story, but in an environment of sticky inflation the risks are increasingly skewed towards an extended pause from the Fed.

Image Source: Pexels

US jobs confirm a January Fed hold

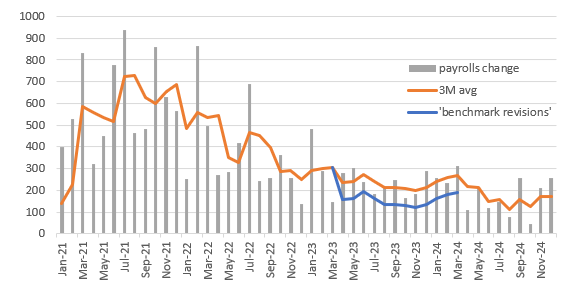

The US jobs report shows payrolls rose 256k in December versus the 165k consensus figure. Revisions to the past two months were -8k. The unemployment rate has fallen to 4.1% from 4.2% – the consensus was for it to hold at 4.2% with the risk skewed towards a 4.3% outcome. Wage growth was 0.3% month-on-month with the year-on-year rate slowing to 3.9% from 4%. All of this provides clear backing for a no change interest rate decision from the Federal Reserve later this month. There are two payrolls reports ahead of the March Federal Reserve FOMC meeting and there will be the annual benchmark revisions next month. These are widely expected to see some significant downward revisions, but in general the recent run of reports suggests the market is right to see the risk of an extended pause from the Fed. That view will only increase if core inflation comes in at 0.3% MoM for a fifth consecutive month next week.

Change in non-farm payrolls (000s)

Source: Macrobond, ING

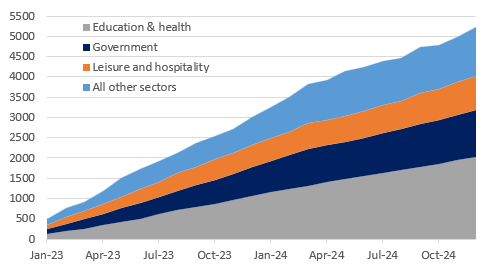

Job composition the one criticism

The details tell the usual story of the strength being led by the same three sectors – private education & healthcare services (+80k), leisure and hospitality (+43k) and government (+33k). They have contributed 78% of all the jobs added over the past two years and in our view that is one criticism that can be levied on the jobs story. These sectors are typically lower paid, less secure and more part time in nature than the 'typical job'. Moreover, for the traditional engines of US growth, such as business services, financial services, technology, transport and logistics, manufacturing, construction, etc to have contributed just 1.22mn of the 5.2mn jobs added over the period is disappointing – since government alone has added 1.15mn!

Cumulative change in US non-farm payrolls over past two years (000s)

Source: Macrobond, ING

Growing prospects of an extended Fed pause

This time around there was a surprise gain of 43k in retail trade though. On the weaker side we see manufacturing falling 13k while mining & logging posted a 3k drop and wholesale trade fell 4k, but that doesn't change the story of a decent report. It also shows that the slowdown in jobs creation has been more muted than previously thought. Non-farm payrolls averaged 207k in the first half of the year and 165k in the second half of the year.

A January no change decision from the Fed is now guaranteed – the market is pricing less than 1bp of a 25bp rate cut – and the risk of an extended pause has increased with the market no longer fully discounting a rate cut until September. That said, we do have two jobs reports ahead of the March FOMC meeting and we will have the annual benchmark revisions. The preliminary estimate of revisions showed that after cross referencing with tax data the Bureau of Labor Statistics admitted to having overestimated job creation by one-third between April 2023 and March 2024. We will get confirmation next month with revisions to subsequent data too. That could yet change the story, but for now we have to admit that our forecast of three rate cuts in 2025 may be too aggressive.

More By This Author:

The Commodities Feed: European Gas WeakerFX Daily: Fiscal Rigor Pledge Is Calming Sterling Market

US Rates Heading Deeper Into The Zone Of Interest

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more