U.S. House Prices Come Under Further Pressure

The surge in mortgage rates has resulted in a steep drop in home buyer demand while supply of homes for sales is on a gradual rise. As a result home prices are now falling in every major city. With house price-to-incomes ratios remaining stretched by historical standards, further large falls are expected.

Housing demand is slowing as supply rises

Mortgage rates have more than doubled over the past 12 months as Federal Reserve interest rate increases pushed up borrowing costs more broadly in the economy. This meant that the monthly mortgage payment for the typical $380,000 loan rose from $1,600 per month to nearly $2,500, dramatically limiting the number of household that could finance a house purchase. Unsurprisingly mortgage application for home purchases halved and this downturn in demand led to a steep drop in housing transactions. This is now having knock-on effects in residential construction along with other retail activity that is tied to home sales, such as household furniture, furnishings and household appliances.

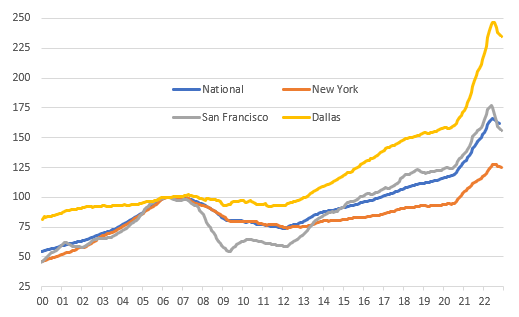

Consequently, the US housing market has switched from one experiencing excess demand, that lifted prices 40% nationally between the beginning of 2020 and the summer of 2022, to one where supply now exceeds that of demand. Unsurprising this is now having an impact on prices, with all major cities in the US having experienced house price declines according to today’s S&P Case Shiller house price data.

S&P Case Shiller house price levels

Source: Macrobond, ING

Prices falling in every major city

Nationally, we saw prices fall 0.3% month-on-month, but the 20 major cities saw prices fall 0.5% MoM, slowing the year-on-year house price growth to 6.8% from 8.6%. The pain is most acute on the West Coast, with prices in San Francisco down nearly 12% between May and November, Los Angeles down 6%, San Diego down 7% and Seattle down 9%. Northern and Eastern cities are faring better for now.

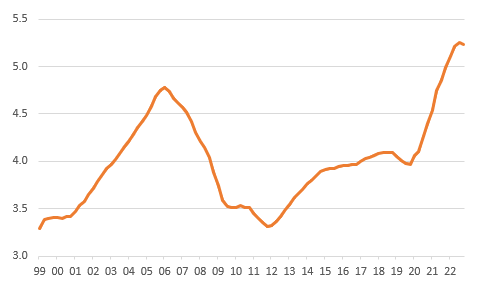

Even after these falls, house price-to-income ratios remain very high and are well above where we were at the peak of the 2006 housing bubble. To get back to a long run average price-to-income ratio of around four times income, would imply prices nationally falling around 20%. The caveat to this is that mortgage rates have fallen back in recent months and there has been an uptick in mortgage applications that could mean it isn’t quite as bad as 20%, but the affordability and valuation metrics still point to the risk of downside price risks.

House price-to-income ratio

Source: Macrobond, ING

Lower rents will help the Federal Reserve switch to rate cuts

While price falls of such a magnitude certainly wouldn’t be pleasant and would inevitably hit sentiment and contribute to weaker activity more broadly in the economy, it will be a factor that helps get inflation lower and opens the door to Federal Reserve interest rate cuts.

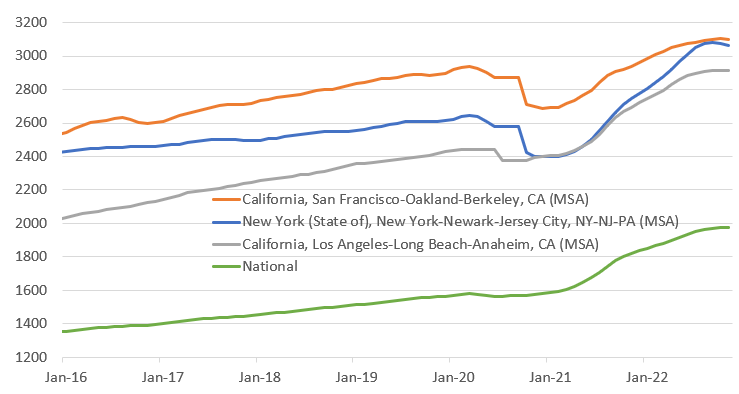

Zillow observed monthly rents ($)

Source: Macrobond, ING

Housing rents follow the general trend of prices and as the chart above shows, using data on observed rents from Zillow, we are starting to see them peak out in major cities and actually head a little lower in the likes of New York and Dallas. This is important given the cost of shelter has a one-third weighting within the CPI basket of goods and services used to calculate the inflation rate. If you have a component of such influence actually experiencing price falls this can help to drag the overall price index down too. Add in the fact vehicle prices have a near ten percent weighting and they too are coming under downward pressure, we fully expect consumer price inflation to be below 2% by the end of this year. In an environment of recession and on-target inflation, we expect the Federal Reserve to be cutting interest rates aggressively from later this year.

More By This Author:

Eurozone Avoids Contraction But Domestic Demand Falters

Italian GDP Fell Slightly At The End Of 2022

FX Daily: Bracing For Volatility

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more