U.S. Inflation Progress Stalls On Sticky Services

U.S. headline inflation edged marginally lower to 3.1% year-on-year while core inflation remained at 4% as residual pricing power in the services sector lingers. Nonetheless, we still expect inflation to break down into the 2-2.5% region through the first half of 2024.

Image Source: Pixabay

Inflation pressures linger in key areas

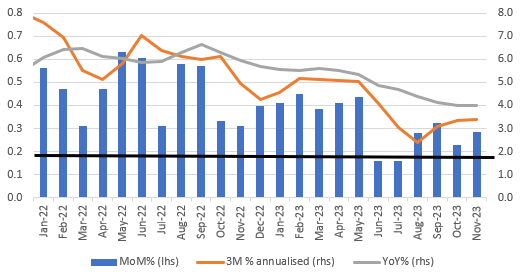

U.S. consumer price inflation rose 0.1% month-on-month or 3.1% year-on-year in November while the core rate (ex-food and energy) increased 0.3% MoM or 4% YoY. This was broadly in line with expectations – although the headline rate was forecast to be 0% rather than 0.1% MoM. The details show energy was a big downward influence, falling 2.3% MoM while new vehicles fell 0.1% for the second month in a row and apparel prices fell 1.3% MoM. However, used car prices surprisingly jumped 1.6% MoM, medical goods and services rose 0.5% and 0.6%, respectively while the cost of shelter remained firm. Insurance costs (particularly for vehicles) continue to soar – now up nearly 20% YoY. The chart below shows core CPI MoM, 3M annualised and YoY data, with the black line representing the MoM rate we need to average to get annual inflation rates back to 2%. Progress has been made, but not enough yet to satisfy the Federal Reserve.

Core CPI - ex food and energy

Supercore strength to keep the Fed wary

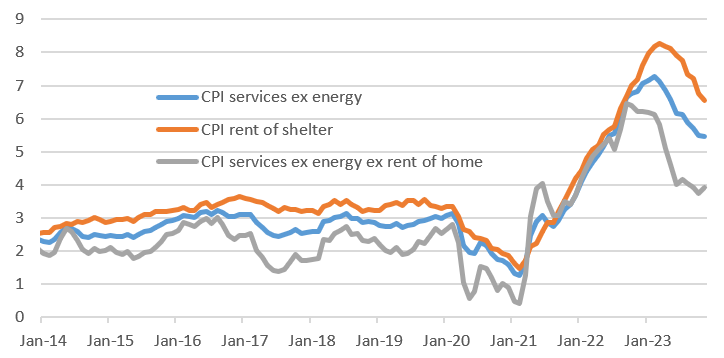

If we look at the so-called “supercore” services – services ex-energy and shelter – we see there is residual strength, rising 0.44% MoM rather than just below 0.2%, which would over time bring us back to a 2% annual rate of inflation. The Federal Reserve remains nervous that a tight labour market could keep wages firmer than anticipated, resulting in ongoing price increases in this labour-intensive part of the economy.

Consequently, we doubt the Federal Reserve will seek to offer the market any meaningfully dovish signals tomorrow, fearing it would give the Treasury market the green light to push Treasury yields lower and effectively unwind some of the Fed rate hikes from earlier in the year. Instead, it looks set to retain its view that the market is being too aggressive in pricing rate cuts. We expect the central bank to stick to projecting just 50bp of easing in 2024 versus the 115bp or so currently priced by markets.

Supercore services inflation still too hot

2-2.5% inflation looks possible for the second quarter of 2024

We have plateaued at just above 3% since June for headline annual CPI, but with gasoline prices falling such a long way and observed rents pointing to a sharp slowing in housing CPI measures through early next year, we remain confident we will break below 3% and stay there from early 2024. Also note today's NFIB small business survey, which showed only 25% of businesses were raising prices right now versus 30% last month. In fact, the last time we saw fewer businesses raising prices was January 2021. So, while today's report wasn't as good as it could have been, there are still reasons for optimism on sustained lower inflation rates in 2024.

More By This Author:

Key Events In Developed Markets And EMEA For The Week Of Monday, December 11We Expect Another Fed Hold, But With Pushback On Rate Cut Prospects

December’s ECB Cheat Sheet: A Reality Check For Ultra-Dovish Expectations

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more