US Jobless Claims Tonight May Kill The Rally

The numbers for US jobless claims are expected to spike higher due to coronavirus-induced layoffs. This may kill the current rally in the US stock market. Short SPX/USD?

US stock index futures rose in the past 2 days as a result of Fed’s promise to offer unlimited support and the USD2 trillion fiscal stimulus package which was agreed by the White House and Senate.

The question now is: Can the fiscal stimulus package prevent a recession and soften the blow by the current COVID-19 pandemic?

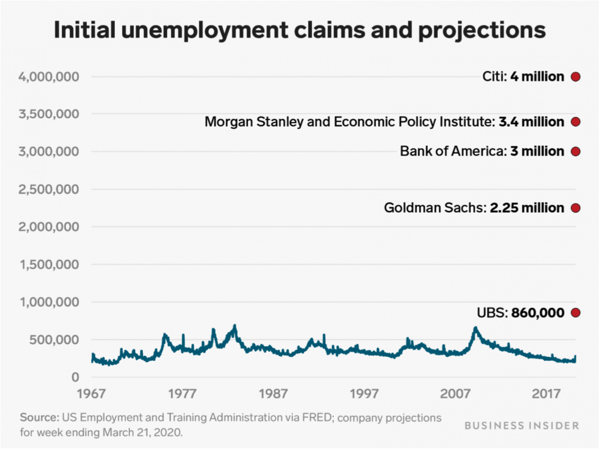

US jobless claims will be released tonight, with estimates ranging from 1 million to 4 million. Even at 1 million, this figure would be a 3-time increase from last week’s number.

Here’s a projection by different banks on tonight’s numbers.

Moreover, St. Louis Federal Reserve President James Bullard has warned that the US unemployment rate could climb to 30 percent this year, a grim assessment of an economy that had seen the percentage of unemployed Americans fell to a half-century low just one month ago.

In our opinion, in order for US stock futures to have a sustainable recovery, either the number of cases in US must peak or a vaccine that is ready to be shipped must be available.

During a Fox News virtual town hall, President Trump said he was considering lifting some of the restrictions by Easter, which lands on April 12th this year.

We feel that it may be too early and could cause devastating consequences if Trump decides to ease coronavirus restrictions prematurely.

S&P 500 is currently holding at the Fibonacci 23.6 retracement which acts as a resistance. The jobless claims tonight could push price lower towards 2365 price level.

(Click on image to enlarge)

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more

A great read. Highly recommended.