US Equity Futures Tumble After Tech Rout

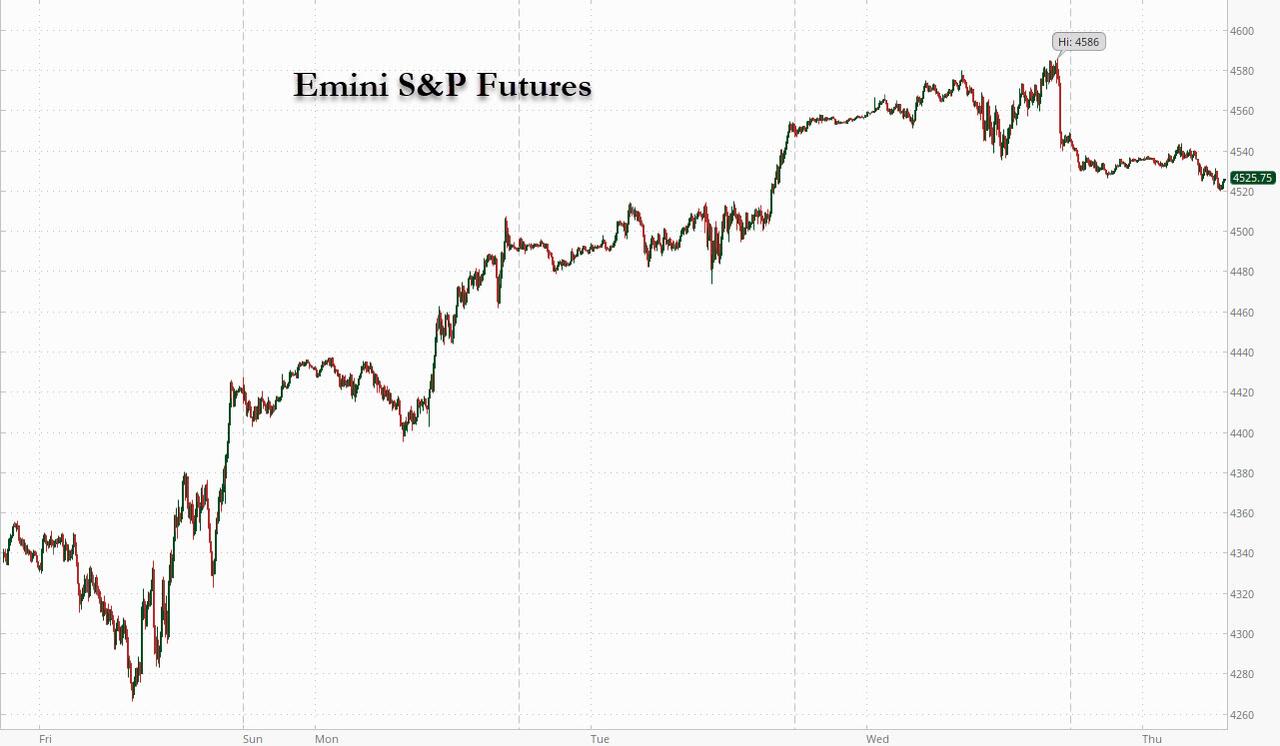

If Google's earnings on Tuesday sent futures sharply higher yesterday, then Facebook's disastrous earnings report late on Wednesday has reversed almost all of the gains - US index futures are sharply lower today led by a plunge in technology stocks after a bout of disappointing earnings reports from Meta, Qualcomm and Spotify boosted concern about the market impact of the Fed tightening. Nasdaq futures tumbled 2.2%, emini S&P futs were down 50 points or 1.1% to 4527 and Dow futures were 0.4% lower. The dollar strengthened before rate decisions in Europe and the U.K.

(Click on image to enlarge)

Facebook parent Meta Platforms was on pace for its biggest drop ever and slashing its valuation by about $200 billion- the biggest in market history - after its sales forecast missed estimates amid stagnating user growth and increasing competition from TikTok. Meta shares, which had plunged 22% in late New York trading, continued its losses in Thursday’s premarket session. NVidia Corp. and Qualcomm lost more than 3.8%. Amazon.com Inc., which will post its financial results after U.S. market hours, slid 3.7%. Twitter, Spotify, Snap and Pinterest also fell, while T-Mobile US gained 7.7%.

