U.S. Equity Factors Post Wide Range Of Losses So Far In 2022

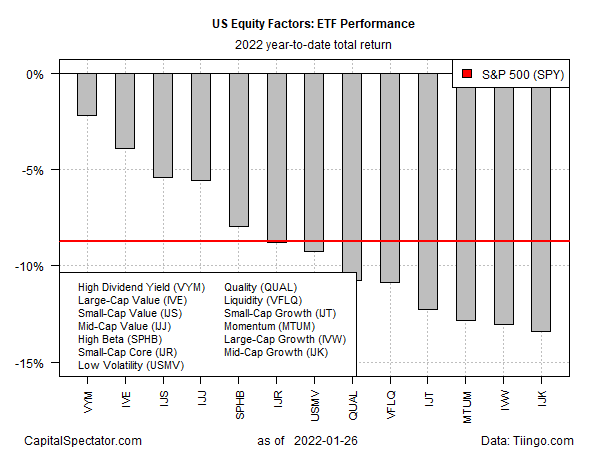

Minds will differ on the case for factor diversification in equity portfolios, but advocates will find a degree of support for the idea in year-to-date performances, based on a set of ETFs through yesterday’s close (Jan. 26).

Although all the primary US equity factors are posting losses so far in 2022, in line with the broad market, the declines vary by a substantial degree. The market’s overall beta risk, in other words, has been minimized or exacerbated, suggesting that building portfolios based on factors offer investors more control over risk management compared with conventional diversification strategies.

It’s debatable if this year’s preliminary results will prove to be the exception or the rule as 2022 unfolds. But perhaps the year ahead will be a stress test for equity factor strategies in the wake of yesterday’s news that the Federal Reserve may raise interest rates several time in the months ahead. In turn, expectations for rising interest rates could create new and perhaps stronger headwinds for stocks. The question is whether those risks will vary by more than trivial degrees for various slices of equity factors?

For some initial guidance, consider how equity factors have fared year to date. Let’s start with the best performer, which is to say the equity factor with the smallest 2022 decline: Vanguard High Dividend Yield (VYM), which is down a relatively mild 2.2% so far.

VYM’s slide is a light touch when you consider that the broad market, based on SPDR S&P 500 (SPY), has lost 8.8% year to date. The deepest setback for our set of factor ETF proxies: a 13.4% retreat via iShares S&P Mid-Cap 400 Growth ETF (IJK).

Longer-term results also show diverse results. Nonetheless, the investment world continues to debate the merits of managing portfolios with factor tilts, which is a type of active management. The appeal is that by designing and managing equity risk through a factor prism there’s greater opportunity for enhancing return, reducing risk or both, relative to owning a portfolio that tracks a broad definition of stocks.

The source for optimism in expecting factor-investing strategies to provide superior opportunities is a simple empirical fact: different factors generate different risk and result in profiles through time, some with relatively low correlations to others and the markets overall.

As Vanguard noted in a research paper (“Equity factor-based investing: A practitioner’s guide”) a few years ago, “Factor-based investment performance is highly cyclical and typically inconsistent across different economic and market conditions. To increase the odds of success, investors must be willing and able to endure numerous and potentially extended periods of underperformance relative to the broad market index.”

In theory, exploiting those differences lays the groundwork for generating superior risk-adjusted results, particularly for investors intent on applying relatively aggressively factor-timing strategies. But those differences also highlight the challenge in that successfully anticipating which factors will outperform/underperform and when is far from guaranteed. As a result, it’s not inconceivable that some factor-based portfolio strategies could underperform a broad equity benchmark through time, perhaps dramatically so.

In any case, equity factor results vary, sometimes by wide degrees, and that’s not likely to change. As a result, the potential exists for juicing results relative to a conventionally designed portfolio. If this year’s equity factor differences are a guide, the opportunities may be unusually ripe in 2022, but no less is true for the potential risks.

Disclosures: None.