U.S. Job Worries Sour Sentiment

Consumers remain anxious about the potential for big tariff-induced price hikes, but the increasingly dominant worry is the state of the jobs market. Job security perceptions look particularly weak, and in an economy where the consumer accounts for 70% of all economic activity, the Fed will remain under pressure to offer more support.

Image Source: Pexels

Confidence remains on its lows

The October preliminary reading for the University of Michigan consumer sentiment index has changed little from the final September print - slipping to 55.0 from 55.1, but at least it is above the 54.0 consensus prediction. The breakdown shows current conditions rising 0.6 points to 61.0, while the expectations component dropped 0.5 points to 51.2. To give you some context, the average consumer confidence print over the past 25 years was 91.8, so the responses are rather gloomy. Moreover, we are at the same sorts of levels as during the GFC in 2008 and when inflation rose above 9% in 2022.

The details show the reason for such pessimism are worries about jobs, with 63% of households expecting unemployment to rise over the next 12 months. There are also weak readings for perceptions of household finances and comfort in retirement. The perceptions of "is government doing a good job fighting inflation and unemployment?" hit new lows with 66% saying government is doing a poor job and only 18% saying it is doing a good one.

Historically, the relationship between this measure of consumer sentiment and actual consumer spending hasn’t been as good as with the Conference Board’s measure, but the sentiment reading surrounding the jobs market does have strong performance regarding labour market outcomes.

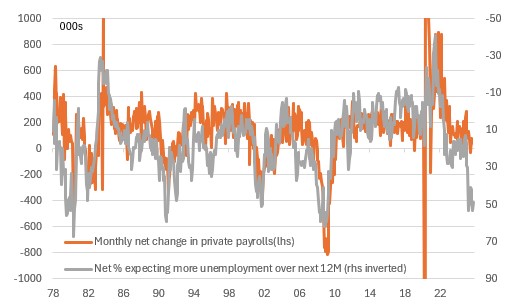

The chart below shows the relationship between fear of job loss and the actual change in private payrolls. It is a lead indicator presumably because workers see and feel changes in the workplace before they show up in the data – Workers tend to know if there is a hiring freeze or some other cost containment measures come in and go on to presume that jobs may soon be trimmed. That has historically proven to be the right assumption, so this does not bode well for the outlook.

U. of Michigan employment expectations versus the change in private payrolls (000s)

Source: Macrobond, ING

25bp October cut should be confirmed by a weak Beige Book

It also tallies with the jobs numbers we have been getting amidst the government shutdown. The ISM employment series is in contraction territory, while the ADP private payrolls report shows three outright falls in employment in the past four months. The Beige Book – the Fed’s anecdotal survey of the state of the US economy – is due out next week, and we are not expecting any meaningful improvement on its August messaging that 11 out of 12 Federal Reserve districts are seeing no net change, and the other is seeing falls in employment.

Fed Governor Chris Waller – one of the leading candidates to take over as Fed Chair next May – spoke earlier today, stating that “the labor market is weak and that’s the punchline for policy” and that the jobs surveys are “all telling you the same story”. He advocates a policy of ongoing 25bp cuts, saying “you can just do 25, keep going, see how it goes”.

We suspect a majority of Fed voters will end up agreeing with him and expect 25bp cuts at October’s and December’s FOMC meeting, with a further 50bp of cuts in early 2025.

More By This Author:

Asia Week Ahead: Singapore Monetary Policy Decision And Key China DataFX Daily: USD Rally Isn’t A Blip, But Will Struggle To Accelerate

Rates Spark: Benign Environment For Carry Trades

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more