Investors will now focus on upcoming earnings from Amazon, the last remaining tech giant, while looking past signs of a temporary soft patch in the U.S. job market, according to Ipek Ozkardeskaya, senior analyst at Swissquote.

“There are millions of jobs available in the market, and there is nothing the Fed could do to get people to work,” she wrote in a note. “What people care about is the earnings, and inflation.”

The poorly received earnings reports from the U.S. tech giants are a challenge for dip buyers hoping that corporate performance will ease worries about central bank interest-rate hikes. Markets have swung sharply and stocks are nursing losses this year as officials pare stimulus to curb inflation.

“Volatility is here to stay,” Anna Han, equity strategist at Wells Fargo Securities, said on Bloomberg Television. “Our outlook for 2022 was that we’d see more spikes in volatility. With that choppiness, with that unpredictability, investors are going to express that by compressing multiples.”

Electric vehicle stocks are sliding in premarket trading Thursday amid a broader selloff in tech and growth firms with U.S. stock index futures sinking. Lordstown Motors slides 5.2%, Workhorse falls 3.8%, Rivian slides 3.8%, Nio is 3.6% lower, Tesla drops 3%, Li Auto declines 3%, XPeng loses 2.8% and Nikola slips 1.9%. These stocks have all posted double-digit declines so far this year amid concerns of rising interest rates. Here are some of the biggest U.S. movers today:

- Meta Platforms (FB) plunges as much as 22% in premarket trading after the Facebook- and Instagram- owner gave a revenue forecast for 1Q that missed estimates amid stagnating user growth. Other social media stocks declining premarket include: Snap (SNAP US) -16%; Pinterest (PINS US) -8.5%; Twitter (TWTR) -8.1%

- Spotify (SPOT) falls 9% in premarket trading after the subscription music service’s update, with quarterly growth and margin forecasts slightly missing estimates. However, analysts remain largely positive.

- Semiconductor stocks fall in premarket trading as Qualcomm (QCOM) slides 3.2% after chip shortages hit results. Areas outside of the company’s phone sales were underwhelming. Advanced Micro Devices -2% (AMD), Nvidia -3.2% (NVDA), Micron -2.1% (MU)

- T-Mobile (TMUS) shares rise 8% in extended trading after the mobile phone service company gave a full-year outlook for postpaid customer additions that at the midpoint of the range exceeded analysts’ projections.

- Align Technology (ALGN) falls 2.5% in premarket trading Wednesday after the company’s Invisalign case shipments for the fourth quarter missed analyst estimates.

- Cognizant Technology Solutions (CTSH) fell 2% in extended trading on Wednesday after the IT services company reported its fourth-quarter results and outlook.

In Europe, tech and industrial companies led declines in the Stoxx Europe 600 Index, which slid as much as 0.9% to just a few points shy of Monday’s opening levels and was close to its 100-day moving average. Tech, industrials and media are the worst-performing sectors; FTSE 100 outperforms, with miners trading well following robust numbers from Shell. Compass Group jumped 8.1% to pre-pandemic levels in London after the catering-services provider reported first-quarter sales that beat estimates. Roche dropped 2.8% after the Swiss drugmaker issued a conservative forecast, saying sales of Covid-19 tests and therapies will likely wane.

The BOE hiked interest rates for the second successive meeting, taking the key rate up 25 basis points to 0.5%. Officials also signaled they would start running down their bond holdings, halting reinvestments on their gilt pile and offloading their corporate-bond portfolio.

The focus in Europe shifted to the European Central Bank’s rate decision. A record regional inflation print is adding pressure on policy makers to act amid concerns they may be too slow in fighting inflation. The pound advanced for a fifth day and traded at $1.3620.

