US Financial Stability Trumps Near Term Inflation

US core inflation came in hotter and has nudged expectations for a rate hike higher. While the Fed is probably inclined to hike 25bp, this is contingent on calm being restored to the financial system.

Irrespective of this, the fallout from recent events will inevitably lead to a tightening of lending conditions which will weigh on growth and inflation.

Hot inflation lifts rate hike chances

Headline US CPI rose 0.4% month-on-month in February, as expected, but core (ex food and energy) was up 0.5%, versus the 0.4% consensus. As a result, the annual rate of headline inflation slows to 6% from 6.4% while the annual rate of core inflation moderates to 5.5% from 5.6%. On the face of it this supports the case for a Federal Reserve rate hike next week (we are up to about 19bp priced now), but that is still contingent on market calm. Financial stability risks always trump near-term inflation worries.

The details show shelter costs remain elevated, rising 0.8% MoM while airline fares jumped 6.4%, recreation increased 0.9% while apparel rose 0.8% MoM for the second month in a row. On the softer side, used car prices fell sharply again despite car auction prices suggesting the opposite while medical care costs continue to ease.

But inflation to fall as economic conditions deteriorate

Despite the strength in today’s core inflation measure, we expect inflation to slow rapidly through the second half of 2023 as the decline in house prices, which is leading to a flat lining in new rent agreements eventually feeds through into the CPI.

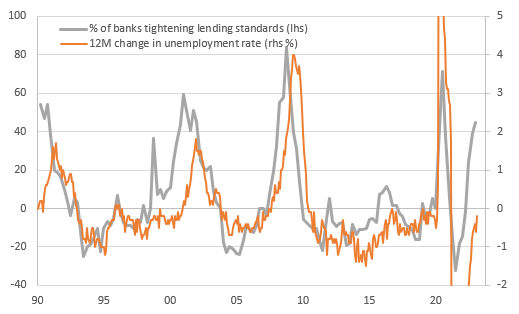

This is not the only reason though. This has been the most aggressive monetary policy tightening cycle for 40 years and by going harder and faster into restrictive territory the Federal Reserve naturally has less control over the outcome. Higher borrowing costs have been accompanied by a rapid tightening in lending conditions, which will increasingly weigh on credit flow. Banks will become increasingly cautious on the back of the SVB/Signature fallout and regulators will be more watchful, which will in turn make banks even more cautious. This will restrict access to credit and put up its cost, further weighing on the economy and eroding corporate pricing power.

Tight lending standards will get tighter, hitting the economy hard

Source: Macrobond, ING

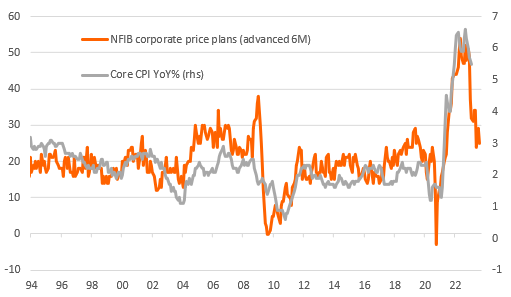

Corporate profit margins will increasingly be squeezed

This was again evident in today’s National Federation of Independent Businesses survey on the economy. The proportion of companies that said they raised prices over the previous three months dropped to 38% in February from 42% in January. This is the lowest reading since April 2021 (having hit 66% in March last year). More importantly, the proportion of companies looking to raise prices over the coming three months dropped back to 25% from 29% – close to the 24% figure hit in December. As the chart below shows, this has a good lead quality on core CPI and suggests sub 3% inflation by year-end.

NFIB price plans series points to a rapid slowdown in core inflation

Source: Macrobond, ING

Companies, particularly in the small business sector "remain doubtful that business conditions will get better in coming months", according to the survey. Bank failures will not make them any more cheerful and intensifying competition is likely to mean profit margin squeezes and slower inflation.

Fed probably still inclined to hike rates next week, but cuts are coming

So where does this leave us with the Fed next week? We don’t see the need to hike rates. The tightening of lending conditions that will inevitably result from the fallout of the past few days heightens the risk of a hard economic landing and inflation returning to target by early next year. We do think there is an inclination for the Fed to hike if conditions allow.

Longer term our view on the high chance of rate cuts before year-end has only been reinforced by recent developments.

More By This Author:

FX Daily: What To Expect From Another Day Of Market MayhemUK Budget: Short-Term Positives To Be Met With Medium-Term Caution

Turkey: External Financing Remains A Concern

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more