U.S. Federal Reserve Keeps Its Options Open With Another Hawkish Hold

The Fed funds rate target range was held at 5.25-5.5% by a unanimous vote, with a hawkish tone retained to ensure financial conditions remain tight and aid in the battle to constrain inflation. Higher household and corporate borrowing costs are starting to bite though and we don’t expect any further hikes this cycle.

US Federal Reserve Chair Jerome Powell

Rates held with a hawkish bias retained

No surprises from the Federal Reserve today with the Fed funds target range held at 5.25-5.50% for the second consecutive meeting – the longest period of no change since before the tightening cycle started in early 2022. The accompanying statement acknowledges the “strong” economic activity – a slight upgrade on the “solid” description in September while there was explicit mention of “tighter financial and credit conditions”, which will weigh on the economy.

Nonetheless, in the press conference Chair Powell recognises that the economy is starting to see the effects of tighter monetary policy, but that the committee still has a bias towards more hikes rather than seeing the prospect of cuts on the horizon. This is understandable since the Fed does not want to give the market the excuse to significantly backtrack on the recent repricing of “higher for longer” policy interest rates. While there does appear to be a slight softening in the degree of hawkishness the Federal Open Market Committee (FOMC) is expressing, they are careful not to provide a signal that policy has peaked, which could tempt traders to drive market rates lower in anticipation that the next move would be rate cuts. Such action could potentially reignite inflation pressures, but we doubt it.

Peak rates with cuts on the horizon for 2024

The surprise surge in longer-dated Treasury yields and the tightening of financial conditions it’s prompted will inevitably create more headwinds for activity in an environment where mortgage and car loan rates are already above 8% and credit card interest rates are at all-time highs. With Treasury yields staying at elevated levels, the need for further policy rate hikes is dramatically reduced and we do not expect any further Fed rate hikes.

Consumer spending remains the most important growth engine in the economy, and with real household disposable income flat-lining, savings being exhausted and consumer credit being repaid – and this is before the recent tightening of lending and financial conditions is fully felt – means we see the primary risk being recession. If right, this will depress inflation pressures even more rapidly than the Fed is anticipating, giving it the scope to cut policy rates in the first half of next year.

Bond yields falling into the Fed meeting more to do with less (relative) supply pressure on the long end

The bond market went into the FOMC meeting in a decent mood. The refunding announcement was deemed tolerable, partly as the headline requirement of US$112bn was US$2bn lower than the market had expected. Note, however, that 10yr issuance increases by US$5bn (to US$40bn) and 30yr issuance increases by US$4bn (to US$24bn), while 3yr issuance increases by just US$2bn (to US$48bn). As a stand-alone that is negative for the long end. But it’s the new December projections that has the market excited, as both 10yr and 30yr issuance is projected to fall by US$3bn (to US$37bn and US$21bn, respectively). In contrast, 2yr, 3yr and 5yr issuance volumes are to increase by US$8bn. So the issuance pressure morphs more towards shorter maturities and away from longer maturities as we head through the fourth quarter. Yields are down. The 10yr now at just under 4.8%. It has not materially broken any trends though.

The big bond market story from the FOMC outcome is an underlying continuation theme. Higher real rates have been a feature since the last FOMC meeting, and the one before. And the Fed knows that this has a clear tightening effect. It’s a rise in market rates that cannot be easily diversified away by liability managers that need to re-finance in the coming few quarters. The Fed knows that both floating rate debt and all types of re-financings will amplify pain as we progress forward. Given that, it can let the debt markets do the last of the pain infliction for them. The rise in real yields has helped to push the curve steeper, and the 5/10yr has now joined the 10/30yr with a positive upward sloping curve. Only the 2/5yr spread remains inverted. This overall look does suggest the bond market is positioning for a turn in market rates ahead. The big move will come when the 2yr starts to anticipate cuts. We are not there quite yet; hence the 2/5yr inversion hold-out.

That all being said, there is enough from the Fed today for the market to use the opportunity to test lower in yields. We still think we need to see the payrolls report first. If that is close to consensus then there is likely not enough to make the break materially lower. It is true that Powell has pointed to higher long rates as a pressure point. But does not have to mean that upward pressure on long rates suddenly goes away. There is still a path back up to 5% if the market decides not to use the double positive today of lower long-end supply (in relative terms) and a Fed that is pointing at long yields as something to get concerned by. We still feel that pressure for higher real rates remains a feature, despite the easing off on longer tenor issuance pressure. We need to see the economy really lurch lower, in particular on the labour market, before the bond bulls take over. The Fed is not quite pointing towards this just yet either.

FX: Too little to reverse the dollar momentum

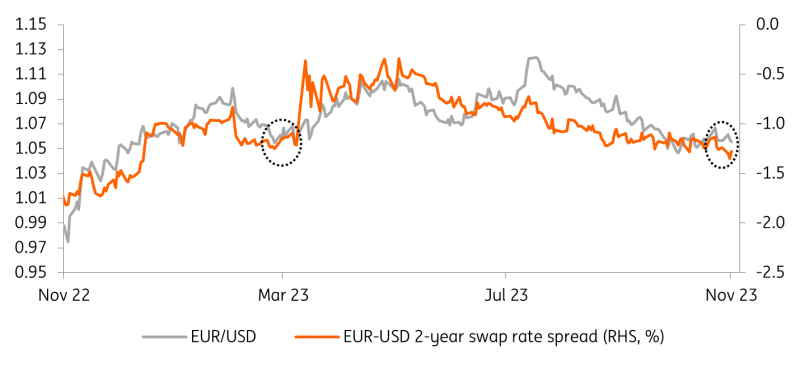

Markets perceived today’s Fed announcement and press conference as moderately dovish, and the drop in Treasury yields would – in theory – point to a softer dollar. The 2-year EUR-USD swap rate differential is around 8bp tighter than pre-meeting, but remains considerably wide at -128bp. As shown in the chart below, such a differential is consistent with EUR/USD trading around 1.05-1.06 and, despite the acknowledgement that financial conditions have tightened, there weren’t enough dovish elements to trigger a material dollar correction.

EUR/USD and 2Y swap rate gap

ING, Refinitiv

Looking ahead, we remain of the view that the dollar’s direction will be set by US data as the Fed’s reiteration of its higher for longer approach and threat of another hike still keep the big bulk of the bullish dollar narrative alive.

Barring a negative turn in US activity data, our 1.06 EUR/USD year-end target remains appropriate. There are probably more downside risks in the month of November, although in December the dollar has negative seasonality.

More By This Author:

The Commodities Feed: Central banks increase gold reservesAsia Morning Bites For Wednesday, November 1

Eurozone Economy Sees A Small Contraction As Inflation Plunges

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more