Asian equities snapped a four-day rally after Meta Platforms and Sony posted subdued earnings and prospects, weighing on the region’s technology sector. The MSCI Asia Pacific Index eased 0.3% after gaining as much as 0.1%. Sony and Panasonic were among the biggest drags on the gauge amid concerns over their future earnings. Regional tech shares also took a hit from disappointing forecasts from Facebook’s parent and Spotify, while materials and utilities climbed. Panasonic Falls Most in 3 Months After 3Q Results Disappoint Sony Drops After Disappointing PlayStation Sales and Outlook Spotify Craters After Forecasting Slower Start to New Year *T Nasdaq 100 futures dropped more than 2% intraday while Japan’s benchmarks fell, offsetting gains in South Korean and Singapore gauges, which staged a catch-up rally after reopening from the Lunar New Year holiday. Asia’s stock gauge yesterday advanced for a fourth day as fears of Fed tightening receded. The earnings season has taken center stage, with investors trawling through management commentary for the outlook for supply chains and corporate profits. Bank of England and European Central Bank rate decisions are due later Thursday. “The downside on Wall Street could create headwinds for the Asian tech sector,” and potential hawkish rhetoric from the central banks in Europe may play a critical role in markets, Anderson Alves, a trader at brokerage ActivTrades, wrote in a note. Hong Kong’s stock market is set to reopen on Friday, followed by mainland China and Taiwan on Monday.

Japanese stocks dropped, ending a four-day rally, as a weak forecast from Facebook’s parent sparked a selloff in technology shares. Electronics and machinery makers were the biggest drags on the Topix, which fell 0.9%. Fast Retailing and Tokyo Electron were the largest contributors to a 1.1% loss in the Nikkei 225. The Topix had gained 5.1% over the previous four sessions, its best four-day gain since May 2021. “We’re seeing a clear divide between firms that are able to continue to grow earnings and those that aren’t,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management Co. “People are going to be more selective in their stock picks, which means you’ll see some names being sold off.”

Indian stocks also fell, halting the biggest three-day gain in almost a year, dragged by Infosys Ltd. The benchmark S&P BSE Sensex slipped 1.3% to 58,788.02 in Mumbai, while the NSE Nifty 50 Index dropped 1.2%. All but two of the 19 sub-indexes compiled by BSE Ltd. declined, with a measure of tech stocks snapping a four-day winning streak to fall 2%. Shares climbed more than 4% in the last three sessions as the government’s annual budget earmarked higher spending to restart the investment cycle and support a recovery in businesses disrupted by the pandemic.

Australia's S&P/ASX 200 index fell 0.1% to 7,078.00, dragged lower by tech shares after disappointing earnings from sector bellwethers in the U.S. Regional tech stocks and futures contracts on the Nasdaq 100 dropped after Facebook parent Meta and streaming service Spotify plunged in late trading on soft outlooks. Read: Australia Braces for Tough Earnings Season as Risks Pile Up In Australia, payments firm Block was among the benchmark’s biggest laggards. Nufarm was the top performer after a 1Q update. In New Zealand, the S&P/NZX 50 index rose 0.4% to 12,335.32.

In rates, Treasury yields jjmped following wider losses in gilts after Bank of England raised rates by 25bp in a 5-4 vote, with four MPC members favoring a 50bp hike. BOE Governor Bailey press conference is ahead at 7:30am ET, and European Central Bank rate decision is expected at 7:45am, followed by President Lagarde press conference at 8:30am. Treasury yields are cheaper by 1bp-2bp across the curve, 10-year by 2bp near 1.795% vs 6.5bp increase for U.K. 10-year yield; 2- year gilt yield rose as much as 10bp to 1.129% IG dollar issuance slate empty so far; $7.55b of new debt was priced Wednesday, taking weekly total to $19.5b vs $15b-$20b projected. Peripheral spreads widen with short-end Italy lagging. Japanese government bonds yield edged lower after a 30-year debt sale fetched a higher-than-estimated price.

In FX, Bloomberg dollar spot index drifts higher, rallying as the greenback advanced against all of its Group-of-10 peers, with CHF and NOK underperforming, GBP outperforms in G-10. The euro fell below $1.13 as it snapped a four-day advance; the Bund yield curve steepened slightly into the ECB. Gilt yields rise up to 2bps, led by the long end, while the pound inched lower, trimming its gains on the week, amid broad dollar gains and with traders turning their focus to the BOE. The BOE is expected to raise its policy rate as well as take the initial steps toward unwinding some of its 895 billion-pound ($1.2 trillion) stimulus program. The yen dipped amid broad dollar strength; two-year overnight-indexed yen swaps this week breached zero for the first time since 2016 -- the year the Bank of Japan introduced its negative interest rate policy. The sometime proxy for investor expectations of future policy rates has risen three basis points this year. Bank of Japan Deputy Governor Masazumi Wakatabe says it’s a mistake if bond yields are rising on speculation that the BOJ might make adjustments to its monetary policy. Australian dollar declined as falling stock indexes spurred risk-off price action. Bonds rose ahead of the Reserve Bank’s quarterly Statement on Monetary Policy Friday. Turkish lira is the weakest in EMFX after Jan. inflation came in at the highest in 20 years.

In commodities, crude futures decline. WTI trades at the bottom of Wednesday’s range, falling 1% near $87.40. Base metals are mixed; LME copper falls 0.7% while LME aluminum gains 0.9%. Spot gold drops ~$4 near $1,803/oz. Spot silver loses 0.9% near $22

Looking at the day ahead now, and the main highlights will be the aforementioned monetary policy decisions from the ECB and the BoE, with press conferences afterwards from President Lagarde and Governor Bailey. Otherwise on the central bank front, there’s also the confirmation hearings at the Senate Banking Committee for the three new nominees for Fed governor. On the data side, there’s the January services and composite PMIs from around the world, and in the US there’s the ISM services index for January, December’s factory orders and the weekly initial jobless claims. Finally, earnings releases today include Amazon, Eli Lilly, Merck & Co., Honeywell and Ford.

Market Snapshot

- S&P 500 futures down 0.9% to 4,535.75

- MXAP down 0.3% to 186.61

- MXAPJ little changed at 609.19

- Nikkei down 1.1% to 27,241.31

- Topix down 0.9% to 1,919.92

- Hang Seng Index up 1.1% to 23,802.26

- Shanghai Composite down 1.0% to 3,361.44

- Sensex down 1.1% to 58,886.60

- Australia S&P/ASX 200 down 0.1% to 7,078.01

- Kospi up 1.7% to 2,707.82

- STOXX Europe 600 down 0.5% to 474.50

- German 10Y yield little changed at 0.04%

- Euro down 0.2% to $1.1288

- Brent Futures down 0.9% to $88.68/bbl

- Gold spot down 0.1% to $1,805.27

- U.S. Dollar Index up 0.23% to 96.16

Top Overnight News from Bloomberg

- Facebook parent Meta Platforms Inc. is set to shed about $200 billion in market value, in what would be one of the biggest one-day market capitalization wipeouts for any company on record

- The fastest inflation in decades is ending the low-rate era, but governments in the euro area have already locked in 461.85 billion euros ($522.5 billion) of funding in a pandemic- driven debt splurge. On top of that, the economic growth rate in Europe has never been this much higher than the average coupon on European sovereign bonds, suggesting the income nations generate from a growing economy will keep the debt burden manageable

- The world’s well of debt with yields below zero has shrunk to the lowest in more than three years as the prospect of imminent interest-rate hikes drives a selloff in bonds

- The U.K.’s cost of living crisis is set to escalate dramatically on Thursday, with millions facing a record increase in energy bills, forcing the government to roll out a multi-billion pound package to ease the burden

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were mostly negative and took their cues from the selling pressure in US equity futures and Meta slump. ASX 200 (-0.1%) was subdued by losses in tech but with downside stemmed by mining stocks and mixed-to-firm data. Nikkei 225 (-1.1%) weakened as Japan mulls a quasi-emergency extension for Tokyo and with earnings in focus. KOSPI (+1.7%) outperformed and played catch up to this week's gains on return from the Lunar New Year holiday. US equity futures were mostly pressured after almost USD 200bln was wiped off from Meta's value which weighed on other social media stocks; E-mini S&P -0.9%, E-mini Nasdaq 100 -2.1%.

Top Asian News

- StanChart Zimbabwe Starts Probe After Reports CEO Suspended

- UAE Wealth Funds Behind $10 Billion Israel Plans Scout for Deals

- UAE Intercepts Hostile Drones After Wave of Attacks

- Tokyo Sets New Guidelines for Seeking Virus Emergency

European bourses are pressured, Stoxx 600 -0.7% given the US after-market read across, followed by numerous earnings releases in the pre-market dictating individual movers/sectors. European sectors are predominantly in the red as Tech lags post-Meta, -20.3% in the pre-market, while Healthcare is hit following Roche's soft guidance.

Top European News

- StanChart Zimbabwe Starts Probe After Reports CEO Suspended

- U.K. Jan. Composite PMI 54.2 vs Flash Reading 53.4

- ABB Expects Minimum $750 Million From E-Mobility IPO: CEO

- Infineon Shares Decline Despite Raised Revenue Guidance

US Event Calendar

- 7:30am: Jan. Challenger Job Cuts YoY, prior -75.3%

- 8:30am: 4Q Unit Labor Costs, est. 1.0%, prior 9.6%; Nonfarm Productivity, est. 3.8%, prior -5.2%

- 8:30am: Jan. Initial Jobless Claims, est. 245,000, prior 260,000; Continuing Claims, est. 1.62m, prior 1.68m

- 9:45am: Jan. Markit US Services PMI, est. 50.9, prior 50.9

- Jan. Markit US Composite PMI, est. 50.8, prior 50.8

- 10am: Dec. Factory Orders, est. -0.4%, prior 1.6%; Factory Orders Ex Trans, est. 0.4%, prior 0.8%

- 10am: Dec. Durable Goods Orders, est. -0.9%, prior -0.9%; -Less Transportation, prior 0.4%

- Cap Goods Orders Nondef Ex Air, prior 0%

- Cap Goods Ship Nondef Ex Air, prior 1.3%

- 10am: Jan. ISM Services Index, est. 59.5, prior 62.0, revised 62.3

DB's Jim Reid concludes the overnight wrap

With all my injuries of late I can't help thinking that my future sporting prowess might be more suited to, and also safer, in the metaverse. However even the metaverse isn't a smooth ride as we found out last night. Indeed it's rare that I'll lead on one after hours earnings result but Meta's (formerly Facebook) earnings miss sent shares down as much as -23.85% in the early hours. For a company that had around $890bn of market cap at yesterday’s close, that would equate to around $200bn of market cap losses, and wiping out the last year of gains. The market cap loss is also bigger than the market cap of Netflix ($202.9bn) at yesterday’s closing prices. This gives a scale of a damage done. The shares were hit hard by a combination of extraordinary expenses associated with building the metaverse, along with what appears to be stagnating growth in the user base. Those were common themes in other earnings releases overnight. Spotify was almost -30% lower in after-hours trading after revealing subscriber growth below analyst expectations, while Qualcomm was nearly -10% lower after hitting snags trying to expand their business. As a result, Nasdaq futures are trading (-2.17%) lower in Asia and the S&P 500 contract is following in sympathy (-0.90%).

Prior to the Meta news things were looking up for equities after a sensational four days. Indeed the S&P 500’s (+0.94% yesterday) advance over the last 4 sessions is +6.07%, which is the biggest 4-day gain since the relief rally following the November 2020 presidential election. For reference, at its recent intraday low at the start of last week, the S&P was down by -11.40% on a YTD basis, but it’s now recovered the bulk of that to only be down -3.71%. Today may put us back into reverse gear for a period of time at least with Amazon the big US earnings release to look forward to.

The S&P 500 climb up to the close was led by communications (+3.09%) following Alphabet’s (+6.43%) strong earnings and stock-split announced after the previous session’s close. The NASDAQ (+0.50%) managed to also advance for the fourth straight day, but by a smaller margin, while the small-cap Russell 2000 underperformed, falling -1.03%. European equities also gained, but lagged behind US indices, with the STOXX 600 advancing +0.45%.

Looking forward and it's all about central banks today with a likely 25bps rate hike by the Bank of England potentially being overshadowed more by what the ECB doesn’t say today when they also meet. The ECB will be in a slightly difficult spot as it’s a non-forecast meeting so they won’t have any new numbers to present to allow them to methodically adjust their tone (if they indeed wanted to). However the rather large inflation beats seen this week across Europe will make for a difficult press conference if the tone doesn’t somehow become more hawkish. Our chief European economist Mark Wall wrote in a blog post yesterday (link here) that President Lagarde will be under pressure to explain why the ECB continues to expect inflation will fall below target in the medium term. Remember that our economists recently updated their call on ECB liftoff to an initial 25bp hike in December 2022, and in their preview for this meeting (link here) they outline their view that they expect the slow, step-by-step pivot to exit will continue. Will this appease an impatient market though? Expect Lagarde’s press conference to be a box office affair. Could the ECB at some point see a similar kind of attack we saw on front-end pricing in Australia in Q4 last year? There has to be some risk of this. As a minimum remember that in June last year the Fed and market weren’t pricing in a hike until 2024. Now we are debating 3-7 hikes and QT for 2022. So things can change very quickly once momentum builds.

We are entering an interesting week ahead with the central banks meetings today, US payrolls tomorrow and US CPI next Wednesday. Ahead of next Wednesday, the flash CPI estimate for the Euro Area unexpectedly rose to +5.1% in January (vs. +4.4% expected). That’s the highest inflation since the single currency’s formation, and was an unexpected increase from last month’s record as well. Furthermore, core inflation at +2.3% was also stronger than the +1.9% expected, albeit that did come down from the +2.6% reading last month.

Sovereign bond yields reversed an early rally as the inflation numbers came out and edged higher for the most part in Europe yesterday, with those on 10yr bunds (+0.4bps) inching higher to hit their highest level since April 2019. In part that was spurred by the view that the strong inflation data would force an earlier tightening of monetary policy from the ECB over the year ahead, and the euro also strengthened +0.29% in its 4th consecutive move higher. That made a contrast with the US, where diminishing bets that the Fed would hike rates by 50bps at the next meeting helped yields on 10yr Treasuries down -1.2bps to 1.78%. The number of hikes in 2022 got down to 4.625 in early US trading from 5.05 near the US open on Monday before closing at 4.71 (-0.07 hikes on the day), its lowest level in a week.

Onto the BoE. They are set to announce their latest decision at 12:00 London time, and we’ll also get the release of their quarterly Monetary Policy Report. In his preview (link here), our UK economist Sanjay Raja writes that he expects the BoE to follow up their December rate hike with another 25bps increase, taking the Bank Rate to 0.5%. Furthermore, he expects that the MPC should confirm that any APF reinvestments will cease from here on out, resulting in around £38bn falling out of the Bank’s balance sheet this year. That view expecting a rate hike is widely shared, with overnight index swaps just about pricing in a 25bp move at the meeting today, and that’s also the consensus view amongst economists on Bloomberg too.

Asian markets are reacting to the after hours US losses in thin holiday trade this morning. The Nikkei (-1.11%) is trading down, after four consecutive sessions of gains while the Kospi (+2.07%) is in positive territory after trading resumed following a three-day holiday break. Elsewhere, markets in China and Hong Kong remain closed for the Lunar New Year holiday. Meanwhile, Iron ore extended its rally for the third day with futures in Singapore up +2.80% at $143.70 ton on hopes that China's stepped-up monetary easing will boost demand.

Earlier today, IHS Markit showed that South Korea’s January PMI rose to +52.8 from +51.9 in December as new orders picked up despite persistent supply chain woes. Separately, Japan’s services sector shrank at the fastest pace in five months after the Markit’s final estimate showed that the PMI slumped to 47.1 in January from 52.1 in the previous month.

In other news from the last 24 hours, the OPEC+ group agreed to a further output increase of +400k barrels per day in March, although recently the issue has been that suppliers are struggling to meet their quotas for a number of reasons, which has helped oil prices reach post-2014 highs lately. Oil itself was fairly subdued overall on the day, with Brent crude only up +0.35%, but the strength we’ve been mentioning in other commodities continued apace yesterday, with Bloomberg’s Commodity Spot Index (+1.56%) hitting a fresh all-time high thanks in part to a surge in US natural gas futures (+15.79%) amidst signs of further cold weather ahead. See my CoTD (link here) yesterday that showed that this is the strongest cycle for commodities on record at this stage of a US economic recovery.

Aside from the Euro Area inflation release, there wasn’t much in the way of other data yesterday. That said, we did get the ADP’s report of private payrolls for January, which unexpectedly showed a -301k decline as the Omicron variant took hold (vs. +180k expected). We’ll see tomorrow if that has any read through to what is already expected to be a bad headline payroll print. Current expectations are at +150k but I suspect the whisper number might be lower.

Elsewhere, geopolitical tensions in Eastern Europe remained on the edge after the Pentagon indicated to move some of its Europe-based forces further towards east and deploy additional US based troops to Europe.

To the day ahead now, and the main highlights will be the aforementioned monetary policy decisions from the ECB and the BoE, with press conferences afterwards from President Lagarde and Governor Bailey. Otherwise on the central bank front, there’s also the confirmation hearings at the Senate Banking Committee for the three new nominees for Fed governor. On the data side, there’s the January services and composite PMIs from around the world, and in the US there’s the ISM services index for January, December’s factory orders and the weekly initial jobless claims. Finally, earnings releases today include Amazon, Eli Lilly, Merck & Co., Honeywell and Ford.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more